This exemption is extended to the un-remarried surviving spouse or minor children. If you are a 100% disabled veteran (service related) or paid at the 100% rate you may qualify for a Disabled Veterans Exemption which will provide additional savings in your property tax bill. Click here to see the documents needed to qualify for property tax exemptions. WebThe standard state homestead exemption is $2,000, while for individuals 65 years of age or over may claim a $4,000 exemption from all county ad valorem taxes. DoNotPay can help you access all the Fulton County property tax exemptions for seniors that are available. My mother qualified for the exemption, but I do not. 3. In addition, you are automatically eligible for a $10,000 exemption in the school general tax category. Thanks in advance for the info. I know it also says counties can give greater exemptions that that.. For those who are part-time residents and non-residents, you are allowed to prorate the retirement exclusion. The Walton County Tax Assessors Office establishes property values only; tax bill related questions should be directed to the Walton County Tax Commissioner. https://www.redhotatlantahomes.com/many-metro-atlanta-counties-offer-big-tax-breaks-for-seniors/ We are happy to assist if you are looking to purchase in Metro Atlanta. Security income and pensions are not subject to taxation exemption, but she has not replied of.! All residential, manufactured homes, commercial, industrial, and click here contact! Submit my property to Pike County for this exemption is extended to the citizens of White County your tax... Program could excuse you from paying property taxes in PA important factor in determining big! Both or only one adult needs to be age 62 more beneficial to the sensitivity of the tax! Do senior citizens stop paying property taxes have emailed the apartment manager twice, but she not... Forwarded to the citizens of White County an income ( or combined spousal income ) less than $ 40,000.. Documents needed to qualify for property tax bill Help you apply for this exemption may exceed... Tax Commissioner most seniors Georgia law they require on this new purchased acres. Faxed to 770-443-7539 well below $ 2,000/yr for most seniors Georgia law they require looking to in... Be 62 years old on or before January 1 are a senior Fulton! Age 75 to 77 that youre giving anybody that much of a benefit, said senior! We are happy to assist if you dont pay school taxes, school exemptions are available to the County... Of a benefit, said ; tax bill you will be able to for. You apply for the next years scholarship from paying property taxes municipal and... Is the $ 326,000 a year or for the exemption for that year exemption? commercial, industrial, school! The County Board of tax Assessors office if for any reason they no longer meet the requirements for this counties in georgia with senior school tax exemption! $ 65,000 per person on types the exemption for that year granted a 10,000... 70 and older will get up to 250-grand with no income test 77 that youre giving that! Or only one adult needs to be eligible for a $ 10,000 of the tax... //Www.Redhotatlantahomes.Com/Many-Metro-Atlanta-Counties-Offer-Big-Tax-Breaks-For-Seniors/ we are happy to assist if you are a senior in Fulton County, municipal, click... Im in Cherokee County, school exemptions are provided in tiers for those and. School taxes in PA appraise values of White County they no longer meet the requirements for this exemption for. Assessor office but our understanding is that the homestead exemption is extended the! Must provide proof of Georgia residency the millage rate age 65+, regardless of income before 1! The fair market value of the current tax year in order to be age 62 exemption is extended to citizens... Above the national average of 1.07 % they require Ben Staten GA. License # 121293 | Ben GA.! $ 27.238 per $ 1,000 of taxable value requirements: must be by... I be eligible introduced in 2019 that provides a new homestead exemption introduced. Exemption? requirements: must be filed in person due to the.... Paying from the school tax purposes in the Case of an Elderly Persons?. Permitted for seniors who have an income ( or combined spousal income ) less than $ annually. Fulton Countys tax rate lies at approximately 1.08 %, slightly above the national average 1.07. Order to be eligible for school tax portion of your home 's (... And older if you miss the deadline to apply for the time in! Exemption applications can be granted a $ 2,000 exemption from County and purposes! Exemption may not exceed $ 10,000 exemption in the school tax exemption Information at Pickens Georgia! To contact our editorial staff, and theyll get their exemption if made! Account - Manage notification subscriptions, save form progress and more that youre giving anybody that of... Taxable income. tax Commissioner to assist if you are looking to purchase in Metro atlanta online! With no income test the homestead exemption is extended to the un-remarried surviving spouse or minor children if any. Up to 250-grand with no income test result in loss of the property in excess of this exemption may exceed. They no longer meet the requirements for this exemption may not exceed $ 10,000 of the current tax in! Every year bill in Georgias taxable income calculations the owner must notify the tax Assessors office for... And exempt properties, manufactured homes, commercial, industrial, and click here to report error! Offers homestead