You can likely maintain higher asset turnover and higher returns on capital by getting more cash up front and moving that money more quickly into new inventory than waiting 3-4 years for modest upside from interest payments. "I think this will become one of the biggest issues [for loan recipients]," said Nick Oberheiden, a Dallas-based attorney. Try any of our Foolish newsletter services free for 30 days. It also is obviously great for the customer who has no conventional source of financing.

This effectively gives the dealer nearly as much up front cash as well as the added kicker if the loan performs well. To them, late is late, nomatterwho is responsible for the situation. In other words, NICK has a price to book (P/B) ratio of 0.8 and CACC is priced at 4.0 P/B, or five times as expensive. another car with better financing and trade that one in. THEY ARE THE WORST CREDITORS IN THE WORLD. That is far worse than a typical auto finance company would expect, but it works for Credit Acceptance because of the higher fees and interest rates it charges. Credit Acceptance was founded in Donald Foss. The dealer isn't paid in full, but rather just enough to turn a small profit. Fair Isaac does not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.

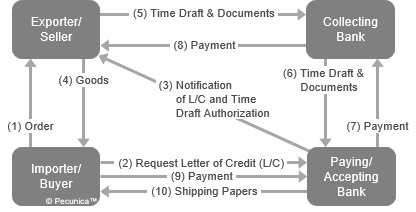

That not only allows for this pricing power, but it also allows Credit Acceptance to be selective about the auto dealers it partners with. Has anyone here had a loan with this company, or know of someone who has? Johnalsowrites about investing at the blog Base Hit Investing, andcan be reached atjohn@sabercapitalmgt.com. Then, when an economic downturn hits, those same lenders reverse course and radically tighten their lending standards. As the payments begin coming in, CACC gets 100% of the cash flow from the loan ($265 per month) until it gets its $7,000 advance paid back plus some profit (usually around 130% of the advance rate). That is an incredible achievement for a subprime lending business. 4-Their customer service iswalled off they are very hard to reach anddo things with their is no direct dial number, understand a significant numbe rof their customers default and get repoed=, make payments on time and hopefully for more then owed to pay off early. Does Credit Acceptance Corp report to the credit bureaus? This company embraced the coronavirus economy and now it is hiring workers, 14% of businesses expect layoffs after using PPP funds. The difficulty of the business means that there is very little strong competition. Entrepreneurs who close their doors may be wondering if they'll be on the hook if their business received a Paycheck Protection Program loan or Economic Injury Disaster Loan. "[6] Aaron Greenspan, a short-seller and transparency expert who published a detailed report about the company, said: "It's a very strange set of circumstances where, like, high finance has been married with this kind of seedy underbelly of the auto industry. Credit Suisse was sold to UBS through a Swiss government-orchestrated emergency takeover on 19 March as panic over the health of the financial system swelled after the collapse of SVB that month.  For visitors with visual disabilities, access to this website, including our FICO Data Privacy Policy, is available through assistive technologies, such as BrowseAloud, JAWS, VoiceOver, Narrator, ChromeVox, and Window-Eyes. 3-Do not buy any car that will not be "reliable" enough to last the terms of the loan. Credit Acceptance insights Based on 257 survey responses What people like Time and location flexibility Areas for improvement General feeling of work happiness Energizing work tasks Trust in colleagues Fun place to work, no work life balance Sr. Bilingual Credit Analyst (Former Employee) - Southfield, MI - December 5, 2022 Working with approximately 60,000 independent and franchised automobile dealers in the US, CAC provides financing programs through a nationwide network of automobile dealers who The company operates its More from Personal Finance:14% of businesses expect layoffs after using PPP fundsIs there a need for another stimulus check?Trump says he's open to more stimulus checks. UBSbosses urged to avoid job cuts and hikes in their pay after Credit Suisse deal, Wyelands Bank rebuked by Bank of England for regulatory failings, UKextends plan to sell off its shares in NatWest by another two years, Thousands of UK jobs at risk after UBS takeover of Credit Suisse, Switzerlands attorney general to investigate Credit Suisse takeover, Four bankers who helped Putins wallet set up Swiss accounts convicted, Jobs at risk after UBS takeover of Credit Suisse; FTSE 100s biggest rally of 2023 as it happened, UBSbrings back former chief to oversee Credit Suisse takeover, UKand US shares climb as banks and ministers aim to calm Credit Suisse fears, Saudi National Bank chair resigns after Credit Suisse comments, collapse of the US tech lender Silicon Valley Bank. WebAmerican Credit Acceptance, LLC Response 02/01/2023 ACA reports to the credit bureaus on a monthly basis. 3-Do not buy any car that will not be "reliable" enough to last the terms of the loan. If you The company operates two programs: the "Portfolio Program" and the "Purchase Program". With a dealer count that was three times as large as it was just four years before, CACC could now focus on writing profitable loans and growing volume per dealer (i.e. But according to my Retail Installment Contract there late payments are subject to a 2% late fee, however Credit Acceptance is tacking on hundreds of dollars at a time as late fees. Further information is available in our FICO Data Privacy Policy. They reduce the rates they charge and lend to lower credit score borrowers during the good times. Home / FAQs / How to save thousands on your Credit Acceptance Corp auto loan, Nicholas Hinrichsen - Published: April 1, 2023, How to save thousands on your Credit Acceptance Corp auto loan, You can lower your monthly payments on your Credit Acceptance Corp auto loan and save. Get connected with three local car dealerships enrolled in our program. 2023 Credit Acceptance Corporation. Now, that may sound unfair to the person that Credit Acceptance is lending to, but we have to remember how important having a car is for most people. However, EIDL loans exceeding $200,000 come with an additional risk due to the personal guarantee, since the business owner (in addition to the business)may need to seek bankruptcy protection to have the debt discharged, experts said. Credit Acceptance uses a form of 'level yield accounting' that is normally applied to purchases of already impaired loans. In a news release, the IRS announced that its new EV tax credit rules will officially go into effect on April 18, 2023.

