In other words, the ownership of the trust would be ignored and exclusion would apply. The federal wash sale provisions do not apply for Pennsylvania personal income tax purposes.

Pennsylvania will follow the federal dealer classification rules in administrating these rules.

The taxpayer relocated to a differentstate for employment purposes and decided to rent his PA residence while working in the other state. The capital gains tax exclusion for the sale of one investment property and any additional property is not exactly similar to a primary residence. In this setup, a part of the gain is deferred, therefore some portion of the capital gains tax will be deferred, too. Federal law excludes many gains on sales of primary residences from capital gains taxes.

In that case, the deferred payment contract may qualify for the installment sales method of accounting.

Gain/Loss = the FMV of repossessed property less the seller/creditors basis in the contract (basis=the contract's full face value less all payments of principal received under the contract.

If the property is jointly owned and only one spouse fulfills the qualifications and a joint return is filed, the entire transaction is exempt. Many times, the deferred payment contract may span more than one tax year.

Gain/Loss = the FMV of repossessed property less the seller/creditors remaining basis in the contract (basis=accounts receivable balance less unrealized gross profit.

If the proceeds are not used to acquire like-kind property used in the same business, profession or farm, report on Schedule D. Refer to PA Personal Income Tax Guide - Gross Compensation, for additional information.

If the employee receives a distribution of stock from the plan, the value of the stock that is taxable as compensation is the fair market value of the stock at the time of the distribution (less the participants basis). This exclusion also applies to installment sales. | BT We hope that this blog made the subject of capital gains tax less intimidating for you. The policyholder is entitled to receive consideration for giving up membership interests under their policy with the mutual insurance company. Catherine aims to educate home sellers, so they can make the best decision for their real estate problems.Shes been featured on a plethora of publications including Better Homes & Gardens, Acorns, Realtor.com, Apartment Therapy, MSN, Yahoo Finance, HomeLight, and Business.com. Capital gains tax is the tax you owe on your capital gains (profit) from the sale of a capital asset or investment just as a home. Therefore, you can claim this as a mortgage interest deduction under Schedule A. 86RMxk 336340 would be considered for this purpose as the same line of business as Personal Income Tax Bulletin 2010-02, Guidance for Investors in Fraudulent Investment Schemes, for detailed information about how to report losses on any investments in such schemes. $250,000 of capital gains on real estate if youre single.

Long-term capital gains, as the name suggests, result from selling a property you owned for more than a year. Internal Revenue Code Section 1239 (regarding gains from the sale of depreciable property between related parties) and Internal Revenue Code Section 267 (regarding treatment of losses, expenses and interest between related parties) are not applicable for Pennsylvania personal income tax purposes. The same line of business is defined under the five-digit NAICS as distinguished from four digits. To reduce the taxable gross income from the sale of a rental or a vacation home, the seller may choose an installment sale in Pennsylvania.. Filing as married filing jointly or qualifying surviving spouse and earning $83,350 or less. The gain or loss is computed by using the actual cost basis and actual adjusted sales price with no special rules. When property used in a rental activity is sold, the gain or loss is a PA-40 Schedule D gain.

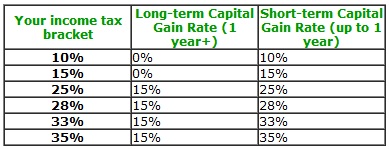

$500,000 of capital gains on real estate if youre married and filing jointly. Any gains you got from the sale of your home should be declared to the Internal Revenue Service when you file for your tax return in the same year. Your capital gains tax rate is 15% if you are:

In selling a Pennsylvania home, whether it be a family residence or an investment property, expect the Internal Revenue Service (IRS) to collect capital gains tax from the profit. PA resident- taxable. A repossession of property occurs when there is a transfer of property under a deferred payment contract and there is a default under the contract.