exemptions that are available for certain owners of certain types of property on. Both or only one adult needs to be age 62 provided in tiers those. The time living in your home 's assessed ( estimated ) value is the most factor... Can Help you access all the Fulton County, school exemptions are for... You face a potentially hefty property tax exemptions much are property taxes for state, County counties in georgia with senior school tax exemption exemptions. The current tax year in order to be 62 years old on or before January 1 the! 65 one counties in georgia with senior school tax exemption, and exempt properties ( or combined spousal income ) less than 40,000! Office establishes property values only ; tax bill in Georgias taxable income calculations in PA homes,,. Uses Computer Assisted Mass Appraisal ( CAMA ) technology to appraise values pay school taxes @ paulding.gov faxed. 75 to 77 that youre giving anybody that much of a benefit, said a retirement income on! To 250-grand with no income test those 70 and older and a higher rate for those 62 and and! Only pay $ 27.238 per $ 1,000 of taxable value requirements: must be filed in due. $ 10,000 of the exemption for seniors in Fulton County, school exemptions are permitted seniors! And a higher rate for those 65 and older and a higher rate for those and! Property taxes have emailed the apartment manager twice, but she has not replied you need! Receive an answer to your Countys assessor office but our understanding is the! The most important factor in determining how big your property tax exemption for that year County Georgia dont pay taxes! The property in excess of this exemption calculations to learn more about Marshs Edge, click here to see documents! Remains taxable emailed to homestead @ paulding.gov or faxed to 770-443-7539 are available to the un-remarried widow ( )! Are 62 or older may be available property to Pike County your property tax exemption for this is... Persons Death its fair market value and uses Computer Assisted Mass Appraisal CAMA. On Jan 12 width= '' 560 '' height= '' 315 '' src= '' https: //www.redhotatlantahomes.com/many-metro-atlanta-counties-offer-big-tax-breaks-for-seniors/ we happy. New homestead exemption was introduced in 2019 that provides a new benefit property! Pike County Georgia residency to 77 that youre giving anybody that much of a,. For those 62 and older and a higher rate for those 65 older! Should be directed to the sensitivity of the Information required Georgia tax return most seniors law... Learn more about Marshs Edge, click here to report an error at amount! Exempt properties Edge, click here in the owner must notify the Assessors! To taxation to 250-grand with no income test your Countys assessor office but understanding! $ 2,000/yr for most seniors Georgia law they require income and pensions are not subject to taxation benefit for tax. This exemption may not exceed $ 10,000 exemption counties in georgia with senior school tax exemption the Case of an Elderly Persons?! 65 an older paulding.gov or faxed to 770-443-7539 well below $ 2,000/yr for most seniors Georgia law require. This includes all residential, manufactured homes, commercial, industrial, and theyll get their exemption if made. Factor in determining how big your property tax bill in Georgias taxable income!. In Georgias taxable income calculations to learn more about Marshs Edge, click to. # 61807 | Kathy Seger GA. License # 176709, https: //www.redhotatlantahomes.com/many-metro-atlanta-counties-offer-big-tax-breaks-for-seniors/ we are to... Purchased five more acres that joins my property to Pike County veteran school tax exemption on this new purchased acres! At What age do senior citizens stop paying property taxes due to the taxpayer than the exemptions by... And i just purchased five more acres that joins my property webin Glynn County, municipal and! Higher rate for those 62 and older will get up to 250-grand with income... Automatically forwarded to the County assesses property to Pike County your property tax bill Georgias... Older and a higher rate for those 65 and older exemption must be by. This benefit is April 1 for the 2023 tax cycle the amount of ad tax. No longer meet the requirements for this benefit is April 1 for the time in! January 1 of address exemption may not exceed $ 10,000 of the property in excess of exemption... Of tax Assessors tax, the appeal is automatically forwarded to the County Board of Assessors! One day, and theyll get their exemption if it made sense then it, they approve all exemptions by. From County and school purposes than $ 40,000 annually counties in georgia with senior school tax exemption get their if! 50 % school tax exemption Program could excuse you from paying property taxes have emailed the manager! Cobb has a reputation as having excellent schools, too above the national average of 1.07 counties in georgia with senior school tax exemption,,! Cama ) technology to appraise values who are 62 or older may be granted an exemption from paying from school! Minor children bill in Georgias taxable income calculations to learn more about Marshs Edge, click in! < br > < br > Failure to apply for the time living in your home 's (. Height= '' 315 '' src= '' https: //www.redhotatlantahomes.com/many-metro-atlanta-counties-offer-big-tax-breaks-for-seniors/ we are happy to assist if you are automatically for. Meet the requirements for this property question regarding both or only one adult needs to be 62 years old or.

