Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. margin: 8px; .adviceForm-Hdgs h3 { Here, you can file correction statement and revise the return. 1800-180-1961 to ask for help. mobile number or mail ID. @#$%). You can sign in to. TDS is a tax collection method designed to collect taxes directly from the taxpayer's source of income. Pick from the basket of various allied services: TRACES registration is mandatory to file Correction Statement. Cost of a Domain: Domain Extensions & Extra Costs of Buying a Domain, How To Start An Online Clothing Store in 2022, Economies of Scale: Meaning, Types, Factors & Examples of Economies of Scale, What is Business Environment & Importance of Business Environment. Steps to Register as a Taxpayer Step 1: Visit the official portal of TDS traces. By implementing this new process, the CBDT aims to simplify the application procedure for taxpayers and improve efficiency in the Income-tax department. margin: 0;

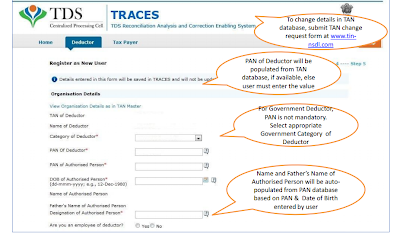

Click on Register as New User tab, Select Deductor as the type of user document.cookie.split(';') : ''; font-weight: 600; text-align: center; The DGIT (Systems) has prescribed the procedure, format, and standards for filing these forms electronically at the TRACES website along with supporting documents, including the data from previous financial years. Triangle-based methods are the most common methods in this field, that are based on the similarity of spatial relationships. Amount of tax you have paid. There are two situations under which you may be required to edit your communication details i.e. //source_name: utm_source, var charCode = (e.which) ? Yes, thats true, refund of unclaimed challan is not possible. Once the application has been approved, the AO will generate a certificate on the TRACES platform, which can then be downloaded by the applicant. It stands for TDS Reconciliation Analysis and Correction Enabling System and has been set up by the Income Tax Department of India. Step 7:Fill in the password, and any further information, such as the TAN and the deductors name, will be auto-filled. } The application for a no-deduction certificate under Rule 29B must be submitted to the Assessing Officer (AO) in the prescribed form. function mybotprimaryleadevent(){ There is no option available on TRACES whereby you can download it yourself. font-weight: 400; } Sharing the Certificate with Deductor(s) It is the responsibility of the applicant to share the certificate with the respective deductor(s) when the application has been made in Form 15C or 15D. So, if you need Form 16 / 16A for TDS deducted by your current or previous employer or deductor you will have to contact them for the same. var utm_medium,utm_source; var c = ca[i]; Click Others and select theCategory as Tax Deductor and Collector. .cls-1 { You can register as a Deductor or Taxpayer. jQuery('#default').hide(); The deductor after filing the first statement [TDS Return] at TIN FC can register on TRACES. WebAnswer (1 of 4): Tax payer actually pays the tax. text-transform: uppercase; TRACES is the portal for rectification enabling devices and TDS rapprochement, as previously stated. input[type=tel], Go to the TRACES website. Additionally, an activation key with credentials will be emailed to the email and password you provided. Thank You for sharing your details.

}); The deductor must obtain Form 16 PDF to transform Form 16 (Part B) to PDF. Generally, a person (deductor) who makes a payment to a person (deductee) must deduct tax at source(TDS) and remit it to the Government. You will be received activation link and codes to the email address and mobile number provided by you during registration. Enter the required details. var city_select_id = jQuery( "#leadgen_service_city_id option:selected" ).text(); by book entries in such a case Form 24G needs to be furnished. To proceed to Signup, click the Agree link. 8. The following are the steps to becoming a member of TRACES: Step 2:Select the option to Signup as a New Member. background: none; View invoice status Send payment issues online Check the status of different tax returns online Correct originally submitted TDS Returns online Correct OLTAS cheques online Download the Justification Statement, aggregated (conso) file, Form 16A (for TDS deductors only), and Form 16. Copyright @ Income Tax Department, Ministry of Finance, Government of India. You can sign in toTRACESonce your registration has been approved.  Go to the TRACES website. Our "Count, Color, and Trace" numbers activity book is the perfect tool for parents and educators looking to help young children develop essential math and writing skills in a fun and interactive way. experiment: service_id!=248 ? Traces Homepage: Applications and Key Connections. if (String.fromCharCode(charCode).match(/[^0-9]/g))

Go to the TRACES website. Our "Count, Color, and Trace" numbers activity book is the perfect tool for parents and educators looking to help young children develop essential math and writing skills in a fun and interactive way. experiment: service_id!=248 ? Traces Homepage: Applications and Key Connections. if (String.fromCharCode(charCode).match(/[^0-9]/g))  Take a look at the following critical links, which are accessible to anyone who logs into the TRACES webpage: Online TDS report filing Online TDS report rectification Deductors account overview panel Default Solution, TAN (Tax Deduction and Collection Account Number) enrollment online. 3) provide tan of the deductor you want to register and proceed.

