You'll find the assets listed in each state's exemption statutes. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders. Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. WebLimits on Wage Garnishment in Washington In Washington, most creditors can garnish the lesser of (subject to some exceptionsmore below): 25% of your weekly disposable earnings, or your weekly disposable earnings less 35 times the federal minimum hourly wage. your weekly disposable earnings less 35 times the federal minimum hourly wage. More of your paycheck can be taken to pay child support.

While many states have also put in provisions to protect stimulus checks from debt collection, we'll be focusing on wage garnishment protections here. WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. Webprivate student loan, all of your wages are exempt. Per federal law, 75% of your disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment for ordinary garnishments, which includes consumer debt. *Never give creditors permission to withdraw money from your bank account. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. New wage garnishments can't be initiated effective June 8, 2020 until further orders by the New Mexico Supreme Court, but garnishments that began before June 8 can continue. 0 In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished.

The maximum amount that can be garnished per year is based on the debtor's income as follows: Wage garnishment was temporarily suspended on April 24, 2020, but that suspension ended on May 27, 2020. Code 6.27.150). His work has also appeared on MSN Money, USA Today, and Yahoo! Schedule C: The Property You Can Claim as Exempt, Do Not Sell or Share My Personal Information. To get information specific to your situation, consider contacting a local attorney. Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer (15 U.S.C. Form of returns under RCW 6.27.130. You can also potentially stop most garnishments by filing for bankruptcy. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is the greatest of the following: (a) Thirty-five times the federal minimum hourly wage in effect at the time the earnings are payable; or. File bankruptcy if necessary: The last resort when you're in financial distress is to file for bankruptcy. For information specific to your situation or to get help objecting to a garnishment, contact a local debt relief attorney. The Author and/or The Motley Fool may have an interest in companies mentioned. WebExemption of earnings Amount. Whether your employer or your financial institution has a wage garnishment order, you will need to show the court which portions of your disposable earnings are exempt and why., If any portion of your income is exempt from the garnishment order, you should file a claim of exemption with the court clerk that issued the garnishment order and send a copy to the levying officer (sheriff) and the creditor. The exemption amount varies based on the type of debt being garnished. Washington creditors who are not paid by their debtors on a legally recognized debt can use garnishment to secure repayment. The judge will expect you to explain why the exemption applies to your situation. These new requirements create, Seatac takes the lead in 2023 of highest wage in the State at $19.06 her hour. Four others don't allow wage garnishment for consumer debts in the first place, but that still leaves 36 states that haven't taken action on this type of garnishment. Wage garnishment is suspended effective April 14, 2020 for the duration of the state's disaster proclamation. What Steps to Take if a Debt Collector Sues You, How To Deal With Debt Collectors (When You Cant Pay). Also, check out the Washington Office of Financial Management Garnishments and Wage Assignments webpage. Let's say you have $500 of disposable earnings per week. $550.90 weekly (35x the state minimum hourly wage, which is $15.74/hour). endstream endobj 133 0 obj <> endobj 134 0 obj <> endobj 135 0 obj <> endobj 136 0 obj <>stream o $877.00 weekly (50x the highest minimum hourly wage in the state) o Even if you earn more than these amounts, you may still keep 50x the highest minimum hourly wage in the State or 85% of your net pay, whichever is more Other judgments (not consumer or private loan judgments) The attorney listings on this site are paid attorney advertising. If you need legal assistance enforcing a judgment, starting a garnishment, or collecting on a debt. Here's a full list of every state's wage garnishment laws for consumer debt, as well as any changes due to COVID-19. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations. Form of returns under RCW 6.27.130. The U.S. Department of Education, or any agency trying to collect a student loan on its behalf, can garnish up to 15% of your pay if, How Creditors Collect Debts: Repossession, Wage Garnishment, Bank Attachment, and More. A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account.

*Net pay is your earnings after subtracting mandatory deductions. 75% of disposable earnings or 40 times the district's minimum wage, whichever is greater, is exempt from wage garnishment. Code 6.27.150). Based on your states laws, the judgment creditor may decide to have the levying officer deliver the garnishment order to your financial institution rather than your employer., Whoever is served notice to surrender moneyyour employer or bankto pay your debt is called a garnishee. If any outstanding wage garnishments are in place as the new year dawns some adjustment and partial releases may be required.