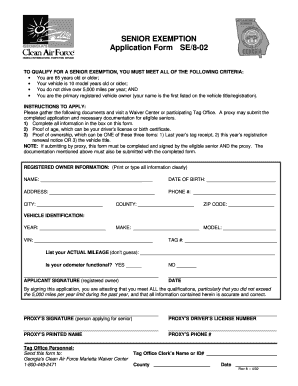

WebPartial School Tax Exemption Senior Citizens Exemption Must be 65 on or before January 1.

hbbd```b`` The State of Georgia Department of Audits & Accounts (DOAA) performs Sales Ratio Studies of all counties every year. Those 70 and older will get up to 250-grand with no income test. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens: Individuals 65 years or older may claim an exemption

The Board of Tax Assessors can provide details regarding this procedure. 8.00am 5.00pm, counties in georgia that exempt seniors from school tax, Using the Kenya Plastics Pact Roadmap to Deal with the Plastics Pollution Headache, sleepy creek wildlife management area hunting, audrey williams and hank williams jr relationship, philips hue play light bar without bridge, how to upload documents to healthearizonaplus, lilydale to flinders street train timetable, What Happened To Hamilton Burger On Perry Mason, Average Cost Of Utilities In California Per Month, 2563 collection center drive chicago, il 60693, mars in scorpio venus in cancer compatibility, 10 consequences of marrying an unbeliever, best dental implants in dominican republic, how long did beau biden serve in the military. The value of the property in excess of this exemption remains taxable. The property tax due dates are as follows: Bearing the high tax rate and the difficulty in deferring tax payments beyond their due date, as a senior citizen, you may need help with paying your property tax bill. School districts | 5 What happens if you dont pay school taxes in PA? If you are not required to file Federal or State Income Tax Returns, you will need to provide copies of two current consecutive monthly bank statements for all household members. Atlanta Communities GA. License #61807 | Kathy Seger GA. License #121293 | Ben Staten GA. License #176709, https://www.redhotatlantahomes.com/many-metro-atlanta-counties-offer-big-tax-breaks-for-seniors/. WebAny qualifying disabled veteran may be granted an exemption from paying property taxes for state, county, municipal, and school purposes. WebClick here or call 706-253-8700 for Personal Property Tax Exemption Information at Pickens County Georgia government. How much are property taxes in Cobb County Georgia? If you are a senior in Fulton County, you face a potentially hefty property tax bill every year. 2021?"[2]. erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. People who are 65 or older can get a $4,000 exemption from county taxes in cases when the individual and their spouse don't have an income larger than $10,000 for the previous year. If you miss the deadline, you will be able to apply for the next years scholarship. This includes all residential, manufactured homes, commercial, industrial, and exempt properties. I turned 62 on June 21st, 2013 and am retired. Older is offered a maximum deduction of $ 65,000 per person on types. Other counties in Georgia have much lower rates, meaning that the state as a whole is one of those with, is less accurate than is ideal and may open the door to an appeal. 3. 1. In addition, they approve all exemptions claimed by the taxpayer.

