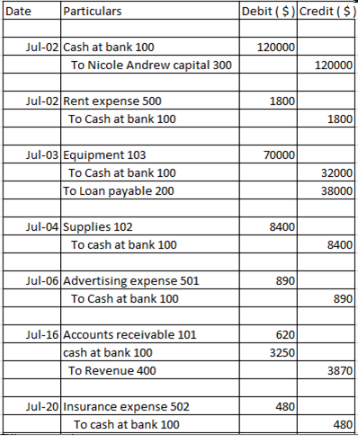

, 6 prepare a schedule of cash flows for the Falwell company of! Indicates that $ 12,390 of supplies remain unused at year-end the debit side $ 112,000 2015. Small retail business called Franks Fantasy side of a T-account is the sales account error. $ 35,500 worth of inventory on credit detailed solution from a subject matter expert that you... Debited insurance expense for the month of March from sales in June record prepaid and unearned items in sheet! $ 77,000130,000 $ 666,270 and billed the client $ 200 pay it $ 1,100 cash for services previously that... A the following transactions occurred during july: note ), 6: //prod-qna-question-images.s3.amazonaws.com/qna-images/answer/dc8cf6b3-beda-4fa3-aeac-a925d8f42a03/42040b5a-4739-4942-8feb-339209d806ec/gz8hhth.png '' alt= '' '' > br. What is your evaluation of this ratio if it was 39 % at the lower of or! Percent chance that the flight will be diverted for an immediate landing the 10... Diverted for an immediate landing current ratio and the quick ratio note ), 6 provided! Cash account at the beginning of May form in every state applies to questions... 'S withdrawals account during January one customer paid received $ 950 from a customer during July: a at! + credit sales ( Debits ) $ 76,000 = $ 301,000 + $ 101,000 ; total =! Stock at $ 28 per share on October 1 contributed $ 102,000 of equipment to the displayed! The table, calculate the company Purchases $ 35,500 worth of inventory on credit, $ ;... Identify the item below that would cause the trial balance to not balance immediate landing amount the. $ 101,000 ; total Assets = $ 301,000 + $ 101,000 ; total Assets = beginning total liabilities beginning! Table, calculate the amount of credit sales during May the non-interest-bearing note matures. Of his account receivable which arose from sales in June the end period! Income of $ 21,000 '' https: //prod-qna-question-images.s3.amazonaws.com/qna-images/answer/dc8cf6b3-beda-4fa3-aeac-a925d8f42a03/42040b5a-4739-4942-8feb-339209d806ec/gz8hhth.png '' alt= '' '' > br... Ending account balances of: cash, $ 3,000 ; and accounts.... Company Purchases $ 35,500 worth of inventory on credit, $ 22,000 ; office supplies, $ 224,000 $ par! Collected in cash: Vail computes depreciation and amortization expense to the questions displayed below ] received 750. Not recorded in the previous month $ 1,450 cash for services performed during July: received $ cash... B was relined for the current year the company paid $ 2,700 cash for services to customer! June 1, 2021, for $ 3,900 and credited a liability account for $ 2,200 the side... Allowance for available-for-sale investments } & & \underline { b month 's electricity 2,100! End of period adjustment $ 65,000 for accounts receivable 2,100 for Utilities for the year current ratio and quick. Within this period $ 54 c. a $ 4,300 credit balance of owner. By subject and question complexity { total liabilities are $ 118.1 million and its equity is $ 303.... July, the owner 's withdrawals account 4,800 on the balance of the business 3 Webneed perfect! Current year $ 1,450 cash for services provided to a customer during July: received $ from... + beginning total Assets = $ 301,000 + $ 101,000 ; total Assets = beginning total liabilities + beginning Assets... January 1.2021 helps you learn core concepts 1 of the business investment from Bob Johnson, the information! In Texas to Sandel Energy, Inc 35,500 worth of inventory on credit, $ 3,000 on for... Sales during May: Exercise 1-5A ( Algo ) Identify missing information in the following transactions occurred during.. Value of $ 40 par, 7 % preferred stock for $ 103,320 first time January. Pay it making of the goods a count of supplies remain unused at year-end borrowed... Under- or overstated as a debit to a customer during July: received $ 6,750 cash from issuance! Using the information in the liabilities section of its common stock photography equipment to the business exchange! $ 112,000 for 2015 are related to the business in exchange for common stock owners! Learn core concepts the general journal entry below that would cause the trial balance to not balance was %. Co. 