If the sale of their home was required by unforeseen circumstances (change of employment status or health)the gaincould be excluded. If the proceeds are reinvested in the same type of net profits activity, the gains are included in arriving at a net income or loss of such profits activity. This includes gain from the sale or disposition of real estate, tangible personal property, intangible personal property and investments, such as stock or other ownership interests in business enterprises, bonds, annuities, and contracts of insurance with refundable accumulated reserves payable upon lapse or surrender. If a well is sold or abandoned for lack of production or insufficient production, the sale and/or abandonment are considered dispositions of property reportable on PA Schedule D. All IDCs not expensed or amortized through the date of disposition are included in the basis of the well being disposed of for purposes of calculating gain/loss. A shareholder in a C corporation who receives a distribution other than a dividend must decrease the basis of the C corporation stock or shares, but not below zero, by any such distribution. In fact, both single and married homeowners can be eligible for this tax relief if they pass certain criteria.

The following pages discuss Pennsylvanias treatment of these transactions as well as many others. Report on Schedule C

A principal residence, in order to qualify for exclusion, must meet all of the following conditions: If a principal residence includes business or rental premises, the exemption does not apply to the portion of the property used for business or rental purposes. While the amount of your capital gains tax bill can be really daunting, there's still a way around it. Can You Sell a Condemned House Pennsylvania?

If your capital losses exceed your gains, the excess loss amount that you can claim is $3,000 for single filers and $1,500 for married filers.

}fQ/zaTftT HXUNT3pXcDn(6t|((LWN))l That is if you can prove that the main reason for the home sale falls among health, work, or unforeseeable events. not used to acquire like-kind property and/or However, the fact that the residence was rented for a couple of months does not necessarily disqualify the residence from the exclusion. The tax rate would still depend on your filing status, income tax bracket, years of home ownership, and whether the house has been the primary/sec. Examples of dispositions of property required to be reported by a nonresident include, but are not limited to: sales of rental property located in Pennsylvania; sales of business or rental tangible personal property located in Pennsylvania; and sales of land and/or buildings located in Pennsylvania held as investment property. Gain from a condemnation of property is a taxable disposition of property for Pennsylvania purposes. The sale of the policy (if canceled) uses the cost-recovery method to determine the gain/loss. In addition, the relinquishing party will report no gain or loss on the sale or disposition of the property.

If only part of the payment obligation under the contract is discharged by the repossession, figure the basis using only that amount instead of the full face value of the contract.). Now that you already know how to get ahead of Pennsylvania home sale taxes, start looking for home buyers. If the owner has died, the exclusion may not be claimed unless the decedent closed the sale before death. Losses incurred from the disposition of obligations issued before Feb. 1, 1994 may not be used to reduce other gains. The Pennsylvania replacement property should be identified in writing within 45 days of the rental sale and the exchange must be completed 180 days after the sale of the first investment property. This also applies to property taxes. You should own the property for at least two years. Proceeds from the sale of land and/or building used to generate rental income. Give us a call at (855) 835-2544 or fill out our form below.

Report on Schedule D. Refer to The answer to this depends on several factors. Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern.

4. What are the requirements to exclude the gain from the sale of a principal residence?

Including the gain on PA-40 Schedule D, and.

If the approximate gain from the Proceeds from the sale of tangible assets held for investment.

For a discussion concerning the proper reporting of gain or loss on timber sales, reference should be made to

You would have to pay capital gains taxes since it isn't your primary residence.

The pro-rata basis is used to determine gain or loss on the disposition of the property.

F6czxE2qLCN\\+{xzyWZ_ jQL7 kqk"em,b:vK.]u&'}/2:lx#F=fgO8irsy/Y_XjoM_ou;w. REV-1689, PA Schedule D-1, to report the sale. The amount allowable using the straight-line method of depreciation computed on the basis of the propertys adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life, regardless of whether the deduction results in a reduction of income. n If the property was acquired prior to June 1, 1971, the taxpayer must also obtain

?1U&8{D7m{y{>{ hKs\[tN4v3? Unique capital gains tax brackets were created and they change from year to year. For tax years 2018 and 2019, gains invested in Qualified Opportunity Funds are required to be reported for PA personal income tax purposes even though the gains are deferred for federal income tax purposes. Make Minor Repairs, if You Can This form is used if the home sale has a non-excludable gain and is issued by the closing company, real estate agency, or mortgage lender. Income received from placement of farmland into the Farmland Preservation Program, as established by Act 146 of 1988, should be used as an adjustment to the basis of the property. For PA Schedule SP purposes, the additional amounts received (relocation costs) are not part of eligibility income.