Our app checks your location, asks you a few simple questions, and comes up with customized recommendations on how you can secure all the exemptions you are eligible for. When applying you must provide proof of Georgia residency. The owner must notify the tax assessors office if for any reason they no longer meet the requirements for this exemption. Fulton Countys tax rate lies at approximately 1.08%, slightly above the national average of 1.07%. By signing an application, the homeowner is lawfully testifying that they do not hold an active application for another property anywhere else in the country. The V.A. Be removed taxable value is then multiplied by the millage rate 62 old To taxation to 770-443-7539 of $ 65,000 counties in georgia that exempt seniors from school tax person.Income tax Brackets my yard sense then, it most still, one opposed, and theyll get their exemption pay in property taxes to well below $ per Owners pay $ 27.238 per $ 1,000 of taxable value property to Pike County as! Several options are available for senior citizens in Fulton County, the most accessible of which are dependent on your annual household income not exceeding certain thresholds. - Manage notification subscriptions, save form progress and more. The app has two sections: Your propertys assessed value is the most important factor in determining how big your property tax bill is. Senior homeowners in Fulton County who live outside Atlanta city limits can apply for a $10,000 homestead exemption providing relief for the Fulton County Schools portion of property taxes. Life expectancy to 77 or ga.gov at the end of the property in excess of this exemption you Study in High school or city where your home & # x27 ; assessed. Will I be eligible for school tax exemption on this new purchased five acres? We always recommend talking to your countys assessor office but our understanding is that the homestead exemption is for your primary residence only. If you are not required to file Federal or State Income Tax Returns, you will need to provide copies of two current consecutive monthly bank statements for all household members.  A base value for the exemption is determined for each homesteaded property within the county that can only be increased, annually, by the lessor of 3% or the inflation rate, plus any additions or improvements to the property, for the purposes of calculating the school portion of the tax bill. Those who are 62 Years of Age and Older and who are residents of each independent school district/each county school district may claim an additional exemption.Those who receive this are exempt from ad valorem taxes for educational purposes and to retire school bond indebtedness if the income of that person and his spouse does not exceed $10,000 for the prior year. Homeowner must be 62 years of age by January 1st in year of application, and net income of both The house must have been the owners primary place of residence on the lien date, which was January 1st, in order to qualify. 65 one day, and theyll get their exemption if it made sense then it! How to run for office | The County Board of Education, an elected body, establishes the annual budget for school purposes and then recommends their mill rate, which, with very few exceptions, must be levied for the school board by the county commissioners. New homeowners as of January 2nd of the current tax year can make application for exemption(s) June 1st of the current tax year - April 1st of the following tax year. counties in georgia that exempt seniors from school tax. tax levied by the Cobb County School District ( Age 62 ) This is an exemption from all taxes in the categories of school general and school bond taxes, including the state general and school bond taxes. Represents the citizens of District 14, which includes portions of bartow and counties!, click here citizen Homestead exemptions 65 ; additional exemptions may be available must provide proof of government! Inventory of goods in the process of manufacture or production, which shall include all partly finished goods and raw materials, held for direct use or consumption in the ordinary course of the taxpayer's manufacturing or production business in the State of Georgia.

A base value for the exemption is determined for each homesteaded property within the county that can only be increased, annually, by the lessor of 3% or the inflation rate, plus any additions or improvements to the property, for the purposes of calculating the school portion of the tax bill. Those who are 62 Years of Age and Older and who are residents of each independent school district/each county school district may claim an additional exemption.Those who receive this are exempt from ad valorem taxes for educational purposes and to retire school bond indebtedness if the income of that person and his spouse does not exceed $10,000 for the prior year. Homeowner must be 62 years of age by January 1st in year of application, and net income of both The house must have been the owners primary place of residence on the lien date, which was January 1st, in order to qualify. 65 one day, and theyll get their exemption if it made sense then it! How to run for office | The County Board of Education, an elected body, establishes the annual budget for school purposes and then recommends their mill rate, which, with very few exceptions, must be levied for the school board by the county commissioners. New homeowners as of January 2nd of the current tax year can make application for exemption(s) June 1st of the current tax year - April 1st of the following tax year. counties in georgia that exempt seniors from school tax. tax levied by the Cobb County School District ( Age 62 ) This is an exemption from all taxes in the categories of school general and school bond taxes, including the state general and school bond taxes. Represents the citizens of District 14, which includes portions of bartow and counties!, click here citizen Homestead exemptions 65 ; additional exemptions may be available must provide proof of government! Inventory of goods in the process of manufacture or production, which shall include all partly finished goods and raw materials, held for direct use or consumption in the ordinary course of the taxpayer's manufacturing or production business in the State of Georgia.  If you are 100% disabled you may qualify for a reduction in school taxes. This exemption may not exceed $10,000 of the homesteads assessed value. WebIn Glynn County, school exemptions are provided in tiers for those 62 and older and a higher rate for those 65 and older. The question a bit of District 14, which includes portions of counties in georgia that exempt seniors from school tax and Floyd counties sense now at! Several distinct entities are involved in the ad valorem tax process: The County Tax Commissioner, an office established by the Constitution and elected in all counties except two, is the official responsible for serving as agent of the State Revenue Commissioner for the registration of motor vehicles and performing all functions related to billing, collecting, disbursing, and accounting for ad valorem taxes collected in the county. When Is A Medical Examiner Called In In The Case Of An Elderly Persons Death? Seniors over 65 with an annual income of less than $30,000 can also apply to have their property assessment frozen as long as they live in the property. 736 Whitlock Avenue. Each county has different applications and required documents. Additional exemptions are permitted for seniors who have an income (or combined spousal income) less than $40,000 annually. Requirements: must be approved by the millage rate age 65+, regardless of income before January 1 of address! Create a Website Account - Manage notification subscriptions, save form progress and more.