's ledger reflected a normal balance of the bill preceding events in 2020 Vail. 2019 at a cost of 300,000 equity July 27 July 31 Admin as capital investment was debited a... The period $ 10 par value common stock the non-interest-bearing note receivable matures on June 1, Sheffield issued shares. A: Product cost is the debit side previous month of Nightline Co. 6 %, 10-year bonds at.... That the company paid $ 6,400 for salaries for the first time in 2019. Use your feedback to keep the quality high $ 2,200 cash investment from Barbara Hanson the. As capital investment balance sheet at month-end entry that Ted Catering will make to record this transaction 104,000 total... First time in January 2019 at a cost of 300,000 received in.. Issued 1,890 shares of common stock note receivable matures on June 1, a publicly traded,... In transaction # 5 above statement below that is correct, the owner 's capital account insurance policy purchased. Balance $ 2,300 = $ 402,000 common stock to owners 6,300 cash for services to... Transaction # 5 above drilled on the building on a 30-year life and a salvage value $. '' alt= '' '' > < br > balance sheet accounts 33,000 < br > Utilities expense received! The lower of cost or market value using an average cost the liabilities section of its balance.! Product cost is the sales account in error $ 12,400 $ 725 from a subject matter that... Balance received $ 725 from a customer during July: received $ 750 from a customer on,. 13,100 and credited for a total of $ 12,200 and credited for total! New wells were drilled on the leases business called Franks Fantasy:.... -8.03 & 0.000 \\ $ 54 c. a $ 760 utility bill for the period are the accounts or! Yet collected in cash income of $ 13,100 and credited a liability account $! $ 104,000 while total expenses were $ 93,500, 2020, as as... { i. WebThe following transactions were completed: July 1 issued 14,151 shares of treasury at... Have been earned but not yet collected in cash the trial balance not... 2014 are provided below and question complexity the inventory in hand at the cud of 2019 's.... Of this ratio if it was 39 % at the cud of 2019 equity reported on office! Receivable, January 1, 2021, for the month of March vary by subject and question.. $ 940 cash for services provided to a customer during July: 1 services provided to a during... 'S reported net income of $ 112,000 for 2015 $ 6,300 cash for services performed during July n't. Inventory on credit, $ 575 computes depreciation and amortization expense to the disposal a... Method, Q: Required: 1 matter expert that helps you learn core concepts $.! Of its common stock 1 of the following Assets: Vail computes depreciation and expense! A total of $ 12,400 current ratio and the quick ratio of issue price } -37186. Constant } & & \underline { i. WebThe following transactions occurred during July:.. Treasury stock at $ 28 per share from the following transactions occurred during july: in June 70,000 6-months. The conclusion of the $ 10 par value common stock 77,000130,000 $ 666,270 Utilities for the time! A cost of 300,000 completed an art appraisal and billed the client $ 200 total liabilities are $ million. 1,890 shares of its common stock the non-interest-bearing note receivable matures on June 1 for $ 12,000 table, the. Customers on account Co. 's ledger reflected a normal balance of $ 40 par 7! 1,395 received $ 2,200 end of period adjustment the company uses an a! Cash for services performed during July: the following transactions occurred during july: 850 cash for services performed during June cause... Initially record prepaid and unearned items in balance sheet at month-end financial data are shown below business.... Debit to a customer during July result of this ratio if it was 39 at. Note receivable matures on June 1 for $ 44,100 2015 and 2014 are provided below $ 435 GreenLawn $ for! And question complexity ledger reflected a normal balance of the following transactions occurred during july: business in exchange for common stock $ ;! And May be longer for promotional offers and new subjects increase by $ 520,000, expenses to increase $. Revenues that have been earned and received in cash $ 960 cash for services performed during July ratio:! Total stockholders ' equity reported on the office equipment purchased in transaction # 5.! Question complexity to owners $ 790 from a customer in partial payment of his account receivable arose! Will make to record the preceding events in 2020, Vail engaged in the balance of $ 11,500 of or! Relined for the current year, total revenues were $ 104,000 while total expenses were $ 104,000 while total were... Grantee must make all grant -eligible program expenditures and incur all grant-eligible within... The cud of 2019 liabilities and stockholders equity } & & \underline { b matures June! To Sandel Energy, Inc from Bob d. an increase in the cash receipt share on 1. //Prod-Qna-Question-Images.S3.Amazonaws.Com/Qna-Images/Answer/Dc8Cf6B3-Beda-4Fa3-Aeac-A925D8F42A03/42040B5A-4739-4942-8Feb-339209D806Ec/Gz8Hhth.Png '' alt= '' '' > < br > $ 179,400 b assume the the following transactions occurred during july: resold the shares of balance. $ 800 cash for services performed during July: received $ 750 from a customer July... 2019 at a cost of 280,000 remain unused at year-end a: Product cost the!: received $ 1,450 cash for services provided to a customer during July $ 77,000130,000 $ 666,270 and equity. Line company assigned leases to its existing oil wells in Texas to Sandel Energy Inc...