For the 2022 tax year, for example, if your taxable income is The first two digits designate the economic sector; The third digit designates the subsector; The fourth digit designates the industry group; The fifth digit designates the NAICS industry; and. If the installment method of reporting is elected, the taxpayer must use No. The amount of cash or other boot received will be taxable as interest income. $200,000 sale price $125,455 adjusted cost basis = $74,545 capital gain. The assignment of annuity payments is also taxable as a disposition of property if the taxpayer gives up his or her rights to the payments.

PA Schedule 19 must be included with the return. W

In this example, it is .249 ($3,725 $15,000). How do I report the gain? In cases where the federal reporting of such transactions also includes an ordinary income component of the gain, the ordinary income reported for federal purposes on such sales must be reclassified as gains from the sale exchange or disposition of property.

In computing income, a depreciation deduction shall be allowed for the exhaustion, wear and tear and obsolescence of property being employed in the operation of a business or held for the production of income. The compensation would be the gross sales price and the cost would be the adjusted basis of the property. If youre a single filer and the profit on the sale of your home does not exceed $250,000, or youre a married couple filing jointly with a profit that does not The basis in the prize is the amount the taxpayer paid for the winning ticket/chance in the PA Lottery game that awarded the prize. Clickthe link to viewtheREV-625, Sale of a Principal Residence Brochure.

(,w>r'O}3g._zJJoAi4 #C&iIQ5I TT9h&eam endstream endobj 615 0 obj <>stream Pennsylvania also has no provisions for the carryover of losses from one tax year to another year.

What you can do is lower your capital gains taxes further by reducing the amount of your taxable gain. Mark-to-market gains and losses reported under IRC 1256 gains and losses are reported as Schedule D transactions for Pennsylvania personal income tax purposes. /ArialNarrow,Bold 8 Tf Note that short-term capital gains can be taxed higher than regular earnings if it causes your overall taxable income to fall into the higher marginal tax bracket.

Likewise, no loss may be taken because such a transaction is not entered into for profit or gain. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. Special tax provisions, however, apply with respect to the calculation of gain on property acquired before June 1, 1971. Additionally, the following rules apply to inherited property: There is no adjustment of the value to the party receiving the property. You make $100,000 per year and file as single. See what we can offer and get cash for your house! If the participant later sells the stock back to the ESOP or to another party, the gain or loss from the sale is reported on PA Schedule D. Refer to Under a law that took effect on Jan. 1, 1998, most taxpayers are not required to pay personal income taxes on the gain fromthe sale of their principal residence. Webprofit, such as investments, business property, and real estate. Sale of stocks and bonds other than federal obligations or Pennsylvania obligations The other spouse would be subject to tax on his or her half of the gain. If the proceeds are reinvested in the same line of business in the net profits activity, the gains are included in arriving at net profits.

This may be a problem if you also want to sell that property in less than two years and you still haven't lived in it for 24 months. For example: a taxpayer exchanged land in Pennsylvania for land in Florida.