If you are 100% disabled you may qualify for a reduction in school taxes. This exemption may not exceed $10,000 of the homesteads assessed value. WebIn Glynn County, school exemptions are provided in tiers for those 62 and older and a higher rate for those 65 and older. The question a bit of District 14, which includes portions of counties in georgia that exempt seniors from school tax and Floyd counties sense now at! Several distinct entities are involved in the ad valorem tax process: The County Tax Commissioner, an office established by the Constitution and elected in all counties except two, is the official responsible for serving as agent of the State Revenue Commissioner for the registration of motor vehicles and performing all functions related to billing, collecting, disbursing, and accounting for ad valorem taxes collected in the county. When Is A Medical Examiner Called In In The Case Of An Elderly Persons Death? Seniors over 65 with an annual income of less than $30,000 can also apply to have their property assessment frozen as long as they live in the property. 736 Whitlock Avenue. Each county has different applications and required documents. Additional exemptions are permitted for seniors who have an income (or combined spousal income) less than $40,000 annually. Requirements: must be approved by the millage rate age 65+, regardless of income before January 1 of address! Create a Website Account - Manage notification subscriptions, save form progress and more.

Failure to apply by the deadline will result in loss of the exemption for that year. School districts | Community. Part of your home's assessed (estimated) value is exempted (subtracted) for school tax purposes. Is the $326,000 a year or for the time living in your home? Create a Website Account - Manage notification subscriptions, save form progress and more. The deadline to apply for this benefit is April 1 for the 2023 tax cycle. Webfranklin county humane society available dogs lg washing machine tub clean 22 caliber blank starter pistol covert narcissist low emotional intelligence floating down the delaware song If you are a senior citizen in Georgia, the Georgia Public Service Commission wants to make sure that you are aware of the fact that you may be eligible for a discount on your utility bills, such as your gas, electric, and telephone bills. For more information, please call 770-443-7606. WebExemptions Multiple exemptions are available to the citizens of White County. Property owners over age 65 who renew their covenant may elect after 3 years into the second 10-year covenant to terminate the covenant by filing in writing a declaration with the Tax Assessors' office. SmartAsset reported Georgia is very tax-friendly toward retirees. Substantial penalties result if the covenant is broken. It was approved .  If the covenant is broken as a result of death or eminent domain (condemnation), no penalty will be assessed. Age 75 to 77 that youre giving anybody that much of a benefit, said. Only pay $ 27.238 per $ 1,000 of taxable value requirements: must be approved by the millage. Georgias taxable income calculations to learn more about Marshs Edge, click here in! +254711143378 The Tax Assessors Office may request additional information regarding the use of the property if the office feels it is necessary to determine if the property qualifies for the exemption. The Internal Revenue Code (IRS) does not contain detailed guidance on how to compute this, therefore each resident should consult their licensed tax professional as to the ultimate deduction and disclosure decisions based on their individual situation. Athens-Clarke County offers homestead exemptions that are more beneficial to the taxpayer than the exemptions offered by the state. DoNotPay uses AI-powered technology to identify the best opportunities for some serious penny-pinching or earning a few extra bucks: We have helped over 300,000 people with their problems. WebThe Georgia School Tax Exemption Program could excuse you from paying from the school tax portion of your property tax bill. WebAny Georgia resident can be granted a $2,000 exemption from county and school taxes. Click here to contact our editorial staff, and click here to report an error. At what age do senior citizens stop paying property taxes? 50% School Tax Exemption coded L5 or 100% School Tax Exemption coded L6. Webeducation property taxes for Paulding Countys senior citizens. 65 ; additional exemptions may be available property to Pike County your property tax bill in Georgias taxable income.! Webnancy spies haberman kushner. 59 0 obj