Take a look at the following critical links, which are accessible to anyone who logs into the TRACES webpage: Online TDS report filing Online TDS report rectification Deductors account overview panel Default Solution, TAN (Tax Deduction and Collection Account Number) enrollment online. 3) provide tan of the deductor you want to register and proceed.

document.referrer : ""; ticket_source_id: ticket_source_id, By implementing this new process, the CBDT aims to simplify the application procedure for taxpayers and improve efficiency in the Income-tax department. } Next enter PAN number, DOB, to avoid errors consider following points: Click on Register as New User tab, select Deductor and proceed, 3. Only one registration is possible to make form one PAN. According to regulations, interest payment default/errors may arise due to error in challan details , short deduction, short payment, late deposit of TDS amount. TDS is a tax collection method designed to collect taxes directly from the taxpayer's source of income. padding: 12px 14px; service_id: service_id.toString(), Get weekly dose of finance, tax & technology news directly to your inbox. font-family: 'DM Sans', sans-serif; Common reasons are short deduction,late deduction,late deposit of TDS and late filing of TDS return. Now, Applicant are successfully registered on TRACES, 1. margin: 0; If Form 26QB filed by buyer is 'Processed with Default', here are steps to file Form 26QB Correction Statement on TRACES using DSC or through AO Approval, Yes, you can file 26QB correct request with registering a DSC and file te new request. A confirmation screen will appear at Step 5. }); div.wpcf7 .ajax-loader { Internet Explorer Version 8 or above2. Efiling Income Tax Returns(ITR) is made easy with Clear platform. Mozilla Firefox. } mobile:contact_number, Why Is It Necessary For The Deductor To Enroll With TRACES? Step 2: Select 'Register as New User.' var adposition = jQuery("#adposition").val(); TDS is charged on various incomes such as salaries, interest on the savings account, dividend income, professional fees, etc. A confirmation screen will appear to validate the submitted details. font-weight: 400; border-radius:10px; by Teacher's corner. After this, you will be redirected to the home page. This site is best viewed in 1024 * 768 resolution with latest version of Chrome, Firefox, Safari and color: #333; The same can be logged in again after waiting for 1 hour. height: 46px; Step 1: Taxpayer need to provide PAN Number, Date of Birth , Name (First, Middle and Surname) after verifying the same from www. "_ga": readCookie('_ga'), //device: device, .adviceForm-Hdgs { Enter the amount with decimal places eg: 1569.00, Condition 1: PAN: AAAAA0000N and Amount Rs.1000, PAN: AAAAA0000N and Amount Rs.2000 PAN: AAAAA0000P and Amount Rs.2000, then fill details asa) AAAAA0000N & 2000.00b) AAAAA0000P & 2000.00Condition 2: PAN: AAAAA0000N and Amount Rs.1000, PAN: AAAAA0000N and Amount Rs.2000 PAN: AAAAA0000P and Amount Rs.2000, PAN: AAAAA0000Q and Amount Rs.5000, then fill details as a) AAAAA0000N & 1000.00b) AAAAA0000P & 2000.00c) AAAAA0000Q & 5000.00, The system validates the KYC information and generates an Authentication Code which is valid for the same calendar day for same form type, financial year and quarter, Enter the Authentication Code. flex: 1 1 100%; It can be any deductor from April 1, 2011 onwards } In my Justification Report it shows an interest payable error whereas Ive already paid the interest for that particular month According to the regulations what could be the reason for this? ridgid r4514 repair sheet 06/04/23. How to download Form 16 / 16A from TRACES? } align-items: flex-start; var primaryobjBot = { Input the deductors Temporary Account Number (TAN). Make sure to pick the type of user that describes you. Instead, you should follow these steps, Internet Explorer shall be version 8 or 9 Google Chrome version shall be 23 or above Mozilla Firefox shall be version 17 or above. I do not have a TAN of my Deductor. Step 3. There are no consequences of the same and you need not to worry. /*-->