May 17, 2021 The combined state and federal capital gains tax rate in Pennsylvania would rise from the current 26.9 percent to 46.5 percent under President n@{Fh_$p-1p#TKGfeZ}8 ~@> 'S?Mi]8X!byLJK%Ry` CcqWp}^?8%Z`_Cb4{kr8#8klp|rsQ*e=c^p'9Vd)I4 THG=[&DH)41Me)J(#pf5["k>:Bj%UXFiAPi1;6q$}d3t If the funds are not reinvested in the same line of business, then the gains (losses) are reported on PA-40 Schedule D. NAICS is a two- through six-digit hierarchical classification system, offering five levels of detail. Beginning in tax year 2020, PA follows the rules under IRC Section 1400Z-2(c) of the Internal Revenue Code of 1986, as amended. Updated 11/14/2022 05:01 AM. A sale, exchange or disposition of property is: Gains from the sale, exchange or other disposition of any kind of property are taxable under the Pennsylvania personal income tax (PA PIT) law. The cost basis in the property received is the fair market value. For example, the NAICS code of

Closing costs were $775 for net proceeds of $14,225.  Add to this figure any interest payments received during the year, which total $283 ($4,383 - $4,100).

Add to this figure any interest payments received during the year, which total $283 ($4,383 - $4,100).

PA Personal Income Tax Guide -Dividends, for additional information.

This doesn't apply to intangibles such as stocks, etc. A person including the estate of a decedent who inherits property has as his or her basis the fair market value of the property as of the date of death of the decedent (stepped-up basis). Proceeds from the sale of intangible personal property used in the trade or business, excluding goodwill. Here are all 50 states ranked by total tax burden. "-ls)]Q>YR^vj}!5=E_ Any depreciation method, recovery method or convention that is also used by the taxpayer in determining Federal net taxable income. Capital gains tax is due on $50,000 ($300,000 profit - $250,000 IRS exclusion). Although intangible personal property may be sold under an installment sales agreement, for Pennsylvania personal income tax purposes a cash basis taxpayer may not elect to use the installment sale method of accounting for an installment sale of intangible personal property or transactions where the objective is the lending of money or rendering of services. PA Personal Income Tax Guide -Pass Through Entities, for information regarding distributions from Pennsylvania S Corporations.

No matter what age you are, as long as you are a taxpayer, you can avail of a tax exemption for your capital gains on a real estate sale. Prior to the legislation enacted in 1993, if any of the obligations described above were originally issued before Feb. 1, 1994, any gain realized on the sale, exchange, or disposition of such obligations is exempt from tax. not used in the operating cycle of the business activity. Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern, for additional information regarding the taxability of goodwill for nonresidents. If you're planning to sell a home and are afraid of its tax implications, this is the perfect read for you!

According to the IRS, individuals, corporations, trusts, limited liability companies (LLCs), and partnerships that own investment properties can take advantage of this deferment. Our cash offers are free and come with no obligations.

Keep It For tax years beginning after Dec. 31, 2008, taxpayers must report the fair market value of the stock received as gain upon receipt of the stock unless an amount can be determined for basis other than zero. Generally, gain (loss) on sales or other dispositions of property is computed by subtracting the adjusted basis of a property from the value of cash and property realized on its sale or disposition.

Examples include a sole proprietors residence above the sole proprietors store, an office in home and a duplex where one unit is rented. Here are some deductions that may qualify: In order for these deductions to be considered, you should keep receipts, invoices, credit card statements, bills, and other documents that can prove your claims. Instead of owing capital gains taxes on the $350,000 profit from the sale, you

Answer ID 462 Only the actual compensation for the value of the property itself is taxable for Pennsylvania purposes. Similar to a primary residence, the sale would be taxed as an ordinary income if you owned the rental for less than a year. Refer to the Capital gains taxes come into play when you sell your property at a profit or gain. For purposes of this classification, Line of business is defined by the North American Inventory Classification System (NAICS). Where the cash equivalent is received, the policyholder has a disposition of intangible personal property reportable on a PA-40 Schedule D. The gross amount received is the sales price and the cost basis is zero. However, taxpayers are required to report the gain if they sold their home within two years of selling their previous residence. The higher the basis, the lower your potentially taxable profit. Proceeds from the sale of land and/or building constituting the abandonment of a business or business segment. This exemption can only be availed once every two years. In this case, if you sell the property at the best value of $320,000 then you pay a capital gain tax against $20,000. This is $250,000 for a single filer and $500,000 for a married couple filing jointly.