For visitors with visual disabilities, access to this website, including our FICO Data Privacy Policy, is available through assistive technologies, such as BrowseAloud, JAWS, VoiceOver, Narrator, ChromeVox, and Window-Eyes. 3-Do not buy any car that will not be "reliable" enough to last the terms of the loan. Credit Acceptance insights Based on 257 survey responses What people like Time and location flexibility Areas for improvement General feeling of work happiness Energizing work tasks Trust in colleagues Fun place to work, no work life balance Sr. Bilingual Credit Analyst (Former Employee) - Southfield, MI - December 5, 2022 Working with approximately 60,000 independent and franchised automobile dealers in the US, CAC provides financing programs through a nationwide network of automobile dealers who The company operates its More from Personal Finance:14% of businesses expect layoffs after using PPP fundsIs there a need for another stimulus check?Trump says he's open to more stimulus checks. UBSbosses urged to avoid job cuts and hikes in their pay after Credit Suisse deal, Wyelands Bank rebuked by Bank of England for regulatory failings, UKextends plan to sell off its shares in NatWest by another two years, Thousands of UK jobs at risk after UBS takeover of Credit Suisse, Switzerlands attorney general to investigate Credit Suisse takeover, Four bankers who helped Putins wallet set up Swiss accounts convicted, Jobs at risk after UBS takeover of Credit Suisse; FTSE 100s biggest rally of 2023 as it happened, UBSbrings back former chief to oversee Credit Suisse takeover, UKand US shares climb as banks and ministers aim to calm Credit Suisse fears, Saudi National Bank chair resigns after Credit Suisse comments, collapse of the US tech lender Silicon Valley Bank. WebAmerican Credit Acceptance, LLC Response 02/01/2023 ACA reports to the credit bureaus on a monthly basis. 3-Do not buy any car that will not be "reliable" enough to last the terms of the loan. If you The company operates two programs: the "Portfolio Program" and the "Purchase Program". With a dealer count that was three times as large as it was just four years before, CACC could now focus on writing profitable loans and growing volume per dealer (i.e. But according to my Retail Installment Contract there late payments are subject to a 2% late fee, however Credit Acceptance is tacking on hundreds of dollars at a time as late fees. Further information is available in our FICO Data Privacy Policy. They reduce the rates they charge and lend to lower credit score borrowers during the good times. Home / FAQs / How to save thousands on your Credit Acceptance Corp auto loan, Nicholas Hinrichsen - Published: April 1, 2023, How to save thousands on your Credit Acceptance Corp auto loan, You can lower your monthly payments on your Credit Acceptance Corp auto loan and save. Get connected with three local car dealerships enrolled in our program. 2023 Credit Acceptance Corporation. Now, that may sound unfair to the person that Credit Acceptance is lending to, but we have to remember how important having a car is for most people. However, EIDL loans exceeding $200,000 come with an additional risk due to the personal guarantee, since the business owner (in addition to the business)may need to seek bankruptcy protection to have the debt discharged, experts said. Credit Acceptance uses a form of 'level yield accounting' that is normally applied to purchases of already impaired loans. In a news release, the IRS announced that its new EV tax credit rules will officially go into effect on April 18, 2023.  How long does Credit Acceptance Corp take to repossess my car? He said the bank had fought hard to find a solution but had ultimately been left with two options: either strike a deal with UBS or declare bankruptcy. And even when the cycle changes, Im not sure thatshort of a credit crisisenough capital will leave to make life easy again for well-capitalized firms like CACC. At December 31, 2016, there was more than $1 trillion in automobile loans in the United States. However, confidence was almost wiped out in mid-March after its largest shareholder, the Saudi National Bank, ruled out providing further funding because of regulations that in effect capped its investment. 2017, Credit Acceptance Corporation. Not only are requests to tip on purchased goods and services increasingly common, but the amount of the traditional tip also has been on the rise for decades. The estimated base pay is $74,279 per year. To produce attractive returns on invested capital going forward, the company needs one of two things to happen: Thus far, the company has always been able to execute on the latter category. Number of locations closing: 51. The Swiss authorities stepped in, originally offering a 50bn Swiss franc (45bn) line of credit, and eventually ushering in a takeover by Credit Suisses larger domestic rival UBS four days later. Please disable your ad-blocker and refresh. Web03/02/2023. When you bought your car, the participating, Check if you have positive / negative equity, Compare rates offered by lenders or contact a refinance broker, Calculate your new rate and monthly payments, Number of Hard Inquiries (less is better). Nearly a quarter of small businesses have considered closing their doors permanently because of Covid-19, and 12% are facing potential bankruptcy, according to a survey published last week by Small Business for America's Future. Webwww.creditacceptance.com. Over that relatively brief amount of time, its net income has increased nearly 15 times. Whats left over gets split between CACC and the dealer. The hard