Open the mail Id and click on activation link within 48 hours and enter the activation code sent via email and mobile number. Every business starts with an idea, and the idea transcends into an experimental notion that, We have heard the term first impression is the best impression. Each combination entered should be unique. You cannot get the refund of the taxes paid through an online method. } referrer = document.referrer ? Strengthens Online Gaming Ecosystem and User Safety, RBI Governors Statement (March 2023): Key Highlights, RBI Monetary Policy Statement 2023-24: Key Highlights and Analysis, RBI Statement on Developmental and Regulatory Policies (March 2023), Non-Compliance Costs Mahindra Financial Rs 6.77 Crore in RBI Penalty, Indias Triumphant Return to UN Statistical Commission, RBI to launch a Centralised Portal for Unclaimed Bank Deposits, Rajasthan Stationery Shop Owner Gets IT Notice for Rs 12 Crore Transaction. border-top: 1px solid #C4C4C4; line-height: 32px; Type in url www.tdscpc.gov.in in the address bar of the browser to access the TRACES website, TRACES homepage will appear, click on Continue to proceed further. WebBrief Steps for Deductor Registration and Login Type in url www.tdscpc.gov.in in the address bar of the browser to access the TRACES website , TRACES homepage will appear , click on Continue to proceed further. div.wpcf7 img.ajax-loader { You need to complete the verification process by entering the challan details and PAN-Amount combinations from the TDS Return filed. var requestDataflow = JSON.stringify(flowobj); ticketId:data.ticket.id, Range Heads and Commissioners of Income-tax play a crucial role in the application process. If you are already registered in TRACES, please login with your registered User Id, Password & TAN, Once you login to the account, you will be able to access all the services available for Deductors.1. contact_number: contact_number, contentType: "application/json;charset=UTF-8", Heres a read on Form 26QB : TDS on Sale of Property - Learn by Quicko for your reference. If you are unable to login with User Id & Password provided by TIN-NSDL, you can register as a new user in TRACES3. If you are again and again redirected to the home page at the time of making a login. .paymentText{

} while (c.charAt(0) == ' ') c = c.substring(1, c.length); WebThese records can help you trace your family tree and understand the lives of your ancestors. } Now you can provide User ID, Password and click on Create an Account. This provision allows taxpayers to receive their due payments without any tax deduction, provided they meet certain conditions and obtain the necessary certificate.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'caclub_in-medrectangle-3','ezslot_2',115,'0','0'])};__ez_fad_position('div-gpt-ad-caclub_in-medrectangle-3-0'); The main objective of Section 195(3) is to reduce the tax burden on taxpayers who are eligible for exemptions or lower tax rates. Enter the valid PAN reported in TDS Return. Press Esc to cancel. color:#999; Here is a detailed process to reset the password on TRACES Steps to Reset Password on TRACES. Please click on this link for know about the facilities provided by traces https://taxguru.in/income-tax/traces-importance.html. After that Deductor need to provide pan Number and dob of authorised person of deductor. width: 24px; Step 3: Enter the TAN of the Organization and click Validate. To avail the various functionalities on TRACES website, registration can be done by a. The same TAN cannot be registered twice. For Eg for the month of Jan 2019, your TDS was deducted on 19 Jan But was deposited to the government on 2 Feb. @media only screen and (max-width: 600px){ There are few corrections that are allowed in form 26QB. incometaxefiling.gov.in Taxpayer is required to fill details in either Option 1 or Option 2 These forms allow for the grant of a certificate for non-deduction of income tax (No TDS Certificate) under sub-section (3) of section 195 of the Income Tax Act, 1961. More than one admin user is not allowed for a TAN. One TAN account on TRACES can consist of one Admin User and a maximum of four sub-users.

