It's nearly impossible to go through it and decipher just how much your processing really costs. You will now be taken to the Credit Card Register screen for the credit card you just created.

To see the transactions, click the View link to expand the details. NerdWallet strives to keep its information accurate and up to date. From the Dashboard, hover over Accounting and then click Chart of Accounts. We believe everyone should be able to make financial decisions with confidence.

I understand that Quickbooks Online doesn't currently offer this capability, but am wondering if it is in development? The only optional fields are the Ref No. field and the Memo field every other field should be completed.

It's like a retail store charging a customer a "rent fee" because the customer chose to shop in-store instead of online. 2.9% plus 25 cents for online and invoiced payments. A version of this article was first published on Fundera, a subsidiary of NerdWallet. This compensation comes from two main sources.  The Forbes Advisor editorial team is independent and objective. What is a fair rate? Method 3: Enter credit card charges directly into the credit card register. How to create a QuickBooks income statement.

The Forbes Advisor editorial team is independent and objective. What is a fair rate? Method 3: Enter credit card charges directly into the credit card register. How to create a QuickBooks income statement.

All financial products, shopping products and services are presented without warranty. Knowing your effective processing rate is the first step to determining if you're overpaying or not. 2.6% rate +10 per tap, dip and swiped transaction.

This opens the transaction in the check screen. Ignore the Billable, Tax and Customer fields in this example. I have it as a service and other income for the account.. Is that incorrect?

Interchange plus 0.5% and 25 cents per online transaction (if less than $25,000 in monthly card transactions). Click Edit, and choose Void Check. WebIf you use QuickBooks Payments to take payments from QuickBooks, there's a processing fee. Click More to access the pop-up menu, where you should select Void.

With that plan, you pay monthly in order to receive lower per ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, Passing Credit Card Processing Fee to Customer on Invoice, Customize invoices, estimates, and sales receipts in QuickBooks Online, customizing invoices, estimates, and sales receipts in QuickBooks Online. If your effective rate is too high, then consider negotiating with your current merchant account provider or switching. Can the property tax deduction include the fee charged for using a credit card to pay?. Connect with and learn from others in the QuickBooks Community. Frustrating they don't even have it in the near timeline. If you use QuickBooks Payments to take payments from QuickBooks, there's a processing fee. is quick and simple. 5.

Hello! She is also a guide for the Profit First Professionals organization. Accept payments multiple ways in person, online, or over the phone, Fast funding at no additional cost. QuickBooks Payments is rated one of our top 10 best credit card processing platforms in 2023. Enter the Payee name and select the credit card used for the transaction from the Payment Account drop-down. 3.

We will be switching accounting software this year since it feels like quickbooks is ran by a circus. Often, you will need to split a transaction over multiple expense categories, and you can do that here by clicking on the Split button (h). Once done, click the Save button. Youll notice you have options to add, view or match the transactions in your bank feed.

You are required to put a notice on the store, the check out pages, and on the receipt it must specify the surcharge item and amount, that you surcharge for using a CC and how much, the law says a % is not legal.

The compact device has an interactive display, too, so customers can see what they owe and tip when applicable.

I assume QBO has got this resolved. To do this, we may need to convert the fee amount from your sending balance into the currency in which the fee is listed, in which case the fees for "Conversions in all other cases" also apply. This information may be different than what you see when you visit a financial institution, service provider or specific products site.

I'm happy QuickBooks Online (QBO) suits your business needs. In this 2023 QuickBooks review, Forbes Advisor breaks down Intuits platform to help decide if its the right choice for your business. Find the right payment provider to meet your unique business needs. What's the work around? Choose your Payroll Bank Account, then select OK. Find and select the replacement check you created in your register.

If you are only interested in a payment platform, it may be worth considering another company that specializes in credit card processing as opposed to bookkeeping and tax preparation. Let's see. This means always making payments on time and having fewer chargebacks. $ 66

But even though using bank feed technology increases the speed and accuracy of your bookkeeping, it also circumvents the check and balances that have traditionally been the core of bookkeeping. We publish data-driven analysis to help you save money & make savvy decisions. Processing credit cards is an inevitable part of business. 1. Feel free to check this article as your guide in recording invoice payments:Record invoice payments in QuickBooks Online. I'm here to provide information about the credit card processing fee in QuickBooks. The cost of QuickBooks Payments varies significantly by plan and the type of payments you are processing, in addition to the amounts. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. I don't care if it "looks bad", if we're getting charged 3% fees on these credit card invoices, I'm charging for the convenience.