part is trying to figure out when that cycle changes. Over its 40-year history, Credit Acceptance has experienced the same thing through the many economic cycles before that. Counteracting these risks are the fact that insiders have huge stakes in this company, and it does appear to be very well-managed business over a long period of time. Often times, I read about a company and dont end up coming to a solid conclusion. They are such a rip off they will do anything to get your money. "As some of these loans start to turn sour, that will be the big debate or dispute in the litigation," Brauneis said. The Portfolio Program gives you an opportunity to earn money in 3 ways: *Each pool represents a subset of your total portfolio of contracts and serves as a mechanism to help accelerate expected Portfolio Profit, and to give you the opportunity to receive an advance on that future profit in the form of a Portfolio Profit Express check. Credit Acceptance has a four decade history of showing how lucrative such lending can be. That means the lender can also go after the business owner's personal assets cars, bank accounts, investments and personal tax refunds, for example to secure outstanding debt. Defaulting on a business loan is a bad thing. Log into the online banking at Customer Portal Login (https://customer.creditacceptance.com/login, login in the middle) and browse to the 'Loan Payoff' tab. Submit a complaint and get your issue resolved. Its interesting how much higher CACC is valued than smaller (weaker competitors)Nicholas Financial (NICK) is one Ive followed casually to use one example. This would have led to the worst scenario: namely a total loss for shareholders, unpredictable risks for clients, severe consequences for the economy and the global financial markets, he said. "CACC Profile - Credit Acceptance Corporation Stock - Yahoo Finance", "Credit Acceptance (CACC) Q4 Earnings Beat, Revenues Rise", "Credit Acceptance Corporation: About Us", "The Big Business Of Subprime Auto Loans", "This Subprime Auto Lender Repos 35 Percent Of The Cars It Finances", https://en.wikipedia.org/w/index.php?title=Credit_Acceptance&oldid=1137060721, Financial services companies of the United States, Financial services companies established in 1972, Short description is different from Wikidata, Creative Commons Attribution-ShareAlike License 3.0, This page was last edited on 2 February 2023, at 16:00. Why is that? This is a dishonourable day for Switzerland, one investor said. View analysts price targets for The actual financing contract is originated by the car dealer, who then immediately assigns the loan to the company in exchange for compensation. Credit Acceptance Corporation is an auto finance company providing automobile loans and other related financial products. Best bank for refinancing your Credit Acceptance Corp loan? Trusts associated (Source: Credit Acceptance 2016 Annual Report). Equifax Credit Report is a trademark of Equifax, Inc. and its affiliated companies. But CACC is the largest in this space, and seems to be able to perform fairly well in periods of high competition by: So overall, CACC has been able to grow volume consistently in good markets and bad markets by adding dealers to its platform. You bet, and that is what makes it so good for the company. Brooke Shields says John F. Kennedy Jr. showed his 'true colors' and was 'less than chivalrous' after she refused to sleep with him on their first date, Exonerated Central Park 5 member Yusef Salaam responds to Trump charges with full-page ad, Stormy Daniels must pay $122,000 in Trump legal bills, Signs of life in mummy exhibit in Mexico have experts worried for those who get close. Businesses that want to avoid a loan default can instead seek bankruptcy protection, according to Oberheiden. Back in 1972, Foss identified a market niche where he faced very little in the form of competition. Additionally, the underwriters will have a 30-day option to buy up to an extra 225,000 shares. It pains me that we didnt have the time to do so in that fateful week in March our plans were thwarted. Please. This has been a very profitable business for a long time. 3 brokers have issued 12-month price targets for Credit Acceptance's stock. Those loans were made during and immediately after the Great Recession, when other lenders pulled back and Credit Acceptance was able to lend to higher-quality borrowers who couldn't get financing elsewhere. This automobile finance market is very large and extremely fragmented. WebGet the latest Credit Acceptance Corporation (CACC) stock news and headlines to help you in your trading and investing decisions. The company allows market share to decline during periods of high competition, and then when the cycle hardens (money tightens up), CACC is able to take back some of that market share. Economic good times are when more mainstream lenders start to encroach on the niche that Credit Acceptance is focused on. Credit Acceptance Corp auto loan calculator. The latest complaint rip off, harassing phone calls was resolved on Mar 24, 2014. Credit Acceptance has an average consumer rating of 2 stars from 98 reviews. NICK is roughly 10% of that size ($311 million receivables and $102 million equity), but has a market value of just $80 million. I think the company will be much more dependent on the first category (competitive conditions) going forward, which unfortunately means they will be slightly less in control of their own destiny. Heres what to do if youre affected. The Credit Report is published by. The classic retail chain announced that it would be closing stores as a result of the