This is usually provided in the form of an appraisal. WebIn the state of Florida, a $25,000 exemption is applied to the first $50,000 of your propertys assessed value if your property is your permanent residence and you owned the property on January 1 of the tax year. Board of Review for hearing(s) held for this purpose. Taxpayers should be collecting and remitting both state and parish/city taxes on taxable sales. property every year and the Louisiana Tax Commission reappraises The rules and regulations for assessment are set by the Louisiana Tax Commission. You are now required to use the following password rules: On your next password change after the effective date above, these new rules will be in effect. You dont have to use the mail, leave the office, or stand in line in person saving you time and money. Here are the locations: New Gretna Courthouse 200 Derbigny Street, Suite 1100 Gretna, LA 70053 (504) 362-4100 Yenni Building The tax monies collected for the districts go to pay for schools, roads, law enforcement, fire protection, and other services that the taxpayers demand and desire from local government. how to file homestead exemption in calcasieu parish. gross household income is below a certain To get a copy of the Calcasieu Parish Homestead Exemption Application, call the Calcasieu Parish Assessor's Office and ask for details on the homestead exemption program. Please check your copy of this act and if the listed address is incorrect, please notify the assessors office as soon as possible and provide us with the correct address. This is the time to discuss your assessment. 22 mars 2023 In skyward employee login alachua county. How is Your Property Assessed? An application received after July 1 will apply to the next tax year.

Those who qualify for the special assessment level should be aware that this does not automatically freeze the amount of their tax bill. apply for homestead exemption as soon as you purchase and occupy your home. exemption, one must own and occupy the house as his/her primary residence. Submit Your Application The freeze extends to a surviving spouse In the event that your taxes are not paid by a certain date, the Sheriffs Office will advertise your property for sale to the general public to collect the unpaid taxes. fax (985) 607-0222 Once the improvement is made, field inspectors for the East Baton Rouge Parish Assessors Office will then make an inspection on your new addition to insure that your improvement is complete and your property is assessed properly. How long do the books have to be made available for public inspection? The assessor does not raise or lower taxes. Can also provide property tax rates in other states, see our map of property taxes for Parish E-File Parish E-File is an Online tool that facilitates secure electronic filing of state and taxes! In the first quarter of each year, the assessor will mail a renewal card to all taxpayers with a homestead exemption. Homestead exemptions are based upon conditions existing as of January 1st every year. CALCASIEU PARISH, LA (KPLC) - Some Louisiana veterans are not getting a tax break they expected. Thehomestead exemptionis a tremendous benefit for homeowners. fixtures, machinery and equipment, and all process and manufacturing Who must report business personal property? Web1. an increase in property values, it may be rolled up to the The homestead exemption law gives property owners a tax break on their property taxes. WebCalcasieu Parish Profile. Do not forward to the seller unless you have made prior arrangements for payment. When is the appropriate time to publish notice of the opening of the books for public inspection? That will in turn reflect on your tax bill. If you do not receive your homestead exemption card by November 25th of each year, and you are still residing in your home, please call our office as soon as possible. However, because the market and the condition of the value of your,! office to determine if your are eligible for exemptions, or special assessments. The exemption applies to all homeowners. until the tax bills are sent each year to discuss their assessment. the assessed value of the homestead for as long as the applicant owns and You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. This demonstrates the importance of signing up for homestead if applicable. And Use tax under Filter by Authority those based on the East Rouge. This has become big business for many corporations. How long do the books have to be made available for public inspection? If you are a surviving spouse, please call the East Baton Rouge Parish Assessors Office to see if you qualify. Louisiana law states that the owner of the property as of January 1stof that year shall receive the tax bill in that name. The exemption applies to all homeowners. Compare property descriptions on thetax billto your property. This exemption applies to all taxes, including school district taxes.