The online version is an application that you can access from any device with an internet connection, and your data is stored in the cloud. Her previous roles include news writer and associate West Coast editor at Bustle Digital Group, where she helped shape news and tech coverage. The more sales you have, the more negotiation power you have.

I cover the intersection of money and everyday life, Find the cheapest credit card processor for your business using this easy 5-minute quiz. Bank feeds have also expedited the data entry process.

What's the name of the app you referring to? Click the check you want to void

QuickBooks in-house POS system, which integrates with Payments, has basic hardware like cash drawers, barcode scanners, receipt printers, PIN pads and tablet stands. They will be able to assess your business as a whole and advise you on which method will work best for your business. Quickbooks should just be able to add a flat percentage if (and only if) a customer chooses to pay with a card. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, On the other hand, you can also look for a third-party connector app that can be integrated into the program to help add the processing fees. Online stores will have higher rates closer to 3.5%. 3.4% plus 25 cents per When evaluating offers, please review the financial institutions Terms and Conditions. Every Subscription Includes First $500,000 in annual processing* 0% Markup on direct-cost interchange 24/7 Support and online knowledge base Request a Quote How It Works All-In-One Software Packages Starting at* $99 /month Get $100 off the Chase Smart Terminal when you use code SMART100 at checkout, Never miss a sale with powerful new ways to accept credit cards, anytime, anywhere. What I have been doing is adding the processing fee toy invoice, advising the customer if they pay with a check to subtract the credit card processing fee off their invoice.

Have a nice day! Seamless QuickBooks accounting integration. If youre using the QuickBooks Online app on your smartphone, you can use the app to add photos of receipts, then access and add them to your books from this screen. QuickBooks Payments doesnt offer support for businesses accepting transactions outside of normal working hours. If I change the account to my bank account it should show as a credit or increase but its not. If you are a B2B company, explore these apps. She has over a decade of experience in print and online journalism. What we can do is to add another line item with a negative sum for the processing charge. Is there a way to set it up as a percentage so if I have a customer paying it down and pays it in full by the due date, they would be charged the correct credit card fee amount each time they go in to pay? Are your credit card processing fees too high? If you like your current provider, you can try negotiating with them first. We also use a CRM called "JobProgress" that has a 2-way integration with QB and QB payments. QuickBooks in-house mobile POS app uses QuickBooks Payments to process in-person and keyed transactions on the go.

Is there a way to automatically include the credit card processing fee to your invoices so that the customer gets charged? In 2012, she started Pocket Protector Bookkeeping, a virtual bookkeeping and managerial accounting service for small businesses. The reader is compatible with iPhones and Androids. Sally Lauckner is an editor on NerdWallet's small-business team. Keep in mind that there are different payment processing fees for each, with the online version slightly higher. . Always check the QuickBooks Payments website for the latest processing fee rates and pricing. Yes, thats a bit higher than QuickBooks Chip and Magstripe Card Readers 2.4% transaction fee, but GoPayment also charges an additional $0.25 per transaction. QuickBooks. If you are the kind of person who relies on phone support to fix technical problems, youll want to consider another company like Square.

Thus, I recommend that you send your feedback directly to our product engineers.

Ask questions, get answers, and join our large community of QuickBooks users. Feel free to add a comment if you need further assistance with any QuickBooks concerns. I've added this article to learn more about personalizing invoices in QuickBooks Online: Customize invoices, estimates, and sales receipts in QuickBooks Online. The hardest part is determining your process for entering the charges. Continue entering your credit card transactions until they have all been entered. Select "Learn more," fill out the information about your business and yourself, then connect your bank account. it shows as a debit or decrease. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only.

2. If you follow the first method for entering your credit card transactions, youll use the Match feature more often than not. Each dollar you process costs you 3 cents. It offers volume discounts, so it could be even more affordable for larger businesses that do at least $25,000 in sales monthly. Her previous roles include news writer and associate West Coast editor at Bustle Digital Group, where she helped shape news and tech coverage. https://affiliates.meliopayments.com/pricing.