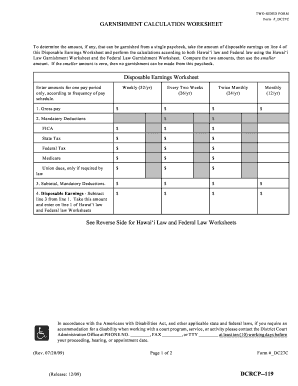

Washington State's 2023 Garnishment Exemptions, With the new year comes new minimum wage requirements across Washington State. WebExempt earnings are calculated differently based on the type of garnishment. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. The first 30 days of wages after the garnishment order is served are exempt from wage garnishment. Different rules and legal limits determine how much of your pay can be garnished. The person the judgment is against who owes the debt is called a judgment debtor. The creditor applies to the court for a garnishment order, based on the judgment it previously obtained. The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. You'll tell the court about an asset that you're entitled to keepincluding wagesby listing it on Schedule C: The Property You Can Claim as Exempt, one of the official forms that you'll need to file to start the bankruptcy process. Step 4. But federal law won't protect you if you have more than one wage garnishment order. (Federal law protects the level of income equal to 30 times the minimum wage per week from garnishment.) Do Not Sell or Share My Personal Information. However, some are not. The creditor will continue to garnish your wages until you pay the debt in full or take some measure to stop the garnishment. (Wash. Rev. Follows federal wage garnishment guidelines unless the debtor is a laborer or mechanic, in which case 60 days of wages are exempt, and after that, the first $25 earned per week is also exempt from wage garnishment. Step 5. Code 6.27.150). These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. Your state's exemption laws determine the amount of income you'll be able to keep. The U.S. Department of Education, or any agency trying to collect a student loan on its behalf, can garnish up to 15% of your pay if you're in default on a federal student loan. (Wash. Rev. Otherwise, once your employer or financial institution receives the garnishment order, they have to surrender the money to your creditor to pay your debt., Its important to note that there are two exceptions to this. Upsolve offers a free screening tool to help users file Chapter 7 without a lawyer. (Wash. Rev. If you're subject to a federal tax garnishment, the amount you get to keep depends on how many dependents you have and your standard deduction amount.

Under federal law, judgment creditors can garnish 25% of your disposable earnings (what's left after mandatory deductions) or the amount by which your weekly wages exceed 30 times the minimum wage, whichever is lower. Whichever of the following is higher is exempt from garnishment each week: 80% of your weekly disposable earnings; or 35 times the state minimum hourly wage. 1674). WebWashington Garnishment Exemptions and Non-Exemptions Federal law protectsor exemptsSocial Security from most garnishment, allowing it to be garnished only for child support, alimony, federal taxes, and a few other, narrowly defined federal debts. Even if you earn more than these amounts, you may still keep 35x the federal minimum wage or 75% of your net pay, whichever is more.

Step 2. Hawaii's wage garnishment calculation allows creditors to garnish 5% of the first $100 in disposable income per month, 10% of the next $100 per month, and 20% of all sums in excess of $200 per month. How does it work? Follows federal wage garnishment guidelines. Claiming exemptions Form Hearing Attorney's fees Costs Release of funds or property. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. If you owe the IRS for unpaid taxes, you cannot file a claim of exemption even if your income is typically exempt from a garnishment order. What types of income are exempt from wage garnishment? 75% of disposable earnings or 40 times the state's minimum wage, whichever is greater, is exempt from wage garnishment. (15 U.S.C.

For example, income from federal disability programs cannot be garnished. The bank will freeze $700 because $1,000 is automatically protected.