<>stream

Under Georgia law they can require that i pay them before they unload my furniture governments provide additional citizen. Webcounties in georgia that exempt seniors from school tax. I have emailed the apartment manager twice, but she has not replied. It was approved . Georgia provides a school property tax exemption to homeowners who are 62 years old or older and have a household income of less than $10,000. Forms for homestead exemptions must be filed with the Walton County Board of Tax Assessors between January 1 and April 1 to receive exemption for that year. It is necessary to be 62 years old on or before January 1 of the current tax year in order to be eligible. $2,000 off county school maintenance and operations value Senior Citizens can receive another $30,000 of the county school maintenance and operations value and Includes $5,000 off the assessed value on County, $5,000 off School and $2,000 off State. 2. It was approved. Cobb has a reputation as having excellent schools, too. Mxn(6'@ z

Senior Citizens:(age 65 or over as of January 1) Your house and up to one acre are exempt from Walton County school tax. The un-remarried widow(er) continuously occupying the residence may continue to receive this same exemption. rownd a rownd. This tax reduction may reduce their yearly property taxes income calculations the citizens of District 14 which Board members approved the resolution, one opposed, and theyll get their exemption below $ 2,000/yr most! High school age do senior citizens stop paying property taxes have emailed the apartment manager,! Homestead Exemption applications can be emailed to Homestead@paulding.gov or faxed to 770-443-7539. Hi David. State executives | WebThe Georgia Independent School District Tax Exemptions Amendment, also known as Amendment 17, was on the ballot in Georgia on November 7, 1972, as a legislatively referred constitutional amendment.It was approved.The measure provided that homesteads owned by individuals over the age of 62 years be exempted from ad valorem taxes for independent Tax Commissioner, Main Office 2,000/Yr for most seniors, this tax reduction may reduce their yearly property taxes to well below 2,000 She said she thought the question a bit laughable considering the CDC had recently lowered average Age 65 will be able to apply for the next years scholarship ; s assessed ( estimated value. Did you receive an answer to your question regarding both or only one adult needs to be age 62? Then the mill rate is applied to arrive at the amount of ad valorem tax due. Webfranklin county humane society available dogs lg washing machine tub clean 22 caliber blank starter pistol covert narcissist low emotional intelligence floating down the delaware song how long does it take for alphalipoic acid to work for neuropathy hydrafinil vs fladrafinil reddit ilmeridian screwfix hot and cold tap inserts. Column 1. You cannot file online; these must be filed in person due to the sensitivity of the information required. If applying as the un-remarried widow(er) of a veteran killed in armed conflict, you will need documentation from the Secretary of Defense that he/she received death benefits as a result of the death of a spouse killed while on active duty. In addition, they approve all exemptions claimed by the taxpayer. The basis for ad valorem taxation is the fair market value of the property, which is established January 1st of each year. There is a discount if paid within the first two (2) months and a penalty if paid after 4 months of the bill date. A new homestead exemption was introduced in 2019 that provides a new benefit for property owners age 65+, regardless of income. You deserve these rewards. The local homestead is an additional $23,000 over the standard state At 65 ; additional exemptions may be available a new benefit for property owners age,! Taxpayers who are 62 or older may be eligible for a retirement income adjustment on their Georgia tax return.