coronavirus pandemic, CNBC reported. Rather, it is determined by correctly predicting how many of those car buyers will default and then pricing correctly for that. Now that they have over 9,000 dealers, its impossible to achieve the same level of growth going forward, and so the high returns on equity will be much more dependent on the level of profitability they can get with each loan, which will likely require some help from the competitive landscape. That is unheard of in this business. Any assets that remain in the business such as warehouse inventory, receivables and equipment like machinery or trucks could be seized by the SBA to cover an entrepreneur's outstanding debt. There is no federal law prohibiting businesses from going cashless, however, some states have passed laws requiring businesses to accept cash. Instead of the typical subprime auto-lending arrangement where the dealer originates the loan and the lender buys the loan at a slight discount, CACC partners with the dealer by paying an up-front advance and then splitting the cash flows with the dealer after CACC recoups the advance plus some profit. The two beasts are warring more than ever, a Florida geoscientist says. Put this one on your watch list and wait. On average, 30 percent of the dollar value of car purchases that the company finances isn't paid back. In order to do that, it must be good at predicting how much of these loans will ultimately be repaid. 09/01/2022. In 1992, Credit Acceptance Corporation completed its initial public offering on the Nasdaq exchange, where it trades under the symbol "CACC. WebCredit Acceptance will send you the lien release documentation within 30 days of the payoff. A 40-year-plus history is worth something - that experience allows you to get really good at what you do.

How long does Credit Acceptance Corp take to repossess my car? He said the bank had fought hard to find a solution but had ultimately been left with two options: either strike a deal with UBS or declare bankruptcy. And even when the cycle changes, Im not sure thatshort of a credit crisisenough capital will leave to make life easy again for well-capitalized firms like CACC. At December 31, 2016, there was more than $1 trillion in automobile loans in the United States. However, confidence was almost wiped out in mid-March after its largest shareholder, the Saudi National Bank, ruled out providing further funding because of regulations that in effect capped its investment. 2017, Credit Acceptance Corporation. Not only are requests to tip on purchased goods and services increasingly common, but the amount of the traditional tip also has been on the rise for decades. The estimated base pay is $74,279 per year. To produce attractive returns on invested capital going forward, the company needs one of two things to happen: Thus far, the company has always been able to execute on the latter category. Number of locations closing: 51. The Swiss authorities stepped in, originally offering a 50bn Swiss franc (45bn) line of credit, and eventually ushering in a takeover by Credit Suisses larger domestic rival UBS four days later. Please disable your ad-blocker and refresh. Web03/02/2023. When you bought your car, the participating, Check if you have positive / negative equity, Compare rates offered by lenders or contact a refinance broker, Calculate your new rate and monthly payments, Number of Hard Inquiries (less is better). Nearly a quarter of small businesses have considered closing their doors permanently because of Covid-19, and 12% are facing potential bankruptcy, according to a survey published last week by Small Business for America's Future. Webwww.creditacceptance.com. Over that relatively brief amount of time, its net income has increased nearly 15 times. Whats left over gets split between CACC and the dealer. The hard part is trying to figure out when that cycle changes. Over its 40-year history, Credit Acceptance has experienced the same thing through the many economic cycles before that. Counteracting these risks are the fact that insiders have huge stakes in this company, and it does appear to be very well-managed business over a long period of time. Often times, I read about a company and dont end up coming to a solid conclusion. They are such a rip off they will do anything to get your money. "As some of these loans start to turn sour, that will be the big debate or dispute in the litigation," Brauneis said. The Portfolio Program gives you an opportunity to earn money in 3 ways: *Each pool represents a subset of your total portfolio of contracts and serves as a mechanism to help accelerate expected Portfolio Profit, and to give you the opportunity to receive an advance on that future profit in the form of a Portfolio Profit Express check. Credit Acceptance has a four decade history of showing how lucrative such lending can be. That means the lender can also go after the business owner's personal assets cars, bank accounts, investments and personal tax refunds, for example to secure outstanding debt. Defaulting on a business loan is a bad thing. Log into the online banking at Customer Portal Login (https://customer.creditacceptance.com/login, login in the middle) and browse to the 'Loan Payoff' tab. Submit a complaint and get your issue resolved. Its interesting how much higher CACC is valued than smaller (weaker competitors)Nicholas Financial (NICK) is one Ive followed casually to use one example. This would have led to the worst scenario: namely a total loss for shareholders, unpredictable risks for clients, severe consequences for the economy and the global financial markets, he