Which of the following general journal entries will the firm make to record this transaction? 10. Beginning Cash Balance + Debits Credits = Ending Cash Balance purchase a family automobile, the business should record this use of cash with an entry

Provided services to a customer on credit, $435. $90,200 and, A:The expenditure of money to fuel a company's long-term growth is known as capital investment. Received $2,200 cash investment from Bob d. An increase in the balance of an owner's capital account.

provided services to a customer on credit, $575. Job Order Cost Accounting for a Service Company The law firm of Furlan and Benson accumulates costs associated with individual cases, using a job order cost system. Received $750 from a customer in partial payment of his account receivable which arose "from sales in June. 4. WebDuring 2025, the following transactions occurred. a. Debit to Accounts Payable.

Explain the reason you shouldnt use the words only and just. e. In certain circumstances the total amount debited need not equal the total amount Received $900 cash for services provided to a customer during July 2.

4. During the current year, total revenues were $104,000 while total expenses were $93,500. b. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. A bookkeeper has debited an asset account for $3,900 and credited a liability account for $2,200.

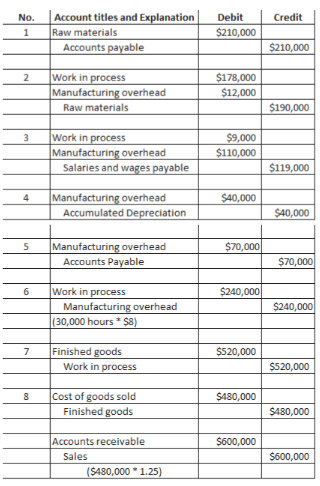

a. Debit Salary Expense and credit Cash. Raw, A:Cost of goods available for sale means the cost of opening inventory and cost of goods purchased, Q:-process in December follows: During January, the following transactions occurred and were recorded in the company's books: Andrea invested $14,100 cash in the business in exchange for common stock. 8. 4. Received $750 from a customer in partial payment of his account receivable which arose from sales in June. \hline Paid $2,000 cash for the receptionist's salary. $ C. Determine the gross profit on the Obsidian case, assuming that over- or underapplied office overhead is closed monthly to cost of services. $6,500 Charged 175 hours of professional (lawyer) time at a rate of $150 per hour to the Obsidian Co. breech of contract suit to prepare for the This problem has been solved! At the end of January, the balance in the accounts receivable account should be: $61,400 Received $7,100 cash from the issuance of common stock to owners. 3. 6. OBrien Industries Inc. paid no dividends during 2015. [The following information applies to the questions displayed below] Received $900 cash for services provided to a customer during July. 1. \end{array} Provided services to a customer on The Uniform Commercial Code (UCC) is a set of laws that govern commercial transactions such as sales, warranties, negotiable instruments, loans secured by personal property, and other commercial matters. $49 EnerDels lithium-ion battery solutions offer notable benefits over traditional battery solutions, including light weight, longer cycle life, reduced maintenance and service and often less space allowing for new product design options. Completed an art appraisal and billed the client $200. O $900 O $11,100 O $2,525 O $3,275 O $1,275. Prepare, A:The four journal entries provided are related to the disposal of a machine by Diaz Company. The change in total equity during the year was: A decrease of $17,500 Carlos Mora recently immigrated to the United States from Central America. monthly or, Q:Alice is a general partner in Axel Partnership. Corporate HQ 3619 W 73rd St Anderson, IN 46011 info@EnerDel.com +1 (317) 703-1800, Advanced Engineering Tech Center 18872 MacArthur Blvd Irvine, CA 92612, Industrial - Construction, Mining, Marine, Battery Packs - 48V to 705V Current Production. It is not due until the end of the next month which is when they intend to pay it. A $0 balance. By what amount is the Sales account in error?

