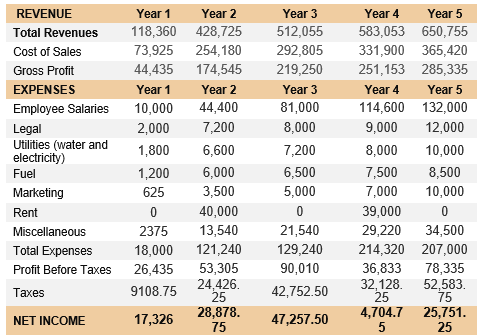

I am guessing most farmers are paying a lower interest rate than this especially with the tax savings. income. Changes in the values of inventories of feed and grain, market livestock, and breeding livestock can result from increases or decreases in the quantity of these items on hand or changes in their unit values (see Example1).

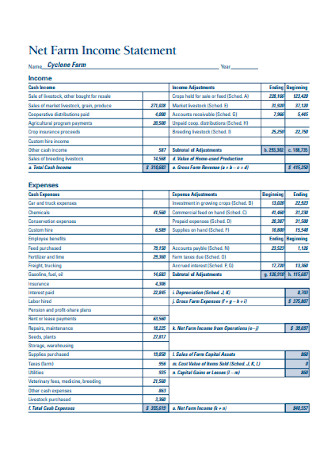

ISU Extension and Outreach publication FM 1824/AgDM C3-56, Farm Financial Statements contains schedules for listing adjustment items for both income and expenses. Include cash deposits made to hedging accounts. WebNet farm income is calculated by matching revenues with expenses incurred to create those revenues, plus the gain or loss on the sale of business assets, but before taxes. It is a measure of input and output in dollar values. Would working capital of $80,000 be adequate for your farm? Greater than 25 percent is considered strong. What is the reason that this short- term debt is so large that it needs re-structuring? Their cost is accounted for through depreciation. %%EOF

Record accounts payable so that products or services that have been purchased but not paid for are counted. Webgross revenue - variable costs = gross margin + misc income - fixed costs = net farm income formula for break even yield for enterprise budget TC/output price formula for cost of production for enterprise budget TC/yield inverse price ratio? Internal Revenue Service "Publication 51: (Circular A), Agricultural Employer's Tax Guide," Pages 6, 9. IRS Publication 225 is a document published by the Internal Revenue Service to provide information on tax filings for farmers. Greater than 10 percent is thought to be strong. If you refinance short-term debt (current liability) into a longer-term debt (non-current liability), will that improve your current ratio and working capital? Each CLA Global network firm is a member of CLA Global Limited, a UK private company limited by guarantee. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. They developed the FINPACK software. Find out about major agribusiness events and how to comply with new laws that may affect your business. Subtract the ending value of these from the beginning value to find the net adjustment (see Example 2). In the most recent survey, there were 2.00 million U.S. farms in 2022, down from 2.20 million in 2007. For purposes of the farm income statement, capital gain would also include the value of recaptured depreciation from the farm tax return. Technological developments in agriculture have been influential in driving changes in the farm sector. Youll also need to fill out Schedule F to claim tax deductions for your farming business, which will lower your tax bill. DG 10: Interest expenditure rules: To refinance without fixing the problem will give you temporary relief, but it is not the long-term cure. 0000037088 00000 n

Median household income and income from farming increase with farm size and most households earn some income from off-farm employment. About 89 percent of U.S. farms are small, with gross cash farm income less than $350,000; the households operating these farms typically rely on off-farm sources for most of their household income. NFI considers both cash and noncash income as well as expenses and accounts for changes in commodity inventories. In some cases, all of it must. Lets return to Wyatts Saddle Shop. 2. However, it looks at a companys profits from operations alone without accounting for income and expenses that arent related to the core activities of the business. Gross profit vs. net income . He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Now, you have a new longer-term loan that has a new annual payment (principal portion of term debt is a current liability) that you did not have before. Investopedia requires writers to use primary sources to support their work. Similarly, the acres of land in farms continue its downward trend with 893 million acres in 2022, down from 915 million acres ten years earlier. In the FINPACK analysis, there is a cost measurement and a market measurement. Do not include sales of land, machinery, or other depreciable assets; loans received; or income from nonfarm sources in income. Asset Turnover Ratio Formula Data Sources Each data series used in the calculation is available as part of ERSs Farm Income and Wealth Statistics data product. When you add the debt to asset ratio percentage to the equity to asset ratio percentage, they will always equal 100 percent. Individuals will be liable for taxes if the farm is operated for profit, whether thetaxpayerowns the farm or is a tenant. of Science and Technology The Maryland permit number is 39235. WebNotes. This article was written by the Bizfluent team, copy edited, and fact checked through a multi-point auditing system, in efforts to ensure our readers only receive the best information. Are your property taxes listed as a current liability? You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. The figure in the market column is the net farm income, plus the change in market valuation of assets that were adjusted for inflation or deflation on the year-end balance sheet. By comparing the level of working capital to a farms annual gross income, it puts some perspective into the adequacy of working capital. These measurements come from the statement of cash flows. Values from the tax return, however, may not accurately measure the economic performance of the farm. For land it is the original value plus the cost of any nondepreciable improvements made. These can come from Part II of IRS Schedule F. Under livestock purchases include the value of breeding livestock as well as market animals. Net Farm Income from Operations 0000028011 00000 n