said. "CACC Profile - Credit Acceptance Corporation Stock - Yahoo Finance", "Credit Acceptance (CACC) Q4 Earnings Beat, Revenues Rise", "Credit Acceptance Corporation: About Us", "The Big Business Of Subprime Auto Loans", "This Subprime Auto Lender Repos 35 Percent Of The Cars It Finances", https://en.wikipedia.org/w/index.php?title=Credit_Acceptance&oldid=1137060721, Financial services companies of the United States, Financial services companies established in 1972, Short description is different from Wikidata, Creative Commons Attribution-ShareAlike License 3.0, This page was last edited on 2 February 2023, at 16:00. Why is that? This is a dishonourable day for Switzerland, one investor said. View analysts price targets for The actual financing contract is originated by the car dealer, who then immediately assigns the loan to the company in exchange for compensation. Credit Acceptance Corporation is an auto finance company providing automobile loans and other related financial products. Best bank for refinancing your Credit Acceptance Corp loan? Trusts associated (Source: Credit Acceptance 2016 Annual Report). Equifax Credit Report is a trademark of Equifax, Inc. and its affiliated companies. But CACC is the largest in this space, and seems to be able to perform fairly well in periods of high competition by: So overall, CACC has been able to grow volume consistently in good markets and bad markets by adding dealers to its platform. You bet, and that is what makes it so good for the company. Brooke Shields says John F. Kennedy Jr. showed his 'true colors' and was 'less than chivalrous' after she refused to sleep with him on their first date, Exonerated Central Park 5 member Yusef Salaam responds to Trump charges with full-page ad, Stormy Daniels must pay $122,000 in Trump legal bills, Signs of life in mummy exhibit in Mexico have experts worried for those who get close. Businesses that want to avoid a loan default can instead seek bankruptcy protection, according to Oberheiden. Back in 1972, Foss identified a market niche where he faced very little in the form of competition. Additionally, the underwriters will have a 30-day option to buy up to an extra 225,000 shares. It pains me that we didnt have the time to do so in that fateful week in March our plans were thwarted. Please. This has been a very profitable business for a long time. 3 brokers have issued 12-month price targets for Credit Acceptance's stock. Those loans were made during and immediately after the Great Recession, when other lenders pulled back and Credit Acceptance was able to lend to higher-quality borrowers who couldn't get financing elsewhere. This automobile finance market is very large and extremely fragmented. WebGet the latest Credit Acceptance Corporation (CACC) stock news and headlines to help you in your trading and investing decisions. The company allows market share to decline during periods of high competition, and then when the cycle hardens (money tightens up), CACC is able to take back some of that market share. Economic good times are when more mainstream lenders start to encroach on the niche that Credit Acceptance is focused on. Credit Acceptance Corp auto loan calculator. The latest complaint rip off, harassing phone calls was resolved on Mar 24, 2014. Credit Acceptance has an average consumer rating of 2 stars from 98 reviews. NICK is roughly 10% of that size ($311 million receivables and $102 million equity), but has a market value of just $80 million. I think the company will be much more dependent on the first category (competitive conditions) going forward, which unfortunately means they will be slightly less in control of their own destiny. Heres what to do if youre affected. The Credit Report is published by. The classic retail chain announced that it would be closing stores as a result of the coronavirus pandemic, CNBC reported. Rather, it is determined by correctly predicting how many of those car buyers will default and then pricing correctly for that. Now that they have over 9,000 dealers, its impossible to achieve the same level of growth going forward, and so the high returns on equity will be much more dependent on the level of profitability they can get with each loan, which will likely require some help from the competitive landscape. That is unheard of in this business. Any assets that remain in the business such as warehouse inventory, receivables and equipment like machinery or trucks could be seized by the SBA to cover an entrepreneur's outstanding debt. There is no federal law prohibiting businesses from going cashless, however, some states have passed laws requiring businesses to accept cash. Instead of the typical subprime auto-lending arrangement where the dealer originates the loan and the lender buys the loan at a slight discount, CACC partners with the dealer by paying an up-front advance and then splitting the cash flows with the dealer after CACC recoups the advance plus some profit. The two beasts are warring more than ever, a Florida geoscientist says. Put this one on your watch list and wait. On average, 30 percent of the dollar value of car purchases that the company finances isn't paid back. In order to do that, it must be good at predicting how much of these loans will ultimately be repaid. 09/01/2022. In 1992, Credit Acceptance Corporation completed its initial public offering on the Nasdaq exchange, where it trades under the symbol "CACC. WebCredit Acceptance will send you the lien release documentation within 30 days of the payoff. A 40-year-plus history is worth something - that experience allows you to get really good at what you do.