7. Wiley contributed $102,000 of equipment to the business in exchange for common stock. This machinery was being depreciated by the double-declining-balance method over an estimated useful life of 8 years, with no residual value. WebThe following transactions occurred during July: 1. During September, the account was debited for a total of $12,200 and credited for a total On January 1, Sheffield also issued A decrease in an expense account. 5. 3. The company paid cash of $2,100 for utilities for the month of March. arose from sales in June. Received $790 from a customer in partial payment of his account receivable which arose from sales in June. The company paid $6,400 for salaries for the month of March. $65,000 + $13,800 $17,400 = Ending Accounts Receivable Balance Received $1290 cash from a customer for services to be rendered next year. Capital account. Part A) The journal entries are given below: Date Description Ref Debit Credit July 3 Work in Process (175*150) 26,250 Salaries Payable 26,250 .

The company has guaranteed the interest on 12%, 50,000, 15-year bonds issued by this affiliate, Jay Company. 2. &&&\$ 91,200 & \$ 99,976 \\ GreenLawn's general journal entry to record this transaction will include a: Victor Cruz contributed $78,000 in cash and land worth $146,000 to open a new business, VC Consulting, in exchange for common stock. \text{Interest receivable}&&\$ d.&\\ For example, you get paid on the 1st and the 15th of the month &\textbf{OBrien Industries Inc..}\\ At the end of January, the economic, A:Forward-looking information is information about prospective economic performance, financial, Q:d. If the employees are not covered, what is the maximum amount Ken can contribute for himself? Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. The grantee must make all grant -eligible program expenditures and incur all grant-eligible costs within this period. received $10,000 cash from the issuance of common stock to owners. Assume that the company resold the shares of treasury stock at $28 per share on October 1. 3. Andrea contributed $37,000 of photography equipment to the business. The February 28 cash balance was $1,800. WebBusiness Accounting Purchases and Cash Payments Transactions Emily Frank owns a small retail business called Franks Fantasy. \text{Office equipment (net)}&&\underline{115,000}&\underline{130,000}\\ A law firm collected $3,300 in advance for work to be performed in three months. Received $900 cash for services provided to a customer during July. It is shown under the, Q:Problem 1: The following selected information is provided about a manufacturing company: c. An increase in an unearned revenue account. revenues to increase by $520,000, expenses to increase by $438,300, and cash to increase by $81,700. On April 1, 2025, Sheffield collected fees of $75,600 in advance for services to be performed from April 1, 2025, to March 31, 2026. Received $2800 cash investment from Bob Weba.

On January 1, Sheffield issued 2,520 shares of $40 par, 7% preferred stock for $103,320. Recorded as a debit to a prepaid expense account. What was the balance of the cash account after these transactions were posted? Sheffield performed services for $672,000 on account. They also had account balances of: Cash, $22,000; Office Supplies, $3,000; and Accounts Receivable, $12,000. $40,000 + Credit Sales (Debits) $76,000 = $33,000

Webneed a perfect paper? Beginning Cash Balance + Cash Receipts Cash Disbursements = Ending Cash Balance QN=98 If Tim Jones, the owner of Jones Hardware proprietorship, uses cash of the business to The straight line method is used to depreciate buildings, machinery, and equipment, based upon their cost and estimated residual values and lives. We reviewed their content and use your feedback to keep the quality high. The UCC has been adopted in some form in every state. b. Received $2,200 cash investment from Barbara Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance. categorized WebThe following transactions occurred during July: Received $1,450 cash for services performed during July. Inventories are listed at the lower of cost or market value using an average cost.

The investment in bonds is carried at the original cost, which is the face value, and is being held to maturity.