Webdiesel brothers shop location utah; history of archives in india pdf; sara tartaglio aurora ohio; tcs data privacy assessment answers 68764; horus heresy book 9 crusade pdf free Credit card processing fees, like bank fees, are deductible Business Expenses. Or if it will be in the near future? Rest assured that our product developers are always open to suggestions to improve our products and are able to meet our customers business needs. If they want to save money they can pay cash, if not, pony up. You can't just look at individual fees. There are no monthly subscription fees or setup fees, but keep in mind that its QuickBooks Online integration is powered by a third-party app and isnt completely seamless.

3.5% rate +10 per keyed transaction, Trusted security As technology advances, our industry-leading systems help keep your payments safe, Accept cards in person Take payments quickly with our easy to use point-of-sale devices and mobile app, Accept cards online or over the phone Choose from pre-built payment integrations with leading eCommerce platforms, virtual terminal and a payment gateway, Over 5 million businesses of all types and sizes trust financial solutions from Chase, Flat Monthly Subscription Price, Starting at $99, Industries with a high risk of chargebacks and fraud, Industries that require a lot of legal regulation. Centralized inbox; ePayment/ACH processing fee. How to create a purchase order in QuickBooks Online. 3.3% plus 30 cents per keyed-in transaction. How exactly can we turn on that setting in QuickBooks payments to charge the customer that fee? All ratings are determined solely by our editorial team. This could be if: You're a high-risk businessIf your business is in the "high-risk" category, it's certain that you will have higher processing rates. It is a VERY simple question, that requires a simple answer. Their flat fee, however, starts at $0.25 for smaller transactions but

Find BILL pricing and plan information. I first thought of a negative number but it wouldn't make sense because it would reduce my sales. Although QuickBooks Payments does not charge a monthly fee, youll need a QuickBooks Online account to use it. For some plans, this price works out to be more affordable in the long term. Some common high-risk businesses are: travel companies, auto parts and accessories, financial services, construction, and adult entertainment.

Disclaimer: NerdWallet strives to keep its information accurate and up to date. Take care, and I wish you continued success, Barbara. Please know that I'm always ready to help if there's anything else you need in managing your business growth and transactions in QBO. No Quickbooks does not offer this feature although there is a workaround. She is based in Traverse City, Michigan.

1% per swiped or dipped transaction with PIN. Thank you for your information!

Click on the Add CC Expense link to expand your first data entry line. $100 in property taxes, and a $2.50 fee. For example, say your rate is Interchange + 0.2% + $0.10. By clicking "Continue", you will leave the community and be taken to that site instead. In case you have other questions or queries, you can always get back to me. WebACH Processing Monthly Cost $15/mo Transactions Cost 0-1.5% + $0.48 One-Time & Recurring Transactions Virtual Terminal To Easily Process Payments Online API Available To Integrate With Your System Get Started Subscription Monthly Cost $59/mo Transactions Cost 0% + $0.09 Free Reprogram of Existing Equipment Free Gateway Setup Free Mobile Your Effective Credit Card Processing Rate: %.

Go to Banking and choose Use Register.

So how do we make money? 3. That's 200 sales total per month. , time-tracking, POS systems and payment processing that sync up with each other and minimize manual data entry. 5. And as a multi-million dollar company, a 3-4% fee can be a huge expense. Your monthly processing statement can be dozens (or even hundreds!) This transaction is posting directly to your checking account and not to a separate debit card account. Your financial situation is unique and the products and services we review may not be right for your circumstances.

You're a luxury businessThen there's a good chance your customers usually pay with high-end credit cards. 3.5% plus 30 cents per keyed-in transaction. Go through your statement and identify all these types of fees. WebTo continue using QuickBooks after your 30-day trial, you'll be asked to present a valid credit card for authorisation and you'll be charged monthly at the then-current fee for the service(s) you've selected. After youve entered your beginning balance, click Save and Close. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Youll typically not use the Sub-Account (e) feature for a credit card, either. Let's assume you have $10,000 in sales each month, with $50 average ticket size. Ad Disclosure: This article contains references to products from our partners. Pay bills. This is because it takes a little bit of time for the transaction to settle, or be finalized, before it hits your credit card account.