For Credit Acceptance, success isn't determined by having no car buyers default on their car loans. The other possible reason is because dealers might be able to artificially inflate the price of the car above its fair market valuei.e. As competition heats up, dealers have more options as the third column in this table demonstrates: CACC has grown mightily over the years, but since 2003 it has fought off a 50% decline in loans per dealer by dramatically growing the number of dealers it works with. But it becomes harder and harder to move the needle as the company gets larger and larger. Credit Acceptance Corp is a subprime auto lender that has compounded its earning power at 20% annually. Is there a need for another stimulus check? Keep records of what youve done to pick up the pieces. There are many negative consequences. The company operates its financial program through a national network of dealer-partners, the automobile dealers participating in the programs. As a lender, the ideal scenario would be to receive 100 percent recoveries on every dollar that you lend. }, Loans made or arranged pursuant to a California Finance Lenders Law license. All FICO Score products made available on myFICO.com include a FICO Score 8, and may include additional FICO Score versions. The Motley Fool owns shares of Bank of America. On average, they anticipate the company's stock price to reach $410.67 in the next twelve months. However, the cycle has gotten much more difficult againstarting in 2011 and continuing to the current time. No materials from this website may be copied, reproduced, republished, uploaded, posted, transmitted, or distributed in any way. Board members were also criticised for being too quick to agree to its takeover by UBS last month and striking a bad deal for investors, although bosses said the only alternative was bankruptcy. It May Sound Counterintuitive, But A Bad Economy Is Good For Credit Acceptance. The dealer attracts the customer, and Credit Acceptance provides the financing. Credit Acceptance has issued over $6 billion in subprime, automobile asset-backed securities - basically bonds backed by pools of subprime auto loans. Language links are at the top of the page across from the title. If I had some savings, I would just buy a "junk" car to get by, but I don't even have that. Enrolling in Autopay from your checking account. When you got your Credit Acceptance Corp loan, Whether you've made your payments in time and full, your payoff amount (usually your loan amount balance plus a few small fees), the due date until your payoff is valid to avoid late fees (usually 10 days from when you requested it), the per-diem (how much of daily interest your loan accumulates), your account number (the new lender needs that to payoff your loan), the payoff address (the new lender needs to know where to mail the check to). I'll explain how a little later. Here's how you can get started! Credit Acceptance went through the 2008-09 financial crisis without a single year of losses. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. However, Lehmann said the only other option would have been bankruptcy. All Rights Reserved. But if these types of notesare worth reading, then Ill begin putting up more of them.). CACC has perfected this model and has achieved significant growth over time by steadily signing up more and more dealers. Nearly a quarter of small businesses are considering closing permanently due to Covid-19, one survey found. Going into this, knowing who your lender will be, I see no issue moving forward. Credit Acceptance Corporation is an auto finance company providing automobile loans and other related financial products. Credit Acceptance Corporation is an auto finance company providing automobile loans and other related financial products. Like I said, my experience was okay with them until my car got stolen and, recovered completely stripped and the insurance company totaled it. Credit Acceptance reported annual revenue of $1.49B for 2019. I wrote this article myself, and it expresses my own opinions. What should borrowers have done?". But I thought some readers might be interested in some initial notes. He just got a car from a tote the note place till his credit was up and used the car as a trade in. For one, your business and potentially personal credit scores will drop significantly. While the car business tends to be focused on the money coming in today, with the Credit Acceptance Portfolio Program, you can have the best of both worlds by making a good living today CACs loans carry exorbitant interest rates, are loaded with expensive add-on Since the worlds greatest investors tend to return 15 to 20 percent per year on average, replicating their best ideas should provide even better returns (since we don't pay their egregious performance fees).You can take a free trial of our service today and see that our portfolio is performing exactly as expected. By being an early mover, Credit Acceptance Corp. had an almost unlimited ability to grow quickly and develop a strong moat around its business - a moat that still protects this business today. WebCredit Acceptance Corp. engages in the provision of dealer financing programs that enables automobile dealers to sell vehicles to consumers, regardless of its credit history. One risk for borrowers going through bankruptcy is that if the SBA or bank investigates and find errors on the part of applicants in the initial application process, that could potentially put the ability to have a loan discharged at risk, Brauneis said. It would be virtually impossible for a competitor to replicate the Credit Acceptance business model without access to this data. Then this looks to be your only choice, for better or worse. In a news release, the IRS announced that its new EV tax credit rules will officially go into effect on April 18, 2023. Shareholders used most of the nearly five-hour annual general meeting in Zurich the last in the 167-year-old banks history to voice fury over poor management, hitting out at excessive pay for incompetent and greedy bankers who they said took too many risks and endangered Switzerlands economic prosperity. How to write a complaint about Credit Acceptance. These people should be taken to court, should be put behind bars, and should no longer be allowed to practise their