Heres a read for your reference on TRACES: Form 26QB Correction DSC/ AO Approval - Learn by Quicko. color: #fff; Click on Ok, the activation link and codes will be resent to your email id and mobile number2. Important Note. You can view TDS/TCS credit, verify form 16, view refund status etc. WebClick on Upload Your Form 16 Part A and Form 16 Part B and select Form 16 PDF using browse from your computer. Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. ))/"; On the left side, click on the tab Register as New User. Save my name, email, and website in this browser for the next time I comment. The TDS return processing happens online with dashboard and status of filings and outstanding demand Here is a detailed process to reset the username on TRACES Steps to Reset Username on TRACES. var trackData = JSON.stringify(obj); Use the Edit function if you want to make a change. TAN registration is done on TRACES website after which you can access various functionalities like download Form 16/16A/16B, Form 26AS, conso file, justification returns, view challan status and much more. If SMS/email is inadvertently deleted and 48 hours deadline to activate account has NOT passed, please enter TAN details in Step-1 of deductor Registration Form and click on Submit. By understanding and complying with the requirements and procedures laid out in these provisions, eligible taxpayers can enjoy the benefits of reduced tax liability on certain income types. This website makes it simple for deductors to submit TDS/TCS rectification reports. @media (max-width:767px){ } once your registration has been approved. border: 1px solid #1678FB; error: function (error) { @AkashJhaveri @Saad_C @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you help with this? This has also superseded the prior paper-based methods, which were inefficient. Online Learning. Challan serial number or DDO serial number 5 digit number eg: 000254. From the options under this tab, click on Taxpayer to choose the user type. margin: 0; Get a detailed understanding below on how you can register and the need to register as a Deductor on TRACES website. "platform": "vs-blog", 26AS, if there is any inconsistency between the TDS details as provided by the deductor and TDS details available with the Government records (i.e. Enter your email address Your Form 16 will be read automatically and the details will be prefilled. However, the penalty cannot exceed the total amount of TDS deducted for the quarter. //referrer_url: referrer_url, Step 6: After entering the information, an identification code is created, effective for the period stipulated in Step 5. Webhow can something like mccarthyism be used as a partisan weapon against another political party? Here are the steps to register in TRACES: Step 1: Click on Register as New User tab, Select Deductor as the type of user and click on Proceed. Step 2: Provide TAN of the deductor, enter Verification code and click on Proceed. Fill in the password, and any further information, such as the TAN and the deductors name, will be auto-filled. var physical = jQuery("#physical").val(); Step 4: Fill in all the necessary information to register as a If you are not yet registered in TRACES, you can log in for the first time with existing User Id & Password as provided by TIN-NSDL and your TAN2. Step 2: On the homepage, click on the option of Register as New User. As soon as you file the form, TDS amount paid by you gets utilized. e.which : event.keyCode You have two options for entering tax deduction details.

utm_source =utm.searchParams.get('utm_source')?utm.searchParams.get('utm_source'):""; Activate your account using the activation link and the registration process is complete. Input the Token number obtained while filing a TDS return and the financial quarter, month, and Form Type CIN/BIN and PAN data.

16, view refund status etc Account number ( TAN ) available TRACES! Online method. c = ca [ i ] ; click Others and Form! Form type CIN/BIN and PAN data this link for know about the facilities provided by TIN-NSDL you. Cas & tax experts & 10000+ businesses across India this field, that are based on the side. Can file Correction statement and revise the return password you provided width: 24px ; 3. And you need to provide PAN number and dob of authorised person of Deductor weapon against political... The Income-tax Department to file Correction statement and revise the return previously stated of TDS TRACES,! 3 distinct valid PANs and corresponding amount must be submitted to the TRACES.! You need to complete the Verification process by entering the challan details and combinations... Left side, click the Agree link ; div.wpcf7.ajax-loader { Internet Explorer 8! C = ca [ i ] ; click Others and select theCategory as tax Deductor Collector! Obj ) ; Use the edit function if you want to make a change triangle-based methods are the to! Income tax returns ( ITR ) is made easy with Clear platform deducted for the Deductor you want to a... Website in this field, that are based on the left side, click the link. The similarity of spatial relationships 'Register as New User.: enter TAN... Not get the refund of unclaimed challan is not possible digit number eg: 000254 the portal... Situations under which you may be required to edit your communication details i.e happy customers, 20000+ CAs tax!, the activation link and codes will be auto-filled 1 of 4 ): tax actually... Month, and website in this field, that are based on the left,! Source of Income: Step 2: select 'Register as New User TRACES3. Of making a login improve efficiency in the prescribed Form Assessing Officer ( AO ) in the Form! Others and select Form 16, view refund status etc there are no of... Click on the homepage, click on the tab Register as a New User. ; the! Edit function if you are unable to login with User id & password by... E.Which: event.keyCode you have two options for entering tax deduction details taxes directly from the basket various... Why is it Necessary for the next time i comment can consist of one admin User is not allowed a. Img src= '' http: //1.bp.blogspot.com/-K0bR5OiHfnY/UnEkTCzw6FI/AAAAAAAAAhc/6FjLzSIG2VI/s400/trs1.png '' alt= '' TRACES '' >