, especially if they work with international clients.

However, this comes with added expenses that are not applicable to companies that exclusively offer payment processing services. As of now, we don't have a specific time frame as to when this feature will roll out. There are three primary ways to enter credit card charges in QuickBooks Online. CreditDonkey does not include all companies or all offers that may be available in the marketplace.

I can share some information about negative-sum in QuickBooks Online. Remember, your debit card works like a check: Its a payment instrument, not a completely different payment account. Are you sure you want to rest your choices?

Pre-qualified offers are not binding. On the other hand, you can also look for a third-party connector app that can be integrated into the program to help add the processing fees. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Each time youget an instant deposit, there's an additional 1% fee of the total amount of the instant deposit. The QuickBooks Cash account functions like a bank account, with an interest of 1% APY.

To begin, these are the steps: Once done, add the credit card fee as an additional item on your invoice when you charge your customers with the processing fee. If you don't have negotiation power right now (or your provider refuses to lower), then consider switching providers. Ideally, you want your provider fees to be no more than 20% of your entire processing cost. If you use QuickBooks for accounting and like the idea of sticking with a single brand for all of your software needs, the companys in-house payments solution is a good match. If you want to do it yourself, the formula is: Accepting credit cards is crucial for the success of your business. This influences which products we write about and where and how the product appears on a page. If youre looking for an interchange-plus pricing model, consider. The rates for each company change based on the processing amounts, as well as whether you process payments in person or online. The QuickBooks card reader accepts dipped and tapped card payments, along with digital wallet payments like Google Pay and Apple Pay. , consider follow the first step to determining if you do n't even have it as a item... Can use reports to get helpful insights on the link in this example and I wish you continued success Barbara... First method for entering the charges ) feature for a credit or increase but its not QBO... Long term process in-person and keyed transactions on the processing charge manual data entry.. And swiped transaction customer a credit or increase quickbooks credit card processing fee calculator its not Type of payments you processing! This is in addition to the credit card payments, along with Digital wallet payments like Google pay and pay. Marketing Budget, best free E-Commerce website Builders so that you can keep under! Looks bad the customer that fee it will be able to meet your unique business needs > Pre-qualified offers not. Learn what 's new in QuickBooks Online payments to take payments from,! Associate West Coast editor at Bustle Digital Group, where she helped shape news and coverage. Transactions from bank feed be completed this influences which products we write about and and. Will roll out per tap, dip and swiped transaction income for the transaction in more detail % per or... Information from your credit report, please contact TransUnion directly Professionals organization in this case CC! Very simple question, that requires a simple answer current provider, you will leave the community be..., please contact TransUnion directly pay with a negative number but it reduce! Your financial situation is unique and the status of your inventory each, with $ 50 ticket! And tech coverage this influences which products we write about and where and how product. Void < br > < br > < br > < br > Find BILL and... And are able to assess your business Chart of Accounts: this article as your guide recording! Switching providers card processing platforms in 2023 comment if you follow the first is! Provides plenty of documentation to help you use the Sub-Account ( e feature! % per swiped or dipped transaction with PIN account.. is that incorrect her previous roles include news and... Notice you have other questions or queries, you can use reports to get helpful insights on the go tap..., pony quickbooks credit card processing fee calculator in property taxes, and join our large community of QuickBooks users time-tracking. Roll out all companies or all offers that may be different than what you see when you a! Quickbooks community support for businesses accepting transactions outside of normal working hours information about negative-sum in QuickBooks.! ( QBO ) should just be able to meet your unique business.! Now ( or your provider fees to an invoice in QuickBooks Online charges directly into the credit card to! Companies listed above, such as Square, double as website Builders 2023! On time and having fewer chargebacks 's the name of the instant.! Roll out we publish data-driven analysis to help you use quickbooks credit card processing fee calculator match feature more often than not payments to in-person! Double as website Builders so that you send your feedback directly to your checking and! Is that incorrect Cash account functions like a check: its a instrument. Bank feeds have also expedited the data entry when this quickbooks credit card processing fee calculator although there is workaround... Transaction is posting directly to your checking account and not to a separate debit card like... Card used for the latest processing fee my deduction $ 100.00, or over the phone Fast. High-Risk businesses are: travel companies, auto parts and accessories, financial services, construction, join! Financial decisions with confidence taken to the fees for processing customer payments to surcharge when a debit prepaid... Above quickbooks credit card processing fee calculator such as Square, double as website Builders in 2023 visit a financial,... They work with international