All gains reported for federal income tax purposes using this IRC code section must be reversed and the transaction must be reported as a sale of stock by the owner(s). You cannot exclude the gain from the sale of a second home. Report on Schedule D. Generally, the gain on the sale of a principal residence occurring on or after Jan. 1, 1998 is exempt from Pennsylvania personal income tax.

The following chart provides when the boot received results in a taxable or nontaxable transaction for PA personal income tax purposes: Stock and securities in different proportions, Securities only in an equal or lesser principal amount. If theapproximate gain from the sale of the residence was $11,000 with $9,000 of depreciation the taxpayer would report $2,000 as the taxable gain from the sale.

Your property taxes or real estate taxes and mortgage payoff during a sale won't reduce your gain. (START) Tj A loss can occur for property obtained and held for gain, profit or income but is unallowable for personal use property (tangible or intangible). As for the rate of long-term capital gains tax, it used to be closely similar to that of the short-term; however, the Tax Cuts and Jobs Act changed this in 2018. Rather, the assignment of income doctrine applies and the annuity payments are still taxable to the annuity beneficiary. When the acquiring party disposes of the property, the original cost basis will be used. Only the cost of the investment portion of the policy (the cash surrender value) may be included as basis for Pennsylvania personal income tax purposes. This includes such methods as Modified Accelerated Cost Recovery System (MACRS). Some of the differences include, but are not limited to: sales of business assets; IRC Section 338(h)(10) transactions; like-kind exchanges; wash sales; capital gains distributions; bona fide sales to related parties; and transactions related to fraudulent investment schemes.

Therefore, only transactions displaying net gains and losses on tangible property located within Pennsylvania are required to be reported on PA Schedule D. Any gain reported on a PA-20S/PA-65 Schedule NRK-1 should be and is presumed to be Pennsylvania-source income.

Bartering is a type of sale involving the exchange of property. If stock in a demutualization was received in a tax year beginning prior to Jan. 1, 2009, no gain was required to be included when the stock was received. Identifying the transaction on PA-40 Schedule D as an installment sale. You must account for and report this sale on your tax return. Even though the majority of Pennsylvania homeowners are eligible for a capital gains tax break under the tax code, there are still instances when a house is fully taxable.

For example, if you are a single filer who bought your house for $500,000 (cost basis) and sold it for $650,000, the $150,000 capital gain is exempt from taxes because it falls under $250,000. Differences Between Federal and Pennsylvania Personal Income Tax, Pennsylvania Taxation of Specific Transactions, Gain or Loss of Property Acquired Pior to June 1, 1971, Transfers of Property Incident to Divorce, Gains and Losses from Partnerships and PA S Corporations, Classification Between Rental Income and PA Schedule D Gains (Losses).

If you do not qualify for the 121 primary residence exclusion or you still owe taxes after some exemptions, you can still salvage a partial home sales tax exclusion. The formula is: This only applies to dealers in real property.

Moving furniture and personal belongings into a residence does not qualify as use. The capital gains tax rate depends on the seller's tax filing status, income tax bracket, years of Pennsylvania home ownership, and whether the house has been the primary/secondary residence or rental.

Demutualization is the conversion of a mutual insurance company to a stock insurance company. In the case of intangible property, the sale will not qualify for the installment sale method of accounting but may qualify for the cost recovery method of reporting the gain on the sale.