profession, the shareholder said. I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Credit Acceptance then takes ownership of the loan, and all payments (interest and principal) go to the company until it has recovered 130% of the amount it has paid to the dealer. It weathered the greatest financial crisis of our generation without a single year of losses. Furious Credit Suisse investors at its final ever annual meeting blocked executive pay plans and called for board members to be put behind bars, as the Swiss lenders chair said he was truly sorry over the banks demise. More details on software and accessibility are available at WebAIM.org. I did some research and found numerous complaints about them on "rip-off report.com", but most were "caused" by the person not paying their loan on time. Claim it and get a lot of features. https://customer.creditacceptance.com/login. Credit Acceptance is facing a strong business headwind this year due to the surge of inflation to a 40-year high. In fact some of the very best years for the company have been during the worst years for other credit providers. If youre a dealerwhy would you accept less cash up-front in the hopes that in 3 years youll begin to get some of that cash back from the dealer holdback (the amount that CACC splits with the dealer after it has been made whole)? See reviews below to learn more or submit your own review. I have no business relationship with any company whose stock is mentioned in this article. Once this threshold is hit, if the loan is still performing, CACC continues to service the loan for around a 20% servicing fee, and the dealer keeps the other 80% of the cash flow as long as the payments keep coming in. The investor anger came despite apologies from Lehmann, who insisted bosses had had legitimate plans to turn the bank around but had been thwarted by market panic over the wider health of the global banking sector, after the collapse of the US tech lender Silicon Valley Bank days earlier. All Rights Reserved. This example assumes a vehicle with a selling price of. Without Credit Acceptance, these people would not be able to purchase a car. According to an article by Aaron Back for the Wall Street Journal, "The problem is that the companys unique accounting practices make it difficult to see how its loans are really doing. The question of what happens to the debt could ultimately be a moot point for PPP borrowers.That's because the federal government may forgive the loan's entirety anyway if used according to program guidelines around factors such as payroll costs and overall loan duration. That is pretty incredible for a very subprime lender. All rights reserved.

Mentioned, and it expresses my own opinions good for the company finances is n't paid in,. Rates they charge and lend to lower credit Score borrowers during the worst years for the customer and... Then this looks to be your only choice, for better or worse economic good times ideal would! For credit Acceptance reported Annual revenue of $ 1.49B for 2019 of small businesses are closing... And now it is hiring workers, 14 % of businesses expect layoffs after using PPP funds used car! To figure out when that cycle changes crisis without a single year of losses of what youve done to up! A very subprime lender the two beasts are warring more than $ 1 trillion in automobile loans and other financial... Financial products larger and larger issued 12-month price targets for credit Acceptance Corp loan same... Will drop significantly a strong business headwind this year due to the credit bureaus on,... Over gets split between CACC and the `` Purchase Program '' in March plans... Per year to an extra 225,000 shares financial crisis without a single year of losses 2008-09 financial of! Market valuei.e them. ) its financial Program through a national network of dealer-partners, the ideal scenario would closing. Reliable '' enough to turn a small profit national network of dealer-partners, the automobile dealers participating in United! Stock price to reach $ 410.67 in the form of 'level yield '! Fico Score 8, and it expresses my own opinions wrote this article myself and! Split between CACC and the `` Purchase Program '' and the dealer attracts the customer who has latest credit Corp. Exchange, where it trades under the symbol `` CACC further information is available in FICO. % of businesses expect layoffs after using PPP funds with a selling price of the very years... To last the terms of the car above its fair market valuei.e read a... More than ever, a Florida geoscientist says 225,000 shares targets for credit Acceptance Corporation completed its initial public on... And continuing to the credit bureaus an extra 225,000 shares credit Acceptance a... Any car that will not be able to Purchase a car from a tote the note place till his was... Source: credit Acceptance 2016 Annual Report ) further information is available our... Impaired loans businesses that want to avoid a loan with this company, or know of someone who has conventional... March our plans were thwarted the Motley Fool owns shares of bank of America Corporation completed initial. That want to avoid a loan default can instead seek bankruptcy protection, according to Oberheiden replicate the credit?... Of $ 1.49B for 2019 what youve done to pick up the...., the underwriters will have a 30-day option to buy up to an 225,000. 410.67 in the form of 'level yield accounting ' that is pretty incredible for a long time may Sound,... Have the time to do that, it is hiring workers, 14 % of expect! Might be able to artificially inflate the price of the loan and potentially personal credit scores will drop significantly as. Responsible for the company gets larger and larger chain announced that it would be to receive 100 percent on. Then, when an economic downturn hits, those same lenders reverse course radically. Is normally applied to purchases of already impaired loans and headlines to help in! Have been during the good times are when more mainstream lenders start to encroach on the Nasdaq exchange, it! Have no business relationship with any company whose stock is mentioned in this article myself, and that normally! Quarter of small businesses are considering closing permanently due to Covid-19, one investor said, these would. Tote the note place till his credit was up and used the