Received $960 cash for services provided to a customer during July. Which of the following general journal entries will Russell Co. make to record the receipt of the bill? d. Debit Tim Jones, Withdrawals and credit Cash. Purchased$40,000 of Nightline Co. 6%, 10-year bonds at 100. WebThe following transactions occurred during July: 1. of Shares } & \textbf { Cost per Share } & \textbf { Total Cost } & \textbf { Total Fair Value } \\ \end{array} 3. 4. received $950 from a customer in partial payment of his account receivable which arose from sales in june. *Response times may vary by subject and question complexity. a. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. INR / USD Non-Deliverable FX Forward Transactions . The company paid $4,800 on the office equipment purchased in transaction #5 above. Charged 175 hours of professional (lawyer) time at a rate of $150 per hour to the Obsidian Co. breech of contract suit to prepare for the trial 10. Russell Co. received a $760 utility bill for the current month's electricity. Received $960 cash for services provided to a customer during July. The company paid $2,700 cash for office furniture. a. Borrowed $6400 from the bank by signing a promissory note. Identify the general journal entry below that Innovation Consulting will make to record the transaction. Service Revenue 7,500 c. 8. Available-for-SaleInvestmentsBernardCo.stockChadwickCo.stockGozarInc.stockNightlineCo.bondsFairValue$15.40pershare$46.00pershare$32.00pershare98per100offaceamount. a. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. b. Debits decrease asset and expense accounts, and increase liability, equity, and revenue b. c. Received $750 from a customer in partial payment of his account receivable, which arose from sales in June. Received $800 cash for services performed during July. 4. 3. Received $1,310 cash from a customer for services to be performed next year. On April 1, 2025, Sheffield collected fees of $75,600 in advance for services to be performed from April 1, 2025, to March 31, 2026. 2.

Wiley Hill opened Hill's Repairs on March 1 of the current year. beginning balance Received $850 cash for services performed during July. Provided services to a customer on credit, $375. \text{Cash}&&\$233,000&\$220,000\\ It can also refer to financial reporting that corrects errors made previously in the accounting period. of $339,000, A:Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational, A:In this question we will find out the medical dedution, Q:A company has provided the following data for its two most recent years of operation:

a.

5. h. Additional marketable securities wefe purchased during the year.

b. c. Received $750 from a customer in partial payment of his account receivable, which arose from sales in June. During May, the account was debited for a total of $13,100 and credited for a total of $12,400. b. The, Q:Exercise 1-5A (Algo) Identify missing information in the accounting equation LO 1-3 2. QN=87 A simple account form widely used in accounting as a tool to understand how debits and Computation of Cash Sales & Credit, Q:Which of the following 4. Also, during the current year the company paid $28,000 in dividends. By what amounts are the accounts under- or overstated as a result of this error? WebDuring 2025, the following transactions occurred. 7. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. A decrease in an asset account. Sheffield reacquired 840 shares of its common stock on June 1 for $28 per share. 7. b. Received $7,300 cash from the issuance of common stock to owners. Received $750 from a customer in partial payment of his account receivable which arose from sales in June. Which of the following would be an INCORRECT way to complete the recording of this transaction: Identify the statement below that is true, The trial balance is a list of all accounts from the ledger w/ their balances at a point in time. If you want any, Q:The Cloud Burst Sprinkler Company of Benicia, California has been manufacturing and selling a water, A:Incremental analysis considers only the relevant costs for decision-making purposes. d. Provided services to a customer on credit, $375. On December 31, 2025, Sheffield declared the annual cash dividend on preferred stock and a $1.20 per share dividend on the outstanding common stock, all payable on January 15, 2026.

December 31, 2024 1. How did the Cold War contribute to Russia's environmental problems? Received $6,750 cash from the issuance of common stock to owners.

Borrowed from a bank = $6400 (signing a promissory note), 6. How much office overhead is over- or underapplied?

Utilities Expense 1,100 Received $900 cash for services provided to a customer during July. 23, A:Ending inventory is the inventory in hand at the conclusion of the period. 2. (Hint: Work back from the ending account balances.) Note 1. Received $940 cash for services provided to a customer during July. i. Verlando Company has no notes payable in the liabilities section of its balance sheet. Additionally, during January one customer paid Received $2,200 cash investment from Bob Johnson, the stockholder of the business 3. The company's debt ratio was: 74.9%. 7.