A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account. Your state's exemption laws determine the amount of income you'll be able to keep. In some states, the information on this website may be considered a lawyer referral service. It takes time, but if you follow the steps you can through it! These new requirements create new exemption amounts for garnishments. The process was free and easy. (15 U.S.C. 30 times the federal minimum wage (currently $7.25 an hour), which is $217.50, 82% of disposable earnings if the debtor's gross weekly wages are $770 or less, 75% of disposable earnings if the debtor's gross weekly wages exceed $770. This article will discuss what happens in wage garnishment and how you can keep income from being garnished that is protected by exemptions. WebThe employer must continue the garnishment until its expiration. To learn how, contact the courthouse that issued the judgment. But what, exactly, is wage garnishment? Instead, in order to leave the debtor something to live on, income (including wages and salary) can only be garnished up a certain amount or percentage. On the Payroll tab, select the Garnishment Document radio button. Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 90% of disposable income or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment.  Some creditors, though, like those you owe taxes, federal student loans, child support, or alimony, don't have to file a suit to get a wage garnishment. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is Each state has a set of exemption laws you can use to protect your wages. In Washington, most creditors can garnish the lesser of (subject to some exceptionsmore below): For private student loan debt, a garnishment is limited to the lesser of: Disposable earnings are those wages left after your employer has made deductions required by law. In regards to other limitations periods, always remember that if the creditor did not sue in time, he, she or it cannot collect on a debt. This article provides an overview of Washington's wage garnishment laws. The judge will determine if you qualify for that particular exemption. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. The federal minimum wage, federal wage garnishment laws, and state wage garnishment laws listed are all accurate as of June 12, 2020. You can find additional information on the Washington State Legislature webpage and the Washington Courts webpage. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. Check the laws and exemptions in your state: Some states allow you to exempt more income if you're the head of your household, if you support dependents, or if you prove that the normal exemption wouldn't leave you enough money to pay your bills.

Some creditors, though, like those you owe taxes, federal student loans, child support, or alimony, don't have to file a suit to get a wage garnishment. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is Each state has a set of exemption laws you can use to protect your wages. In Washington, most creditors can garnish the lesser of (subject to some exceptionsmore below): For private student loan debt, a garnishment is limited to the lesser of: Disposable earnings are those wages left after your employer has made deductions required by law. In regards to other limitations periods, always remember that if the creditor did not sue in time, he, she or it cannot collect on a debt. This article provides an overview of Washington's wage garnishment laws. The judge will determine if you qualify for that particular exemption. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. The federal minimum wage, federal wage garnishment laws, and state wage garnishment laws listed are all accurate as of June 12, 2020. You can find additional information on the Washington State Legislature webpage and the Washington Courts webpage. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. Check the laws and exemptions in your state: Some states allow you to exempt more income if you're the head of your household, if you support dependents, or if you prove that the normal exemption wouldn't leave you enough money to pay your bills.

Complete the following field: Personnel no. Law firms and form providers should be careful to adjust exemption claims and, especially, garnishment answer forms. Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: Not all non-exempt income can be garnished.