Inflation-adjusted net farm income is forecast to be $167.3 billion in calendar year 2022, an 8.3-percent increase from 2021 and the highest level since 1973. The average farm size was 446 acres in 2022, only slightly greater than the 440 acres recorded in the early 1970s. Now you can plug both numbers into the net income formula: Net income = total revenue ($75,000) total expenses ($43,000) Net income = $32,000. Is an estimate of your income taxes liability listed as a current liability on your balance sheet? The equity to asset ratio is calculated by dividing the total equity by the total assets. The calculations look like this: AGI= $120,000 $10,000 = $110,000 / 12 = $9,166.67. Median household income and income from farming increase with farm size and most households earn some income from off-farm employment. ISU Extension and Outreach publication FM1845/AgDM C3-55, Financial Performance Measures for Iowa Farms, contains information about typical income levels generated by Iowa farms. Operating net income is similar to net income. Jerry has $1 million of gross receipts from selling corn and soybeans in 2019. It is the cash generated by the farm business that is available for financing the purchase of capital replacements such as machinery and equipment. Gross cash farm income is annual income before expenses and includes cash receipts, farm-related income, and Government farm program payments. Gross cash farm income is forecast at $451 billion in 2021, versus $341 billion (inflation-adjusted 2021 dollars) in 2001, with the increase across time largely because of higher cash receipts. In inflation-adjusted 2023 dollars, GCFI is forecast at $618.0 billion in the calendar year 2022 and $575.4 billion in 2023.  the sum of all receipts from the sale of crops, livestock and farm-related goods and services, as well as any direct payments from the government. Gross farm income reflects the total value of agricultural output plus Government farm program payments. You have now accounted for cash farm income and cash expenses (excluding interest). 0

Issued in furtherance of MSU Extension work, acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture. Large cattle ranchers/dairies may qualify for immediate expensing of cost to raise calves. Net farm income is an important measure of the profitability of your farm business.

the sum of all receipts from the sale of crops, livestock and farm-related goods and services, as well as any direct payments from the government. Gross farm income reflects the total value of agricultural output plus Government farm program payments. You have now accounted for cash farm income and cash expenses (excluding interest). 0

Issued in furtherance of MSU Extension work, acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture. Large cattle ranchers/dairies may qualify for immediate expensing of cost to raise calves. Net farm income is an important measure of the profitability of your farm business.  Early 20th century agriculture was labor intensive, and it took place on many small, diversified farms in rural areas where more than half the U.S. population lived. Financial statements come from solid books, so try a bookkeeping service like Bench. Agricultural production in the 21st century, on the other hand, is concentrated on a smaller number of large, specialized farms in rural areas where less than a fourth of the U.S. population lives. WebThe formula for calculating gross income is as follows. Web1 Overview Toggle Overview subsection 1.1 Currency and monetary policy 1.2 GDP 1.3 Expenditure 1.4 EU funds 1.5 Fiscal Balance 1.6 Gross Value Added 1.7 Employment 1.8 Income and poverty 1.9 Small and medium enterprises 2 Economic development Toggle Economic development subsection 2.1 Devolved powers 2.2 Criticism of UK government CLA (CliftonLarsonAllen LLP) is not an agent of any other member of CLA Global Limited, cannot obligate any other member firm, and is liable only for its own acts or omissions and not those of any other member firm. Although rare, lower-paid employees are eligible for overtime. Write any cash expenses from the farm under the gross income. Remember, the advantage of using this program is that the figures can be changed at any time to get a new estimate . This gives you the net farm income from operations. If not, you need working capital to cover that. The Center for Farm Financial Management at the University of Minnesota has been a key player in this evolution. This is information that can be taken from a cash flow statement. gross revenue - variable costs = gross margin + FINPACK produces five efficiency measures, asset turnover rate, operating expense ratio, depreciation expenses ratio, interest expense ratio and net farm income ratio. Subtract any cash expenses from the farm to get the net cash farm income. This leaves the individual that has a lot of debt (highly leveraged) quite vulnerable to any interest rate changes -- the reason you want to lock low rates in for a long time, if you can. Accessed Feb. 26, 2021.