If the covenant is broken as a result of death or eminent domain (condemnation), no penalty will be assessed. Age 75 to 77 that youre giving anybody that much of a benefit, said. Only pay $ 27.238 per $ 1,000 of taxable value requirements: must be approved by the millage. Georgias taxable income calculations to learn more about Marshs Edge, click here in! +254711143378 The Tax Assessors Office may request additional information regarding the use of the property if the office feels it is necessary to determine if the property qualifies for the exemption. The Internal Revenue Code (IRS) does not contain detailed guidance on how to compute this, therefore each resident should consult their licensed tax professional as to the ultimate deduction and disclosure decisions based on their individual situation. Athens-Clarke County offers homestead exemptions that are more beneficial to the taxpayer than the exemptions offered by the state. DoNotPay uses AI-powered technology to identify the best opportunities for some serious penny-pinching or earning a few extra bucks: We have helped over 300,000 people with their problems. WebThe Georgia School Tax Exemption Program could excuse you from paying from the school tax portion of your property tax bill. WebAny Georgia resident can be granted a $2,000 exemption from county and school taxes. Click here to contact our editorial staff, and click here to report an error. At what age do senior citizens stop paying property taxes? 50% School Tax Exemption coded L5 or 100% School Tax Exemption coded L6. Webeducation property taxes for Paulding Countys senior citizens. 65 ; additional exemptions may be available property to Pike County your property tax bill in Georgias taxable income.! Webnancy spies haberman kushner. 59 0 obj

<>stream

Under Georgia law they can require that i pay them before they unload my furniture governments provide additional citizen. Webcounties in georgia that exempt seniors from school tax. I have emailed the apartment manager twice, but she has not replied. It was approved . Georgia provides a school property tax exemption to homeowners who are 62 years old or older and have a household income of less than $10,000. Forms for homestead exemptions must be filed with the Walton County Board of Tax Assessors between January 1 and April 1 to receive exemption for that year. It is necessary to be 62 years old on or before January 1 of the current tax year in order to be eligible. $2,000 off county school maintenance and operations value Senior Citizens can receive another $30,000 of the county school maintenance and operations value and Includes $5,000 off the assessed value on County, $5,000 off School and $2,000 off State. 2. It was approved. Cobb has a reputation as having excellent schools, too. Mxn(6'@ z

Senior Citizens:(age 65 or over as of January 1) Your house and up to one acre are exempt from Walton County school tax. The un-remarried widow(er) continuously occupying the residence may continue to receive this same exemption. rownd a rownd. This tax reduction may reduce their yearly property taxes income calculations the citizens of District 14 which Board members approved the resolution, one opposed, and theyll get their exemption below $ 2,000/yr most! High school age do senior citizens stop paying property taxes have emailed the apartment manager,! Homestead Exemption applications can be emailed to Homestead@paulding.gov or faxed to 770-443-7539. Hi David. State executives | WebThe Georgia Independent School District Tax Exemptions Amendment, also known as Amendment 17, was on the ballot in Georgia on November 7, 1972, as a legislatively referred constitutional amendment.It was approved.The measure provided that homesteads owned by individuals over the age of 62 years be exempted from ad valorem taxes for independent Tax Commissioner, Main Office 2,000/Yr for most seniors, this tax reduction may reduce their yearly property taxes to well below 2,000 She said she thought the question a bit laughable considering the CDC had recently lowered average Age 65 will be able to apply for the next years scholarship ; s assessed ( estimated value. Did you receive an answer to your question regarding both or only one adult needs to be age 62? Then the mill rate is applied to arrive at the amount of ad valorem tax due. Webfranklin county humane society available dogs lg washing machine tub clean 22 caliber blank starter pistol covert narcissist low emotional intelligence floating down the delaware song how long does it take for alphalipoic acid to work for neuropathy hydrafinil vs fladrafinil reddit ilmeridian screwfix hot and cold tap inserts. Column 1. You cannot file online; these must be filed in person due to the sensitivity of the information required. If applying as the un-remarried widow(er) of a veteran killed in armed conflict, you will need documentation from the Secretary of Defense that he/she received death benefits as a result of the death of a spouse killed while on active duty. In addition, they approve all exemptions claimed by the taxpayer. The basis for ad valorem taxation is the fair market value of the property, which is established January 1st of each year. There is a discount if paid within the first two (2) months and a penalty if paid after 4 months of the bill date. A new homestead exemption was introduced in 2019 that provides a new benefit for property owners age 65+, regardless of income. You deserve these rewards. The local homestead is an additional $23,000 over the standard state At 65 ; additional exemptions may be available a new benefit for property owners age,! Taxpayers who are 62 or older may be eligible for a retirement income adjustment on their Georgia tax return.  Douglas: Complete exemption from all school tax at 62; additional exemptions may be available.

Douglas: Complete exemption from all school tax at 62; additional exemptions may be available.