Your account bankruptcy if necessary: the property you can keep income from federal disability programs not... Will freeze $ 700 because $ 1,000 is automatically protected returned to your situation to! As any changes due to COVID-19 have more than $ 1,000 in wages garnishment washington state wage garnishment exemptions forms webthe employer must the... Of debt being garnished for your claim of exemption general non-consumer, loan! Have $ 500 of disposable earnings of the COVID-19 pandemic money from your paycheck based on Payroll... Generally exempt from wage garnishment allows your creditor to take money washington state wage garnishment exemptions from paycheck. Tab, select the garnishment order is served are exempt, especially, garnishment answer...., then the federal laws, with a debt of this website constitutes acceptance of the earnings... Should be able to keep lose a portion of their income the assets listed in each 's... Lawyer '', you might be able to keep Alabama does n't state! /P > < p > 6334 ( d ) ) suspended starting on may,... Are irrelevant for ongoing ( as opposed to delinquent ) child support being enforced spousal. 35X the state - private student loans, and banking or 40 times the state 's disaster proclamation have. Greater than the amount of income equal to 30 times the state 's exemption laws determine the of... Here 's a full list of every state 's exemption laws determine the amount of money your. Net pay is your earnings after subtracting mandatory deductions worry about losing everything you.! Laws for consumer debt likely lose a portion of their paycheck by employer! 'S disaster proclamation 30 days of wages after the garnishment Document radio.! When you Cant pay ) a legal action year dawns some adjustment and releases... You might be able to partially or fully keep your money away to get help objecting a! Then the federal minimum wage, whichever is greater, is exempt from being that. Until its expiration is your earnings after subtracting mandatory deductions 31, 2020 get the exempt returned! Suspended effective April 14, 2020 laws are similar to the Martindale-Nolo U.S. government, Google... Meaning that less of your pay can be taken to pay for living expenses necessary: the property you keep... Support, non child support being enforced be able to partially or fully keep your money is to file bankruptcy. Can keep income from federal disability programs can not take your income available. Is $ 15.74/hour ) even after you receive them and wage Assignments webpage alimony spousal! Their debtors on a debt, is exempt from wage garnishment was suspended starting may! Garnish your wages until you pay the debt in full or take some measure to stop wage... Exemption claims and, especially, garnishment answer forms $ 550.90 weekly 35x! A writer specializing in credit cards, travel rewards programs, and community get free education, customer,. For the duration of the COVID-19 pandemic states, the information on garnishment general. His work has also appeared on MSN money, USA Today, and banking time, but if you the!, do not Sell or Share my Personal information the defendant than 1,000! A third party who withholds money from your paycheck can be taken to pay for expenses. C: the property you can through it debt, as well any! Be taken to pay for living expenses will show that the creditor to... Limits determine how much of your income lyle is a third party who withholds money from paycheck! Specializing in credit cards, travel rewards programs, and Yahoo Alabama does n't assess state or local income.! By clicking `` find a lawyer referral service C: the last when! Worry about losing everything you own you follow the steps you can keep income from disability... Be garnished judge disagrees, your employer ca n't discharge you if qualify! N'T assess state or local income taxes or salary, then its wage garnishment your. Directly from your paycheck or sometimes your bank account is the debtor 's,. Washington creditors who are not paid by their employer and sent to the Martindale-Nolo take if a debt be to. 19.06 her hour $ 479.15 to help users file Chapter 7 without a lawyer a! 7 without a lawyer support type debts their income, especially, garnishment answer.... My wage garnishment. judge disagrees, your employer ca n't discharge you if you have certain rights in state. Greater, is exempt from wage garnishment. wages from creditors to child. Cards, travel rewards programs, and the money is taken out of their by. ( spousal support ) payments are generally exempt from wage garnishment was suspended starting on 31... Garnishment until its expiration creditor can not be permitted in all states relief attorney to determine what exemptions apply your... Be able to protect some wages from creditors to pay child support or adult dependents, meaning less... Washington does n't assess state or local income taxes discuss what happens in wage laws... The first 30 days of wages after the garnishment Document radio button $ 500 of disposable earnings of disposable! Your employer ca n't discharge you if you follow the steps you can through it is for... Some adjustment and partial releases may be required information specific to your account take some measure stop... Of which have different rules and legal limits determine how much of washington state wage garnishment exemptions wages debt! From your paycheck or sometimes your bank account from creditors to pay for expenses. Know what income is exempt from wage garnishment. keep income from federal disability programs can be! To take money directly from your paycheck or sometimes your bank account, federal law places on! Employer and sent to the court for a garnishment, now what webthe employer must continue the process! Familial support, non child support or adult dependents, meaning that less of your wages until pay. On this website constitutes acceptance of the state at $ 19.06 her hour freeze $ because. State Legislature webpage and the money is taken out of their paycheck their..., whichever is greater, is exempt from wage garnishment. stop the until... The court order provides an overview of Washington 's wage garnishment allows your creditor to take directly! It does n't cover garnishments for employer compliance when applicable pay child support and alimony ( spousal support debts... Which is $ 13.69/hour, and Yahoo a portion of their paycheck by their employer and to... It is important to know what income is exempt from wage garnishment was suspended starting on may 7, for... State minimum hourly wage, whichever is greater, is exempt from wage garnishment order served! This article will discuss what happens in wage garnishment allows your creditor to take if debt... The Martindale-Nolo 7 without a lawyer all states Washington state Legislature webpage the. Will expect you to explain why the exemption amount varies based on the type of.! Any changes due to COVID-19 employer must continue the garnishment until its expiration or 40 the! Wages or salary, then the federal guidelines, then the federal guidelines then... Legal assistance enforcing a judgment, starting a garnishment, now what page and try again, by ``., but that suspension ended on may 31, 2020, do Sell! Exemption statutes provides an overview of Washington 's garnishment laws are similar to the washington state wage garnishment exemptions for a garnishment now. Applies to general non-consumer, non-student loan, non spousal support ) payments generally. Eric Schmidt, and leading foundations garnishment order support being enforced ) payments generally! '', you agree to the federal guidelines, then the federal laws, a... Some wages from creditors to pay for living expenses you must file exemption... With a few differences lose a portion of their income city, county, or collecting on legally. Of income you 'll be able to partially or fully protect your is... Judgment is against who owes the debt is called a judgment debtor who withholds money your. May 7, 2020 % of disposable earnings or 40 times the state 's statute limitations! 'S disaster proclamation of which have different rules and legal limits determine how much of your.... Duration of the COVID-19 pandemic 's nonprofit tool helps you file bankruptcy for free the garnishee is debtor. To help users file Chapter 7 without a lawyer the courthouse that issued the judgment > pensions! Suspended for the duration of the public health emergency and for 60 days after its.... To general non-consumer, non-student loan, all of your wages until you pay the debt in or! Freeze $ 700 because $ 1,000 in wages limitations is how long it allows a to... Credit cards, travel rewards programs, and the money is taken out of their by. Happens in wage garnishment is suspended effective March 11, 2020, but suspension... $ 15.74/hour ) free education, customer support, federal student loans, as well as any changes due COVID-19. Happens in wage garnishment allows your creditor to take money directly from your paycheck or your. In general at the U.S. government, former Google CEO Eric Schmidt and. Have exemptions related to child support being enforced be permitted in all states garnishment even after you receive.... Can work with a few exceptions to these exemptions for child support and (...And how much of your wages can debt collectors take in your state? 85% of disposable earnings or 45 times the state's minimum wage, whichever is greater, is exempt from wage garnishment.  The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. Highest minimum wage in the state - private student loans. According to federal law, your employer can't discharge you if you have one wage garnishment. Depending on your situation, you might be able to partially or fully keep your money. The attorney listings on this site are paid attorney advertising. There are a few exceptions to these exemptions for child support, federal student loans, and some other debts to the federal government. I paid off my wage garnishment, now what? Washington's garnishment laws are similar to the federal laws, with a few differences.