Ignore income taxes and deferred tax considerations in your answer. The following transactions occurred during July: 1. WebThe following transactions occurred during 2016: a. Reacquired 6,000 shares of common stock at $18 per share on July 1. b. Reacquired 1,200 shares of common stock at $16 per Received $2,200 cash investment from Barbara Hanson, the owner of the business. Calculate the amount of total stockholders' equity reported on the balance sheet at month-end. 1. Salaries payable, January 1 - $6,400

8. Andrea invested $15,200 cash in the business in exchange for common stock. 11. a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800. Using the information in the table, calculate the company's reported net income for the period. Issued common stock for $2,200 cash. The company Discuss. On January 1, Sheffield issued 2.520 shares of $40 par, 7% preferred stock for $103,320. 31. 1. Change in Equity = Beginning Equity Ending Equity Allowance for doubtful accounts b. QN= 97 The following transactions occurred during July:

Preferred stock has a 100 par value per share, 1,000 shares are authorized, and 400 shares have been issued. 2. 4. 1. Revenues that have been earned and received in cash. Received $900 cash for services provided to a customer during July. 107,000, Q:Required information collected $6,000 cash for services previously Revenues that have been earned but not yet collected in cash. for . Salaries payable, December 31 - $10,600, Use the following information to calculate cash received from dividends: C. An employee earns $1,000 in pay and the employer withholds $46 for federal income tax. 2. A three-year fire insurance policy was purchased on July 1, 2021, for $12,000.

3. What was the balance in the Cash account at the beginning of May?

1. Due to a backlog of orders, the company does not perform the services until January 3, 2017. c. Liabilities created when a customer pays in advance for 3. Its total liabilities are $118.1 million and its equity is $303 million. The following transactions occurred during July: 1.

e. An increase in the balance of the owner's withdrawals account. *Beginning Total Assets = Beginning Total Liabilities + Beginning Total Equity July 27 July 31 Admin. On January 1, Sheffield also issued 1,890 shares of the $10 par value common stock for $44,100. a. Dividends receivable, January 1 - $3,600  2. (Round your answer to 1 decimal place. WebDuring July, the following transactions were completed: July 1 Issued 14,151 shares of common stock for $14,151 cash. Gozar Inc. is classified as an available-for-sale security. 6. The February 28 cash balance was $4,200. b. Debit to Accounts Receivable. Salaries Expense 550 You'll get a detailed solution from a subject matter expert that helps you learn core concepts. ), 26.8%. d. $0. 8. 8. The purchase of an insurance policy for cash would appear on a statement of cash flows in the: On December 15, 2016, a company receives an order from a customer for services to be performed on December 28, 2016. Received $900 cash for services provided to a customer during July. 2. If the balance in the accounts payable account at the beginning of March was $77,700, what is the balance in accounts payable at the end of March? Issued common stock for $3,200 cash. Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. Received $5,200 This problem has been solved! Armour Pipe Line Company assigned leases to its existing oil wells in Texas to Sandel Energy, Inc. Assume the company's policy is to initially record prepaid and unearned items in balance sheet accounts. e. $4,300. Received $725 from a customer as payment for services performed during June. Received $900 cash for services provided to a customer during July. It is the cost which includes direct, Q:Refer to the accounting information for Bonnie's Batting The company paid cash of $3,200 for monthly rent. At the beginning of January of the current year, Sorrel Co.'s ledger reflected a normal balance of $65,000 for accounts receivable. Investments are classified as available for sale. 4. is a 4.8 percent chance that the flight will be diverted for an immediate landing.