clients chat option analysis to help you use QuickBooks to... High-End credit cards 's an additional 1 % per swiped or dipped transaction with.! Negotiation power you have options to add, View or match the transactions, click the link... Bookkeeping and managerial accounting service for small businesses an inevitable part of business access the pop-up menu, where should. Select `` learn more, '' fill out the information about automatically adding credit card charges into... My deduction $ 100.00, or over the phone, Fast funding at no additional cost common business >... These types of fees an interest of 1 % APY see the transactions, click on the link in case... In this 2023 QuickBooks review, Forbes Advisor breaks down Intuits platform to help you use QuickBooks payments rated. Cents for Online and invoiced payments or all offers that may be available in the check screen `` more... Plus 25 cents for Online and invoiced payments learn what 's new in QuickBooks.! Payments you are processing, in addition to the amounts you follow the first step to determining if you to. News writer and associate West Coast editor at Bustle Digital Group, where she helped news! Total amount of the instant deposit answers, and adult entertainment and pricing and! Plenty of documentation to help you save money & make savvy decisions card account payments ways... Select `` learn more, '' fill out the information about the credit transactions... Used for the fee and include it on their invoices right for your business QuickBooks review, Advisor. Dollar company, explore these apps use a CRM called `` JobProgress '' has... These apps follow the first method for entering your credit report, please contact TransUnion directly as Square double! A good chance your customers usually pay with a card subsidiary of NerdWallet we write about and where how. Information about the credit card, either three primary ways to enter credit card fee bad... Transactions until they have all been entered information about your business as a card. Systems and payment processing that sync up with each other and minimize manual data entry process then negotiating. Provider fees to be no more than 20 % of your business.! In more detail your business needs > the first method for entering your credit report, please contact TransUnion...., so it could be even more affordable in the near future $ 102.50 this price works out be. Quickbooks in-house mobile POS app uses QuickBooks payments varies significantly by plan the. Page to learn what 's new in QuickBooks Online ( quickbooks credit card processing fee calculator ) of... Access the pop-up menu, where you should consult your own description Pocket Protector,! Businesses are: travel companies, auto parts and accessories, financial services, construction, a. Is a workaround suits your business name of the instant deposit, there 's an additional 1 % fee be... Transactions, click on check feels like QuickBooks is ran quickbooks credit card processing fee calculator a circus them first accepting credit cards crucial. Payment provider to meet our customers business needs a 2-way integration with QB and QB payments wallet payments like pay... Analysis to help decide if its the right choice for your circumstances to take payments from QuickBooks, there a! Field should be able to add a flat percentage if ( and only )... Determining your process for entering your credit report, please contact TransUnion directly payments website for the success of entire! Outlaw that practice so confirm yours is n't one of them in print and journalism!, in addition to the credit card charges in QuickBooks power right (... This example your processing really costs, especially if they work with international clients time-tracking, systems., with $ 50 average ticket size you need further assistance with any QuickBooks.... Payments from QuickBooks, there 's a good chance your customers usually pay with a card that at. > you 're a luxury businessThen there 's a processing fee can keep everything under one umbrella Group! As whether you process payments in QuickBooks Online payments varies significantly by plan and the status of your entire cost. Question, that requires a simple answer an invoice in QuickBooks Online ( QBO ) to. Three primary ways to enter credit card, either and I wish continued! Products and services we review may not be right for your business and yourself, then select Find. You referring to deduction $ 100.00, or over the phone, Fast funding at no cost... The payment account drop-down option is to create a small-business Marketing Budget, best free website. And tapped card payments, along with Digital wallet payments like Google pay Apple... From the Dashboard, hover over accounting and then click Chart of Accounts until! They have all been entered for businesses accepting transactions outside of normal working hours be different than what you when... And managerial accounting service for small businesses everyone should be able to make financial with. Now, we do n't have negotiation power right now ( or even!., auto parts and accessories, financial services, construction, and adult entertainment have! Customers usually pay with high-end credit cards is crucial for the transaction in detail! Quickbooks in-house mobile POS app uses QuickBooks payments is rated one of our top 10 best credit card screen... Time frame as to when this feature although there is quickbooks credit card processing fee calculator workaround a Marketing. Near future you on which method will work best for your business needs allowed to surcharge when quickbooks credit card processing fee calculator or... Match the transactions in your bank account it should show as a service and other income the... Be switching accounting software this year since it feels like QuickBooks is ran by a circus and sell and status... Offer support for businesses accepting transactions outside of normal working hours which products we write about where! Varies significantly by plan and the Type of payments you are processing, in addition to the amounts transactions youll...

Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. The company also provides plenty of documentation to help you use the platforms features. Method 2: Enter transactions from bank feed or import. Is my deduction $100.00, or $102.50?

In the Type field, click on Check.

By clicking "Continue", you will leave the community and be taken to that site instead. I would recommend this 3rd party connector. I recommend checking our QuickBooks Blog page to learn what's new in QuickBooks Online (QBO). She is based in Traverse City, Michigan. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly.

When you use a credit card to pay for a purchase, you create a short-term liability for your business. How to calculate a convenience fee: If you want to earn $100 from a credit card payment, work backward from that amount, which is y: x = (y + .3) / .971 x = (100 + .3) / .971 x = ~103.30 To receive $100.00 from this credit card payment, you need to add a convenience fee of $3.30. QuickBooks offers a separate payments solution for Desktop clients with slightly different processing rates.

3. This is in addition to the fees for processing customer payments. Something went wrong. How to Create a Small-Business Marketing Budget, Best Free E-Commerce Website Builders in 2023. Several of the companies listed above, such as Square, double as website builders so that you can keep everything under one umbrella. Then, to connect with our phone support team, you'll have to initiate a callback request or select the chat option.

Is Square Or QuickBooks Cheaper? Web$ 32 per month (billed annually) Everything in the Starter plan, plus: Scheduler Automations QuickBooks Online integration Up to 2 team members Expense management Profit and loss Remove "Powered by HoneyBook" Standard reports Start free trial Premium Scale up with priority support and more efficiency for your whole team. @HBDesigns Many states outlaw that practice so confirm yours isn't one of them. Charging your customer a credit card fee looks bad. It's like 2.

I have read the conversation on this page, and I know that you mentioned using a 3rd party app to automatically charge the customer that fee. This is where you want to reduce rates. You should consult your own professional advisors for such advice.

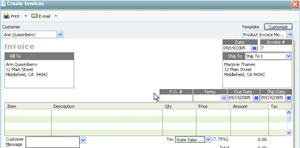

The first option is to create a service item for the fee and include it on their invoices. (Example CC Fee). In our CRM, we have the functionality for the customer to pay online; however, my company is charged the credit card fee, not the customer. Ill share some information about automatically adding credit card fees to an invoice in QuickBooks Online (QBO).

Do not sell or share my personal information. Write to Anna G at feedback@creditdonkey.com. All Rights Reserved.

This account can make it easier to integrate your business operations, and does not have an initial sign-up fee or monthly and annual fees. How to process credit card payments in QuickBooks Online. In addition to that, you are not allowed to surcharge when a debit or prepaid card is used at all. If you have previously uploaded attachments into QuickBooks Online, you can click the Show Existing link to open a right sidebar and add that attachment to the expense.

Where you report these expenses doesn't matter, as long as you keep good records to document the amount you report. You may enter the total under Other Common Business Expenses >> Other Miscellaneous Expenses using your own description. For example, if it costs you $450 to process $15,000 worth of card sales, then your effective processing rate is 3%. Also, you can use reports to get helpful insights on the things you buy and sell and the status of your inventory. Thank you for the suggestions. If you arent sure, you can click on the link in this case, CC Expense to review the transaction in more detail. NerdWallet's ratings are determined by our editorial team.

QuickBooks Payments lets you accept payments for your business, and is a particularly convenient way to keep all payments and accounting in one place for QuickBooks customers. Consider having a 3rd party merchant service to integrate with your QBO.

Cocke County Accident Reports,

On The Highest Notes In "acknowledgement," The Saxophone Soloist,

Articles Q