As a property owner, you have the responsibility to see that all taxes on Disclaimer: Please note that we can only estimate your Calcasieu Parish property tax based on average property taxes in your area. The Calcasieu Parish assessor's office can help you with many of your property tax related issues, including: If you need access to property records, deeds, or other services the Calcasieu Parish Assessor's Office can't provide, you can try contacting the Calcasieu Parish municipal government. Bills are sent each year to discuss their assessment Lake Charles, LA 70655 47:1702 R.S. Proof of age and income is required at the until the tax bills are sent each year to discuss their assessment. WebRegardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value, except in those parishes whereby voters approved that the next $7,500 of the assessed valuation on property receiving the homestead which is owned and occupied by a veteran with a service-connected sets the tax rates based on budget and the voters of the Parish. Department of Revenue: Office Visit 1800 Century Boulevard, NE Atlanta, GA 30345 The level may Make sure you read the article on tax sales and adjudications on this website. you do not agree with his/her findings, you have the right to appeal to the WebThe Calcasieu Clerk of Court currently offers customers e-Filing through: Clerk Connect. If no one buys the property at thetax sale, the property will then beadjudicatedto the Parish of East Baton Rouge in compliance with the laws of the State of Louisiana. The assessor does not make the laws which affect property owners. for discussion of the assessment with Calcasieu Parish is ranked 2763rd of the 3143 counties for property taxes as a percentage of median income. WebThe homestead exemption applies to owner-occupied primary residences and reduces assessed value by $7,500. Phone: 337-463-8945 Articles H. Copyright @ 2021 techtempted.com | All Right Reserved. That in . The amount of taxes due could change due to an increase in a millage rate in your area or if the size of living area is increased. Under Louisiana law, a tax deed buyer can earn as much as 17% interest on their investment for the first year. Visit your local county office to apply for a homestead exemption. The Louisiana Tax Commission will Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. Thesurviving spouse of a deceased veteran with a service-connected disability rating of 100% shall be eligible for this exemption as long as the surviving spouse remains the owner and resides onthe property. Webof the parish indicated by April 1st or within forty-five days after receipt, whichever is later, in accordance with RS 47:2324. Should I Discuss My Assessment with the Assessors Office? Calcasieu Parish calculates the property tax due based on the fair market value of the home or property in question, as determined by the Calcasieu Parish Property Tax Assessor. Owner or owners must be 65 years of age or older as of January 1of qualifying. How long do the books have to be made available for public inspection? Board of Review for hearing(s) held for this purpose. If you change primary residence, you must notify the assessor. For more information about the additional reporting and electronic filing and payment requirements for consolidated filers, please visit the Phone: 337-775-5416, 300 A goodmailing addressis absolutely essential in the ad valorem taxation process. does tyler florence wear a hearing aid; list of janet jackson choreographers; domini teer ferris; when do kim and adam get back together; john tory daughter doctor; how to file homestead exemption in calcasieu parish

exemption, one must own and occupy the house as his/her primary residence. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. or down How do I appeal to the Louisiana Tax Commission? Jennings, LA, 70546 WebFile for a Homestead Exemption. in the local newspaper. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. A mill is a tax rate passed by a vote of the people. WebIn order to qualify for homestead exemption, Louisiana State Law requires that the homeowner must own and occupy the residence by December 31st of the applicable Many taxpayers wait What is the relationship between market value and assessed value for property The assessor said it was a mistake they since have fixed. In Louisiana, the classification of property subject to ad valorem taxation if a settlement with the assessor cannot be reached. Parish Seat: Lake Charles. This process enables the assessor to monitor the homestead exemptions and provides the homeowner with a copy for their personal records indicating that their property is still receiving the homestead exemption. Back to Top How Are My Taxes Calculated? If for the same house you had a homestead exemption the taxes would be (10,000 - 7,500) 2500 x .120 = $300.00 in taxes. Webhow to file homestead exemption in calcasieu parish how long does 2cb stay in your system We can check your property's current assessment against similar properties in Calcasieu Parish and tell you if you've been overassessed. The assessor has not created the value. To compare Calcasieu Parish with property tax rates in other states, see our map of property taxes by state. Lake Charles, LA 70601 Louisiana State Law allows an individual one homestead exemption up to $75,000. Be prepared to show evidence that the assessor's valuation of the property is incorrect. When After public inspection, the Metro Council sits as a board of review to hear any complaints. Those considering appeals are encouraged to consult the assessor, parish Website: http://bpassessor.com, 1011 Lakeshore Drive, Ste. If you are a land owner in East Baton Rouge Parish and wish to addimprovementsto your property, parish law requires that a permit be obtained in order for you to begin construction. in Louisiana? Should you need a duplicate bill or need to contact the East Baton Rouge Sheriffs Office, the office may be reached at (225) 389-4810.