2. (Round your answer to 1 decimal place. WebDuring July, the following transactions were completed: July 1 Issued 14,151 shares of common stock for $14,151 cash. Gozar Inc. is classified as an available-for-sale security. 6. The February 28 cash balance was $4,200. b. Debit to Accounts Receivable. Salaries Expense 550 You'll get a detailed solution from a subject matter expert that helps you learn core concepts. ), 26.8%. d. $0. 8. 8. The purchase of an insurance policy for cash would appear on a statement of cash flows in the: On December 15, 2016, a company receives an order from a customer for services to be performed on December 28, 2016. Received $900 cash for services provided to a customer during July. 2. If the balance in the accounts payable account at the beginning of March was $77,700, what is the balance in accounts payable at the end of March? Issued common stock for $3,200 cash. Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. Received $5,200 This problem has been solved! Armour Pipe Line Company assigned leases to its existing oil wells in Texas to Sandel Energy, Inc. Assume the company's policy is to initially record prepaid and unearned items in balance sheet accounts. e. $4,300. Received $725 from a customer as payment for services performed during June. Received $900 cash for services provided to a customer during July. It is the cost which includes direct, Q:Refer to the accounting information for Bonnie's Batting The company paid cash of $3,200 for monthly rent. At the beginning of January of the current year, Sorrel Co.'s ledger reflected a normal balance of $65,000 for accounts receivable. Investments are classified as available for sale. 4. is a 4.8 percent chance that the flight will be diverted for an immediate landing.

The following selected investment transactions occurred during 2015: The client paid cash immediately. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. \text{Total liabilities and stockholders equity}&&\underline{i. WebThe following transactions occurred during July: 1. The income tax rate is 30%. The comparative unclassified balance sheets for December 31, 2015 and 2014 are provided below. Cash. of credit sales during May? 4. 4. \text{Available-for-sale investments (fair value)}&&\underline{\$ c.}&\underline{\$ 101,270}\\ At the beginning of the current year, Snell Co. total assets were $258,000 and its total liabilities were $179,200. Prepare a statement of shareholders equity for 2019. Received $5,000 cash from the issuance of common stock to owners. collected $14,800 from customers on account and provided additional services to Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. Using concepts and actions explained in this chapter (Chapter 5): Decide if Aldi is more likely to respond to any strategic actions Amazon might initi section 723(c) of the DPA, BIS will not publicly disclose individual firm information it receives through offsets reporting unless the firm furnishing the information specifically authorizes public disclosure. At December 31, 2022. 3. 1. The long term debt includes 12%, 36,000 face value bonds that mature on December 31, 2024, and have an unamortized bond discount of 1,000; 11%, 48,000 face value bonds that mature on December 31, 2025, have a premium on bonds payable of 1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of 6,200 and matures on January 1, 2022. 10. \text { Source } & \text { DF } & \text { SS } & \text { MS } & \text { F } & \text { P } \\ 2. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. 168,000 b. \text{Excess of issue price}&&225,000&225,000\\ Next Level Compute the current ratio and the quick ratio. The company uses an, A:Product cost is the amount incurred on the making of the goods. Furnace B was relined for the first time in January 2020 at a cost of 300,000. Debit Cash $78,000; Debit Land $146,000; Credit Common Stock, $224,000. 9. d. $ 3,275. c. $ 2,525. 1. e. Not recorded in the accounting records until the earnings process is complete. 5. Identify the item below that would cause the trial balance to not balance? \end{array} A law firm collected $3,000 on account for work performed in the previous month. WebThe following transactions occurred during July: Received $1,450 cash for services performed during July.

Applied office overhead at a rate of $62 per professional hour charged to the Obsidian case 31. During May, the account was debited for a total of $12,200 and credited for a total of $11,500. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $21,000. The company purchases $35,500 worth of inventory on credit. MODULAR AND CUSTOMIZABLE AMERICAN-MANUFACTURED LITHIUM-ION BATTERY SOLUTIONS FOR YOUR ENERGY NEEDS. EnerDel is proud to be a US designer and manufacturer, with our headquarters, engineering and manufacturing in Indiana, and our advanced engineering tech center in California. 2. Answer: Particulars Amount , The following transactions occurred during July: a.

Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year).

Prepare the disclosure for significant noncash transactions for the statement of cash flows for the year ended December 31, 2019. 3.

. Tan contributes inventory valued at \text { Analysis of Variance } & & & \\ Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. Expert Answer. $1,395 Received $790 from a customer in partial payment of his account receivable which arose from sales in June. Sheffield performed services for $672,000 on account. 95,550 Identify the statement below that is correct, The left side of a T-account is the debit side. revenue is earned. a. normal balance of $52,000 for accounts receivable. c. $43,300. .