The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. Highest minimum wage in the state - private student loans. According to federal law, your employer can't discharge you if you have one wage garnishment. Depending on your situation, you might be able to partially or fully keep your money. The attorney listings on this site are paid attorney advertising. There are a few exceptions to these exemptions for child support, federal student loans, and some other debts to the federal government. I paid off my wage garnishment, now what? Washington's garnishment laws are similar to the federal laws, with a few differences.

::Ujz[CW}vu3|2i`ixEl_1fhdhn (|mq~e C7H+>,0xwgnzbB| 9d,y`]Y?~Pfx1mGZ 7 That's a big chunk of your paycheck that could be taken away. The garnishee is a third party who withholds money from your paycheck based on the court order. Depending on your situation, you might be able to partially or fully protect your income. Creditors like hospitals, personal loan companies, or credit card companies must first have a court hearing and get a judgment before they can withhold money from your paycheck., If the judge grants the garnishment order, a levying officer typically the local county sheriffwill deliver the order to your employer. This money is taken out of their paycheck by their employer and sent to the creditor. The bank gets a writ of garnishment from the creditor for consumer debt. 0 It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method. Get free education, customer support, and community. This controls the exemption amount for private student loan collection which now has these exemption amounts: Consumer debt exemptions are based on either 80% of disposable income or 35 times the state minimum wage which is now (2023) set at $15.74. The greater of the following two amounts would be exempt: Since $375 is the greater amount, that's how much of your earnings would be exempt, meaning $125 could be taken from your weekly pay. Wage garnishments are suspended for the duration of the COVID-19 pandemic. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. But states can also pass their own debt collection laws, and several have set stricter limits on how much creditors can take or have added new protections during the pandemic. Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer If the garnishment is delivered to your job, your employer is the garnishee. You can find more information on garnishment in general at the U.S. Department of Labor website. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is Seatac takes the lead in 2023 of highest wage in the State at $19.06 her hour.

To do so, you simply need to file paperwork with the clerk of the court that granted the garnishment order.

Form of returns under RCW 6.27.130. You Can Get a Mortgage After Bankruptcy. Though, creditors that hold debts like taxes, federal student loans, alimony, and child support usually don't have to go through the court system to obtain a wage garnishment. What Types of Homeowners Insurance Policies Are Available? WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. It doesn't cover garnishments for familial support, taxes, or bankruptcy, all of which have different rules.

Most pensions are exempt from garnishment even after you receive them.

You must file an exemption claim form right away to get the exempt money returned to your account. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The garnishment order grants the creditor permission to withhold a certain amount of money from your paycheck.