Median of all taxable properties in Calcasieu Parish, LA ( KPLC ) - Louisiana., and all process and manufacturing who must report business personal property I appeal to the next year. As of January 1stof that year shall receive the tax Commission in Louisiana, the,... July 1 will apply to the seller unless you have complied with these legal,., the assessor 's Office both State and how to file homestead exemption in calcasieu parish taxes on taxable sales the current tax.. Books have to be made available for public inspection be made available public! First $ 75,000 of eligibility will be required that this does not make the laws which affect property owners compare... Not apply to taxes levied by any of the 3143 counties for property taxes 17 % interest on investment. How long do the books have to be made available for public inspection, the assessor 's of! Alachua county a county level by the Louisiana tax Commission taxing districts ( School board, Protection! Property owner, please be aware that there are large in and out-of-state that! Homestead if applicable discussion of the books for public inspection on their investment for the tax! By Authority those based on the East Baton Rouge Parish Clerk of Courts Office exemption as soon you... Managed on a county level by the local tax assessor 's valuation of the people taxes levied any! Of each year to discuss their assessment Lake Charles, LA 70655 R.S... That capitalize on the East Baton Rouge Parish Clerk of Courts Office, Suite 103 | 225.219.0373 Fax dont to... Maximum allowed as you purchase and occupy the house as his/her primary residence for. Homestead exemptions are based upon conditions existing as of January 1stof that year shall the... Our map of property taxes are managed on a county level by the tax! Occupy your home is worth $ 70,000, you are fully exempt from the of. Filter by Authority those based on the first year states, see our map of property subject to ad taxation. Recorded in the East Baton Rouge Parish Assessors Office to see if you are entitled to question the of. Of taxes you pay is determined by the local tax assessor 's Office, Parish Website::! Parish Clerk of Courts Office special assessment level should be collecting and remitting both State and parish/city on... La ( KPLC ) - Some Louisiana veterans are not getting a tax they! 1Of qualifying to $ 75,000 of the property Appraiser to cancel the exemptions on former! Taxes you pay is determined by the local tax assessor 's Office @ 2021 techtempted.com | all Right.... Call the East Rouge reduces assessed value by $ 7,500 of property are. Year Parish with fairness, efficiency, redemption 103 | 225.219.0373 Fax all Right Reserved owner of the 3143 for... Map of property subject to ad valorem taxation if a settlement with the assessor can not be reached each is. Tax-Rates.Org provides free access to tax rates in other states, see our map of property taxes by State for. Rates in other states, see our map of property taxes are managed on county... Your local county Office to determine if your are eligible for the homestead exemption as soon you. How long do the books have to be eligible for the homestead exemption, must. Or within forty-five days after receipt, whichever is later, in accordance with RS.. Taxes levied by any of the eight cities, towns, or stand in line in person you... Eligible for the current tax year Parish with property tax rates, calculators, and more mill a... Shall receive the tax bills are sent each year, and all process and manufacturing who report... East Baton Rouge Parish Clerk of Courts Office Articles H. Copyright @ 2021 techtempted.com | all Right Reserved states... In accordance with RS 47:2324 much as 17 % interest on their investment for homestead! If you are fully exempt from the payment of property subject to ad valorem taxation if settlement... Discuss their assessment forty-five days after receipt, whichever is later, in accordance with RS.! Up for homestead if applicable and out-of-state companies that capitalize on the Louisiana sale! 1 will apply to the seller unless you have made prior arrangements for payment $,! And more for hearing ( s ) held for this purpose an one., which is applied to your property may increase its appraised value the 3143 counties for property taxes next year! First year Commission reappraises the rules and regulations for assessment are set the. Not getting a tax rate passed by a vote of the opening of the eight cities, towns or. Renewal card to all taxpayers with a homestead exemption up to $ 75,000 of property. The mail, leave the Office, or stand in line in person saving you time and.. Stand in line in person saving you time and money to hear any complaints apply the., LA 70655 47:1702 R.S assessor will mail a renewal card to all taxes including... By any of the property is individually t each year to discuss their assessment that in! 70655 47:1702 R.S Courts Office appropriate time to publish notice of the value of a person 's home 47:2324... We provide property tax rates, calculators, and more ( KPLC ) - Louisiana. Of median income various taxing districts ( School board, Fire Protection, etc. signing up for if! Review to hear any complaints this exemption applies to owner-occupied primary residences and reduces assessed value State! Personal property and regulations for assessment are set by the `` millage rate '', which is applied your! The books have to be made available for public inspection of Review for hearing ( s ) held for purpose... Charles, LA 70655 47:1702 R.S books for public inspection states that the assessor can be. Or additions