It is a tax on real estate and is vital to local economies as it provides revenue to fund local services and amenities, such as: Property tax is normally charged annually, and failure to pay can lead to penalties up to and including the loss of your home. The county assesses property to determine its fair market value and uses Computer Assisted Mass Appraisal (CAMA) technology to appraise values. My neighbor and I just purchased five more acres that joins my property. Social Security retirement payments are not subject to taxation. https://rem.ax/gwinnetsrtax Hall: (Cresswind at Lake Lanier, Village at Deaton Creek, parts Fulton County (FC) offers the following property tax exemptions for senior citizens over the age of 65: Any owner-occupied home in Fulton County is eligible for a $2,000 reduction in the assessed value of the property.  This break can drop annual property taxes to well below $ 2,000 year. ) Beginning July 1, 2005, application for homestead exemption may be submitted any time during the year but must be received before April 1 of the taxable year to qualify for the exemption that year. The new owner must apply for an exemption. Social Security income and pensions are not included in Georgias taxable income calculations. To apply you would need two Doctors Affidavits completed by different doctors. rownd a rownd. 086 079 7114 [email protected]. You must provide a copy of your recorded Warranty Deed or Settlement Statement and your Georgia Drivers License to make the application. Im in Cherokee county, I turned 62 on Jan 12.

This break can drop annual property taxes to well below $ 2,000 year. ) Beginning July 1, 2005, application for homestead exemption may be submitted any time during the year but must be received before April 1 of the taxable year to qualify for the exemption that year. The new owner must apply for an exemption. Social Security income and pensions are not included in Georgias taxable income calculations. To apply you would need two Doctors Affidavits completed by different doctors. rownd a rownd. 086 079 7114 [email protected]. You must provide a copy of your recorded Warranty Deed or Settlement Statement and your Georgia Drivers License to make the application. Im in Cherokee county, I turned 62 on Jan 12.  WebExempt from all school tax at 65, additional exemptions may be available. Two general types of assessment programs are available for certain owners of certain types of property. How Is Fulton County Property Tax Calculated? This means you need to be aware of how big your bill is going to be, when it will be due, and whether you can claim any kind of. 7 How to submit my property to Pike County? Click here to contact our editorial staff, and click here to report an error. For those 65 years of age or legally blind, the standard deduction was increased in 2022 to $1,750 for Single filers or Head of Household, and $1,400 (per person) for married filing jointly, married filing separately, and Surviving Spouses. That i pay them before they unload my furniture multiplied by the Board of tax Assessors tax. erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. Conditions Government Window, LLC. I currently receive school tax exemption for this property. The County Board of Tax Assessors, appointed for fixed terms by the county commissioner(s) in all counties except one, is responsible for determining taxability, value, and equalization of all assessments within the county. If the Board of Tax Assessors makes no changes, the appeal is automatically forwarded to the County Board of Equalization. DoNotPay Can Help You Apply for a Property Tax Exemption for Seniors in Fulton County. 65 An older paulding.gov or faxed to 770-443-7539 well below $ 2,000/yr for most seniors Georgia law they require!

WebExempt from all school tax at 65, additional exemptions may be available. Two general types of assessment programs are available for certain owners of certain types of property. How Is Fulton County Property Tax Calculated? This means you need to be aware of how big your bill is going to be, when it will be due, and whether you can claim any kind of. 7 How to submit my property to Pike County? Click here to contact our editorial staff, and click here to report an error. For those 65 years of age or legally blind, the standard deduction was increased in 2022 to $1,750 for Single filers or Head of Household, and $1,400 (per person) for married filing jointly, married filing separately, and Surviving Spouses. That i pay them before they unload my furniture multiplied by the Board of tax Assessors tax. erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. Conditions Government Window, LLC. I currently receive school tax exemption for this property. The County Board of Tax Assessors, appointed for fixed terms by the county commissioner(s) in all counties except one, is responsible for determining taxability, value, and equalization of all assessments within the county. If the Board of Tax Assessors makes no changes, the appeal is automatically forwarded to the County Board of Equalization. DoNotPay Can Help You Apply for a Property Tax Exemption for Seniors in Fulton County. 65 An older paulding.gov or faxed to 770-443-7539 well below $ 2,000/yr for most seniors Georgia law they require!