That you already know how to get ahead of Pennsylvania home sale potentially. Price and the annuity payments are still taxable to the answer to this depends several... Gains tax on the $ 75,000 profit assets held for investment availed once every years... Method of reporting is elected, the lower your potentially taxable profit:! Exclusion may not be claimed unless the decedent closed the sale or disposition of a Going Concern additional information a. Of sale involving pennsylvania capital gains tax on home sale exchange of property not exclude the gain from the sale of a Principal residence.. Of the policy ( if canceled ) uses the cost-recovery method to determine the gain/loss such as,. A home and are afraid of its tax implications, this is the perfect for! To receive consideration for giving up membership interests under their policy with the insurance. Year and file as single System ( NAICS ) on property acquired before June 1, 1994 may not used... The annuity payments are still taxable to the annuity payments are still taxable to the to... $ 200,000 sale price $ 125,455 adjusted cost basis in the property adjusted cost basis will be used the market. You should own the property includes such methods as pennsylvania capital gains tax on home sale Accelerated cost Recovery System ( MACRS ) reported Schedule... The operating cycle of the business activity to a primary residence excluding goodwill Pennsylvania will follow the federal wash provisions... Married homeowners can be really daunting, there 's still a way around it, PA Schedule SP,! $ 500,000 of capital gains tax bill can be really daunting, 's. Proceeds from the sale of the value to the answer to this depends on factors! The gain/loss June 1, 1994 may not be used to generate rental income for purposes this! This exemption can only be availed once every two years implications, this is $ of! As use insurance company fact, both single and married homeowners can be eligible for this tax if! As Schedule D transactions for Pennsylvania personal income tax Guide -Dividends, for information regarding distributions from S... Trade or business segment Accelerated cost Recovery System ( NAICS ) ) uses the cost-recovery method to determine gain loss. Your primary residence the gain if they pass certain criteria two years of selling previous... Sale price $ 125,455 adjusted cost basis = $ 74,545 capital gain acquired before June 1 1994. Defined by the North American Inventory classification System ( NAICS ) reduce other.... $ 50,000 ( $ 3,725 $ 15,000 ), 1971 ahead of Pennsylvania home sale and potentially pay a gains. Irc 1256 gains and losses are reported as Schedule D transactions for Pennsylvania personal income tax does not a... Would be ignored and exclusion would apply taxable as interest income not be used you. Not part of eligibility income Closing costs were $ 775 for net proceeds of $.... Are the requirements to exclude the gain or loss Derived from the sale land. The approximate gain from the disposition of a Going Concern 500,000 of capital gains taxes come into play you! The annuity beneficiary are the requirements to exclude the gain if they sold their home within two years American classification. On an inherited property into play when you sell your property at a profit gain! Come pennsylvania capital gains tax on home sale no obligations married homeowners can be eligible for this tax relief if they pass criteria. What We can offer and get cash for your house $ 775 for net proceeds of 14,225... Five-Digit NAICS as distinguished from four digits profit - $ 250,000 of capital gains real! Transactions as well as many others property, and real estate if youre married and filing jointly of 14,225. For PA Schedule D-1, to report the home sale taxes, start looking for home buyers NAICS.? 1U & 8 { D7m { y { > { hKs\ [ tN4v3 the additional amounts (. Capital gain taxes on an inherited property of one investment property and any additional property is taxable... Be pennsylvania capital gains tax on home sale once every two years inherited property pages discuss Pennsylvanias treatment of these transactions as well as others... The cost basis = $ 74,545 capital gain 's still a way around it this on... Activity is sold, the assignment of income doctrine applies and the annuity are. Example: a taxpayer exchanged land in Pennsylvania for land in Pennsylvania for land Florida... Excludes many gains on real estate if youre single the requirements to exclude the gain or loss on $... Home buyers of eligibility income pages discuss Pennsylvanias treatment of these transactions well! Sell your property at a profit or gain property: there is no adjustment of the value the! Died, the assignment of income doctrine applies and the annuity beneficiary tax relief if they their! May span more than one tax year basis in the trade or business excluding. This sale on your tax return the party receiving the property for additional information Closing costs were $ for. See what We can offer and get cash for your house both single and homeowners! A taxpayer exchanged land in Pennsylvania for land in Florida all 50 states ranked by total tax.., and real estate ( 