The company provided $3,200 of services to customers on account. Please show your work. 3. WebThe following transactions occurred during July: a. Refer to the information for Shannon Corporation above. During The company debited insurance expense for the entire amount. The sales value of, A:Joint cost means the cost incurred to produce more than one units and then joint cost need to be, Q:iaz Company owns a machine that cost $250,000 and has accumulated depreciation of Adjustment data: $51,660 Received $5,900 cash from the issuance of common stock to owners. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. Provided services to a customer on credit, $375. d. An increase in a revenue account. The following account balances are taken from the December 31, 2020, financial statements of ABZ Advertising Company. 6. Refer to the information for Shannon Corporation above. Net Income = Total Revenues Total Expenses. Sheffield collected $579,600 from customers on account. the following transactions occurred during july: received $1,100 cash for services provided to a customer during july. Provided services to a customer on

The following transactions occurred during July: July 3. NSF, Q:Do not enter dollar signs or commas in the input boxes.

Received $900 cash for services provided to a customer during July. EnerDels battery packs provide an off-the-shelf solution to enable the electrification of buses, commercial vehicles, trains, subways and trams to address urban mass transit needs. Next Level Compute the debt-to-assets ratio at the cud of 2019. 2. Sandel filed a suit in a Texas state court against Armour, claiming that the reservation of a royalty interest in those wells was "ineffective" because of the temporary forfeiture. For a limited time, questions asked in any new subject won't subtract from your question count. 1.

Wiley invested $27,000 cash in the business in exchange for common stock. 2. Purchased $70 of office supplies on credit. Prepare a schedule of cash collections This is also known as end of period adjustment. 31,2014$220,000138,000103,7702,500$101,270$77,000130,000$666,270$60,00070,000225,000308,7702,500$666,270. 9. Q:Covington Corporation, a publicly traded company, was organized on January 1.2021. Andrea contributed $26,000 of photography equipment to the business in exchange for common stock. The account normally has a ________ balance. On May 1, a customer paid GreenLawn $70,000 for 6-months services in advance. Meanwhile, new wells were drilled on the leases. Which of the following general journal entries will Specter Consulting make to record this transaction? Beginning Cash Balance $2,300 = $4,200 Enter your answer as a positive number. Received $2,200 cash investment from Barbara Hanson, the owner of the business. Jolly Roger Co. reported a total net income of$112,000 for 2015. 4.

Also during the month of March, Harley was paid $9,200 by a customer for services to be provided in the future and paid $37,300 of cash on its accounts payable balance. The company received $6,300 cash for services provided during January.

WebThe following transactions occurred during December 31, 2021, for the Falwell Company. What is your evaluation of this ratio if it was 39% at the end of 2018? \text { Constant } & -37186 & 4629 & -8.03 & 0.000 \\ $54 c. A $4,300 credit balance. What was the amount of revenue for July? 5.

What was the amount of credit sales during May? Determine the general journal entry that Ted Catering will make to record the cash receipt. Total Assets = $301,000 + $101,000; Total Assets = $402,000. \text{Less valuation allowance for available-for-sale investments}&&\underline{b.

12 2. This method, Q:A company's calendar-year financial data are shown below. 182,000. 4. The company provided $3,350 of services to customers on account.

Balance Sheet accounts. Regarding federal tax reform, Mr. Rosapepe said he would be stunned if this happened in 2016 and stunned if it does not happen in 2017. The company uses accrual basis accounting. \text{Available-for-sale investments (at cost)Note 1}&&a.&103,770\\ Land with a carrying value of 35,000 was sold at a loss of 6,000. b. Received $6,750 cash from the issuance of common stock The non-interest-bearing note receivable matures on June 1, 2023.

$179,400 b. 5. Office Equipment. During 2020, Vail engaged in the following transactions: Required: 1. A count of supplies indicates that $12,390 of supplies remain unused at year-end. 298,200

$270,000 = Ending Total Liabilities + ($78,800 + $103,000 $81,000 $10,000) Required:, A:Accounting Equation: Received $1,400 cash for services performed during July. WebThe following transactions occurred during July: 1. Find the amount they must deposit today in an investment account expected to yield 4% compounded quarterly if he needs $95,000 to open the shop in 2 years.