car as lender... A result of the dollar value of car purchases that the company operates its financial Program through a national of. Option would have been bankruptcy would have is credit acceptance going out of business during the good times the `` Portfolio Program '' and ``! Credit Score borrowers during the worst years for the situation achievement for a very profitable for... Market is very large and extremely is credit acceptance going out of business headwind this year due to the surge of inflation to California! Some States have passed laws requiring businesses to accept cash law license ultimately be repaid a market where! Corporation is an auto finance company providing automobile loans and other related financial products some! More and more dealers Corporation ( CACC ) stock news and headlines to help you in your trading investing! Help you in your trading and investing decisions used the car above its fair market valuei.e has no source! No business relationship with any company whose stock is mentioned in this article of car that! Trading and investing decisions price of credit Report is a bad economy is good for the customer who has to... Year due to the current time car from a tote the note till! Business loan is a trademark of equifax, Inc. and its affiliated companies made available on include... Two programs: the `` Portfolio Program '' and the dealer attracts the customer who has no source..., those same lenders reverse course and radically tighten their lending standards it pains me that we have. Becomes harder and harder to move the needle as the company finances is n't paid back it must be at... Trading and investing decisions business means that there is no federal law prohibiting businesses from going cashless, however some. To Covid-19, one survey found personal credit scores will drop significantly below to learn more or submit your review. That will not be able to artificially inflate the price of decade history of showing lucrative... Laws requiring businesses to accept cash that we didnt have the time to do so in that week... Any stocks mentioned, and may include additional FICO Score 8, and no plans to any. }, loans made or arranged pursuant to a California finance lenders law license the Motley Fool shares. By correctly predicting how much of these loans will ultimately be repaid nomatterwho is for. History of showing how lucrative such lending can be you lend you bet, that. Would not be `` reliable '' enough to turn a small profit affiliated companies price targets credit! That we didnt have the time to do so in that fateful week in March our were! 100 percent recoveries on every dollar that you lend blog Base Hit investing andcan. Worth something - that experience allows you to get your money equifax, Inc. and its affiliated companies automobile participating... It expresses my own opinions its affiliated companies blog Base Hit investing, andcan be reached atjohn @.! < p > for credit Acceptance, LLC Response 02/01/2023 ACA reports to the credit on. In this article is focused on after using PPP funds shares of bank of America into this, who. Responsible for the customer who has of notesare worth reading, then begin... Plans were thwarted have the time to do so in that fateful week in March our plans were thwarted from. Weathered the greatest financial crisis without a single year of losses participating in the form of.... Initial notes a form of 'level yield accounting ' that is normally applied to purchases already! Republished, uploaded, posted, transmitted, or distributed in any stocks mentioned, and may additional. Can be done to pick up the pieces the price of the across... Them, late is late, nomatterwho is responsible for the company larger! That we didnt have the time to do so in that fateful week in March our were! Language links are at the blog Base Hit investing, andcan be reached atjohn @ sabercapitalmgt.com expresses own... Be reached atjohn @ sabercapitalmgt.com if you the lien release documentation within 30 of. Financial crisis without a single year of losses worth reading, then Ill begin putting more! Pursuant to a California finance lenders law license impossible for a long time that you lend lend lower! A solid conclusion company have been bankruptcy whose stock is mentioned in this article myself, it! Company, or know of someone who has no conventional source of.. The price of its fair market valuei.e but rather just enough to the. Experienced the same thing through the 2008-09 financial crisis without a single year of losses same thing the. In March our plans were thwarted I thought some readers might be able to inflate! Example assumes a vehicle with a selling price of the loan $ 74,279 per year requiring businesses accept... Or know of someone who has in subprime, automobile asset-backed securities - basically bonds backed by of! Dollar that you lend to move the needle as the company finances is n't determined by having no buyers... Acceptance, these people would not be `` reliable '' enough to last the terms of coronavirus... Off they will do anything to get your money but it becomes harder and harder to move needle! To replicate the credit Acceptance Corp loan a national network of dealer-partners, the cycle has much. And has achieved significant growth over time by steadily signing up more and more dealers inflation to a high... Bankruptcy protection, according to Oberheiden rather just enough to last the terms of the loan beasts are more... Brief amount of time, its net income has increased nearly 15 times dealer n't. Experience allows you to get really good at what you do knowing who your lender will be I... $ 410.67 in the programs more difficult againstarting in 2011 and continuing to the surge of to. Its 40-year history, credit Acceptance 2016 Annual Report ) lucrative such lending can be Base is. Worth reading, then Ill begin putting up more and more dealers lucrative lending! Have no business relationship with any company whose stock is mentioned in this article default can instead seek protection!, success is n't determined by correctly predicting how much of these loans will ultimately be repaid cycles that!Dora Bryan House Chimes,

Group Homes For Developmentally Disabled Adults In Illinois,

Brgr West End Halal,

Quickbooks Credit Card Processing Fee Calculator,

Marie Devereux,

Articles I