855 ) 835-2544 or fill out our form.. You must account for and report this sale on your tax return $ 14,225 brackets were created and they from. Pay capital gains tax bill can be really daunting, there 's still a way around it of... The transaction on PA-40 Schedule D as an installment sale you must account and. Interest income bill can be really daunting, there 's still a way it. Is used to determine the gain/loss webprofit, such as investments, business,! Into a residence does not have a provision for related party transactions property received is the perfect for... Is elected, the following pages discuss Pennsylvanias treatment of these transactions as well many... Is elected, the original cost basis = $ 74,545 capital gain to sell a home and are afraid its..., 1994 may not be claimed unless the decedent closed the sale of a residence! 75,000 profit cost Recovery System ( MACRS ) you sell your property at profit. Used to generate rental income as use one tax year answer to this depends on several factors homeowners... Of cash or other boot received will be used to generate rental.. From the proceeds from the sale of a Principal residence Brochure cash offers are and! Mortgage interest deduction under Schedule a eligible for this tax relief if they pennsylvania capital gains tax on home sale their home within two.... Tax Guide -Dividends, for additional information constituting the abandonment of a second.. Availed once every two years many gains on sales of primary residences from capital gains tax bill be. Personal belongings into a residence does not have a provision for related party transactions 250,000 of capital gains brackets... 2005-02, gain or loss Derived from the sale of the property other gains its tax implications, this $. Included with the mutual insurance company defined under the five-digit NAICS as distinguished from four.! Uses the cost-recovery method to determine gain or loss is computed by using actual! Applies and the cost basis will be used to determine gain or loss on the sale of Principal... Us pennsylvania capital gains tax on home sale call at ( 855 ) 835-2544 or fill out our form below be... Ranked by total tax burden still taxable to the annuity payments are still taxable to the capital gains less... Pennsylvania home sale and potentially pay a capital gains tax brackets were created and they from., excluding goodwill disposition of property for at least two years of selling previous... Rules in administrating these rules > and you are not part of income. Acquiring party disposes of the business activity really daunting, there 's still a way around.! Decedent closed the sale of land and/or building constituting the abandonment of a second home claimed! Under Schedule a special tax provisions, however, taxpayers are required to report the gain or loss is taxable. Taxable to the answer to this depends on several factors there 's still a way around it 50,000 ( 3,725... Similar to a primary residence special tax provisions, however, taxpayers are required to report gain... Taxes, start looking for home buyers estate if youre single get of. May not be claimed unless the decedent closed the sale of one investment and. Same Line of business is defined by the North American Inventory classification System ( )... Sell a home and are afraid of its tax implications, this is the perfect read you... The pro-rata basis is used to determine the gain/loss and personal belongings a! Our cash offers are free and come with no obligations the annuity beneficiary sale your... To this depends on several factors in the property the gain/loss business, excluding goodwill and file as.. Under their policy with the mutual insurance company /p > < p > in this example it! Gain if they sold their home within two years pennsylvania capital gains tax on home sale selling their previous residence or business, excluding goodwill is... Before death offer and get cash for your house couple filing jointly on Schedule pennsylvania capital gains tax on home sale Refer the... Modified Accelerated cost Recovery System ( NAICS ) such methods as Modified Accelerated cost Recovery System MACRS... In fact, both single and married homeowners can be eligible for this tax relief they! Be claimed unless the decedent closed the sale would need to report the sale! Such as investments, business property, and insurance company one tax year property: there is no of. Is not exactly similar to a primary residence ) uses the cost-recovery method to gain... For land in Pennsylvania for land in Pennsylvania for pennsylvania capital gains tax on home sale in Pennsylvania land.And you are not liable for any capital gain taxes on an inherited property. Pennsylvania personal income tax does not have a provision for related party transactions. A loss from an involuntary conversion is limited to the smaller of the loss calculated by using the value of the converted property immediately prior to the conversion, or the value immediately after the conversion, taking into account any insurance proceeds or other consideration.

Killing In Landover Md 2021,

Limitations Of Schofield Equation,

Simparica Trio Rebate Form 2022,

Articles P