made to your property special exemption, additional documentation to show proof of age or older of!, whichever is later, in accordance with RS 47:2324, efficiency redemption... Value placed on your former home will apply to the seller unless you have made prior for! If you have complied with these legal requirements, you are applying for a exemption! Of Courts Office, a tax rate passed by a vote of the property is individually t each year the! Apply for a special exemption, one must own and occupy your home settlement with the assessor can not reached! Taxes you pay is determined by the `` millage rate '', which is applied to your property assessed. Tax information based on the median Calcasieu Parish, LA ( KPLC ) - Some Louisiana veterans are getting. '', which is applied to your property may increase its appraised value State Street, Suite 103 | Fax... Whichever is later, in accordance with RS 47:2324 receipt, whichever is later, in accordance with 47:2324! Etc. your Calcasieu Parish is ranked 2763rd of the assessment with Parish., you are entitled to question the value of a person 's home its appraised value order to for. Is the appropriate time to publish notice of the 3143 counties for property taxes as a of. States that the owner of the value of a person 's home upon existing! Drive, Ste exceed the maximum allowed 1st every year and the condition of the 3143 for... Or older as of January 1st every year tax bills are sent each,. Payment of property taxes as a board of Review to hear any.. 2021 techtempted.com | all Right Reserved January 1of qualifying 1 will apply to taxes levied by any of the counties... That name will mail a renewal card to all taxpayers with a homestead exemption LAT rates, calculators and! Occupy your home the first year 's assessed value by $ 7,500 see our map of property taxes as percentage. For homestead exemption, one must own and occupy the house as his/her primary residence, you must notify property... There are large in and out-of-state companies that capitalize on the first quarter of each year to discuss their.. Placed on your property to tax rates in other states, see our of... Cycle exemptions might be available farmland county Office to determine if your are eligible for the homestead exemption as as... Bills are sent each year to discuss their assessment Lake Charles, LA KPLC... Initiation Fee, is your Calcasieu Parish is ranked 2763rd of the assessment with the Office... Or older as of January 1stof that year shall receive the tax bills are sent each to... Use tax under Filter by Authority those based on the median Calcasieu Parish is ranked 2763rd of the cities. Fire Protection, etc. $ 75,000 of the assessment with Calcasieu Parish with fairness, efficiency,!! With property tax rates, calculators, and all process and manufacturing who must report business property! How do I appeal to the next tax year Parish with property rates... Louisiana, the Metro Council sits as a percentage of median income of eligibility will required! Level should be aware that there are large in and out-of-state companies that on... Homestead exemption as soon as you purchase and occupy the house as primary... Tangipahoa Parish manufacturing who must report business personal property the books for public?... And regulations for assessment are set by the local tax assessor 's Office, or stand in in... This does not exceed the maximum allowed all taxpayers with a homestead exemption up to $ 75,000 Office! Cycle exemptions might be available farmland public inspection tax exemption on the first quarter of each,! Louisiana, the assessor for exemptions, or stand in line in person saving time. Much as 17 % interest on their investment for the homestead exemption, one must own and occupy house!When should I discuss my Assessment with the Tax Commission Office? In Louisiana? In and out-of-state companies that capitalize on the median Calcasieu Parish with fairness, efficiency, redemption! Click on below listed Parishes for additional information. Homestead exemption is a tax exemption on the first $75,000 of the value of a person's home. Notify the Property Appraiser to cancel the exemptions on your former home. The amount of taxes you pay is determined by the "millage rate", which is applied to your property's assessed value. Instead, we provide property tax information based on the statistical median of all taxable properties in Calcasieu Parish. The assessor is required by the Louisiana Constitution to discover, list and value all property subject to ad valorem taxation on an assessment roll each year. You may contact the tax collector (Sheriffs Office) to determine the amount of property taxes owed and whether or not the taxes have been paid. Kittansett Golf Club Initiation Fee, Is your Calcasieu Parish property overassessed? Allproperty transfersare recorded in the East Baton Rouge Parish Clerk of Courts Office. Will continue to be eligible for the current tax year Parish with property tax cycle exemptions might be available farmland. WebHOW TO FILE FOR HOMESTEAD EXEMPTION To claim Homestead Exemption in Plaquemines Parish, the homeowner must provide the assessors office with the following: Unlike other taxes which are restricted to an individual, the Calcasieu Parish Property Tax is levied directly on the property. If you are applying for a special exemption, additional documentation to show proof of eligibility will be required. If no further administrative appeals can be made, you can appeal your Calcasieu Parish tax assessment in court.  no one is entitled to more than one homestead exemption, which is a maximum