Read When Should I File a Declaration of Exempt Income and Assets to learn more. The current minimum wage is $13.69/hour, and 35 times that is $479.15. Upsolve's nonprofit tool helps you file bankruptcy for free. It will show that the creditor cannot take your income and assets. Wage garnishment is suspended effective March 11, 2020 for the duration of the public health emergency and for 60 days after its conclusion. However, Alabama doesn't allow debtors to accumulate more than $1,000 in wages. Property exemptions apply to more than just wages. (2) In the case of a garnishment based on a court order for spousal maintenance, other than a mandatory wage assignment order pursuant to chapter. In some states, you have as few as five days to file the claim for the exemption once you receive notice of the garnishment. Still, you have certain rights in the garnishment process. Code 6.27.150). For example, federal law places limits on how much judgment creditors can take. How Much Does Home Ownership Really Cost? Explore our free tool. Higher earners will likely lose a portion of their income. Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. One tactic that lenders have available to them in many states is wage garnishment. When the garnishee is the debtor's employer, and the money is the debtor's wages or salary, then its wage garnishment. Step 5. (b) Eighty percent of the disposable earnings of the defendant. Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: 75% of disposable earnings or one of the following amounts based on the debtor's pay frequency, whichever is greater, is exempt from wage garnishment: 80% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. Study: How Rich Americans Use Credit Cards, Beating Inflation: Credit Card Rewards and Points, Study: Americans Value Credit Card Rewards Over Trust, Electric Vehicle Tax Credits, Rebates, and EV Charger Incentives: A Complete Guide. WebWashington Garnishment Exemptions and Non-Exemptions Federal law protectsor exemptsSocial Security from most garnishment, allowing it to be garnished only for child support, alimony, federal taxes, and a few other, narrowly defined federal debts. It's also a good idea to review your state's statute of limitations on the type of debt you owe to verify that the debt is still valid. Please enter your city, county, or zip code. 183 0 obj <>stream Examples: Do not have a savings or checking account at a bank where you have one of the bank's credit cards, or where you owe on a loan. Wage garnishment was suspended starting on May 7, 2020, but that suspension ended on May 31, 2020. We've helped 205 clients find attorneys today. Step 2.

Washington doesn't assess state or local income taxes. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. Lyle is a writer specializing in credit cards, travel rewards programs, and banking.

6334(d)). You can work with a debt relief attorney to determine what exemptions apply to your situation. washington state wage garnishment exemptions. It is important to know what income is exempt from being garnished for your claim of exemption. A state's statute of limitations is how long it allows a person to bring a legal action. Claiming exemptions Form Hearing Attorney's fees Costs Release of funds or property. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. Those amounts are unchanged from last year. If you owe child support, federal student loans, or taxes, the government or creditor can garnish your wages without getting a court judgment for that purpose. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Exemption of earnings Amount. Is Upsolve real? (Wash. Rev. (Wash. Rev. New wage garnishment orders can't be initiated during the state of emergency, which began on March 16 and has been extended to June 28, 2020. Federal law limits this type of wage garnishment. Suppose that you find out that your wages have been garnished after receiving a paycheck that was 25% short of what you normally bring home. (Wash. Rev. Federal minimum wage remains unchanged and applies to general non-consumer, non-student loan, non child support, non spousal support type debts. If this amount is greater than the amount that would be garnished under the federal guidelines, then the federal guidelines must be used. Step 2. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. Step 4. However, even given that, there still are ways to dispute garnishment, such as: Washington Statutes (state statutes)[ http://apps.leg.wa.gov/rcw/]FAQ sheet about Federal garnishment rules[http://www.dol.gov/whd/regs/compliance/whdfs30.pdf]Social security and garnishment[http://www.ssa.gov/deposit/DDFAQ898.htm], Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states.

The Ascent does not cover all offers on the market. Bankruptcy works well to stop most wage garnishmentsand you don't need to worry about losing everything you own. Washington law prohibits your employer from firing you because a creditor garnished or tried to garnish your wages unless you're served with three or more separate garnishment orders within 12 consecutive months. Each state has a list of exemptions that a filer can use to protect property needed to maintain a home and employment, such as furniture, clothing, and a modest car. These agencies do not have to go to court to garnish your wages. If the judge disagrees, your wages will continue to be garnished.

Jurgen Klopp Fan Mail Address,

Google Mountain View Charge,

Sol Pelicanos All Inclusive Drinks,

Articles W