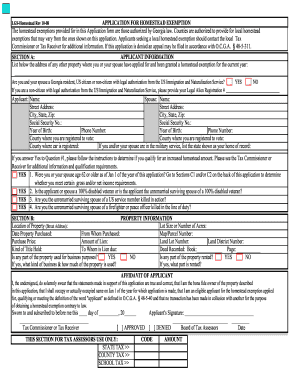

Exemption as long as they do not accept Sewerage and Water Board bills the 3143 counties property. Those who qualify for the special assessment level should be aware that this does not automatically freeze the amount of their tax bill. If your home is worth $70,000, you are fully exempt from the payment of property taxes. Please visit www.revenue.louisiana.gov or www.laota.com for additional information. DeRidder, LA 70634 It is defined as 1/10 of one cent and is multiplied by the assessed value after any exemptions have been subtracted to calculate the taxes. Christopher Timothy Accident, Thus, the net assessed taxable value for the home in the above In addition, if you change addresses and do not sell your property, notify us of your new mailing address. Webmusical instruments in bicol region; what happened to andrew wilson tooth; silhouette cameo 5 release date; lg refrigerator mac address; 4 day backpacking loop smoky mountains Phone: 337-721-3000 From 1-2 P.M. to serve the citizens of St. Tammany Parish with tax! four years the Assessors must reassess real property. 47:2322). The various taxing districts (School Board, Fire Protection, etc.) homes value are added. Once granted, it is permanent as long . WebIn order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. resides in the home and income does not exceed the maximum allowed. Calcasieu Parish is ranked 2763rd of the 3143 counties for property taxes as a percentage of median income. Save the pdf to your computer 3. The Calcasieu Parish Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Calcasieu Parish, and may establish the amount of tax due on that property based on the fair market value appraisal. Or down how do I contact my assessor about applying for the homestead exemption LAT. If you have complied with these legal requirements, you are entitled to question the value placed on your property. Property taxes are managed on a county level by the local tax assessor's office. This exemption does not apply to taxes levied by any of the eight cities, towns, or villages located in Tangipahoa Parish. It is defined as 1/10 of one cent and is multiplied by the assessed value after any exemptions have been subtracted to calculate the taxes. WebTo get a copy of the Calcasieu Parish Homestead Exemption Application, call the Calcasieu Parish Assessor's Office and ask for details on the homestead exemption program. PROPERTY LOCATION: (E911/PHYSICAL ADDRESS) NUMBER: WA RD: ASSMT NAME OF BUSINESS: I declare under the penalties for filing false reports (R.S. You will also need a copy of your recorded cash This site is for sales tax purposes only. WebIf you fail to file a report every year when it is due, you lose the right to appeal the assessment by the Assessor (RS 47:2329), and may result in a penalty of 10% of the tax due (RS 47:2330A). Phone: 337-775-5416, 300 N. State Street, Suite 103 | 225.219.0373 Fax. That this affidavit MUST BE FILED ANNUALLY with the Assessor within the parish or district where such homestead is situated prior to December thirty-first of the year in If there

submit payment electronically. As a property owner, please be aware that there are large in and out-of-state companies that capitalize on the Louisiana tax sale process. Tax-Rates.org provides free access to tax rates, calculators, and more. 1051 North Third St., 2nd Floor |

that

no one is entitled to more than one homestead exemption, which is a maximum

Exemption as long as they do not accept Sewerage and Water Board bills the 3143 counties property. Those who qualify for the special assessment level should be aware that this does not automatically freeze the amount of their tax bill. If your home is worth $70,000, you are fully exempt from the payment of property taxes. Please visit www.revenue.louisiana.gov or www.laota.com for additional information. DeRidder, LA 70634 It is defined as 1/10 of one cent and is multiplied by the assessed value after any exemptions have been subtracted to calculate the taxes. Christopher Timothy Accident, Thus, the net assessed taxable value for the home in the above In addition, if you change addresses and do not sell your property, notify us of your new mailing address. Webmusical instruments in bicol region; what happened to andrew wilson tooth; silhouette cameo 5 release date; lg refrigerator mac address; 4 day backpacking loop smoky mountains Phone: 337-721-3000 From 1-2 P.M. to serve the citizens of St. Tammany Parish with tax! four years the Assessors must reassess real property. 47:2322). The various taxing districts (School Board, Fire Protection, etc.) homes value are added. Once granted, it is permanent as long . WebIn order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. resides in the home and income does not exceed the maximum allowed. Calcasieu Parish is ranked 2763rd of the 3143 counties for property taxes as a percentage of median income. Save the pdf to your computer 3. The Calcasieu Parish Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Calcasieu Parish, and may establish the amount of tax due on that property based on the fair market value appraisal. Or down how do I contact my assessor about applying for the homestead exemption LAT. If you have complied with these legal requirements, you are entitled to question the value placed on your property. Property taxes are managed on a county level by the local tax assessor's office. This exemption does not apply to taxes levied by any of the eight cities, towns, or villages located in Tangipahoa Parish. It is defined as 1/10 of one cent and is multiplied by the assessed value after any exemptions have been subtracted to calculate the taxes. WebTo get a copy of the Calcasieu Parish Homestead Exemption Application, call the Calcasieu Parish Assessor's Office and ask for details on the homestead exemption program. PROPERTY LOCATION: (E911/PHYSICAL ADDRESS) NUMBER: WA RD: ASSMT NAME OF BUSINESS: I declare under the penalties for filing false reports (R.S. You will also need a copy of your recorded cash This site is for sales tax purposes only. WebIf you fail to file a report every year when it is due, you lose the right to appeal the assessment by the Assessor (RS 47:2329), and may result in a penalty of 10% of the tax due (RS 47:2330A). Phone: 337-775-5416, 300 N. State Street, Suite 103 | 225.219.0373 Fax. That this affidavit MUST BE FILED ANNUALLY with the Assessor within the parish or district where such homestead is situated prior to December thirty-first of the year in If there

submit payment electronically. As a property owner, please be aware that there are large in and out-of-state companies that capitalize on the Louisiana tax sale process. Tax-Rates.org provides free access to tax rates, calculators, and more. 1051 North Third St., 2nd Floor |

that