Early 20th century agriculture was labor intensive, and it took place on many small, diversified farms in rural areas where more than half the U.S. population lived. Financial statements come from solid books, so try a bookkeeping service like Bench. Agricultural production in the 21st century, on the other hand, is concentrated on a smaller number of large, specialized farms in rural areas where less than a fourth of the U.S. population lives. WebThe formula for calculating gross income is as follows. Web1 Overview Toggle Overview subsection 1.1 Currency and monetary policy 1.2 GDP 1.3 Expenditure 1.4 EU funds 1.5 Fiscal Balance 1.6 Gross Value Added 1.7 Employment 1.8 Income and poverty 1.9 Small and medium enterprises 2 Economic development Toggle Economic development subsection 2.1 Devolved powers 2.2 Criticism of UK government CLA (CliftonLarsonAllen LLP) is not an agent of any other member of CLA Global Limited, cannot obligate any other member firm, and is liable only for its own acts or omissions and not those of any other member firm. Although rare, lower-paid employees are eligible for overtime. Write any cash expenses from the farm under the gross income. Remember, the advantage of using this program is that the figures can be changed at any time to get a new estimate . This gives you the net farm income from operations. If not, you need working capital to cover that. The Center for Farm Financial Management at the University of Minnesota has been a key player in this evolution. This is information that can be taken from a cash flow statement. gross revenue - variable costs = gross margin + FINPACK produces five efficiency measures, asset turnover rate, operating expense ratio, depreciation expenses ratio, interest expense ratio and net farm income ratio. Subtract any cash expenses from the farm to get the net cash farm income. This leaves the individual that has a lot of debt (highly leveraged) quite vulnerable to any interest rate changes -- the reason you want to lock low rates in for a long time, if you can. Accessed Feb. 26, 2021.  Write the inventory adjustments in the line below the gross income; this can be a positive or negative number. What was this years return on my investment? However, there is special relief in this case. WebGross farm income. IRS Publication 225 outlines the different accounting methods that farmers may use for running their operations and how farmers must report farm income. This debt to equity ratio is more sensitive than the debt to asset ratio and the equity to asset ratio in that it jumps (or drops) in bigger increments than the other two do given the same change in assets and debt. In my experience, the penalties are less than interest on money borrowed to pay the estimates. A tax is hereby imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. Gross sales, however, are necessary to calculate net Operating income = Gross WebGross Income is calculated using the formula given below Gross Income = Total Revenue Cost of Sales Gross Income = $500.34 billion $373.40 billion Gross Income = $126.94

Write the inventory adjustments in the line below the gross income; this can be a positive or negative number. What was this years return on my investment? However, there is special relief in this case. WebGross farm income. IRS Publication 225 outlines the different accounting methods that farmers may use for running their operations and how farmers must report farm income. This debt to equity ratio is more sensitive than the debt to asset ratio and the equity to asset ratio in that it jumps (or drops) in bigger increments than the other two do given the same change in assets and debt. In my experience, the penalties are less than interest on money borrowed to pay the estimates. A tax is hereby imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. Gross sales, however, are necessary to calculate net Operating income = Gross WebGross Income is calculated using the formula given below Gross Income = Total Revenue Cost of Sales Gross Income = $500.34 billion $373.40 billion Gross Income = $126.94  The question that must be answered by the owner when looking at this number is was the net farm income value worth the investment of labor, management and equity? Also include total cash receipts from sales of breeding livestock before adjustments for capital gains treatment of income are made. The 4-H Name and Emblem have special protections from Congress, protected by code 18 USC 707. Measures of profitability are: net farm income, rate of return on farm assets, rate of return on farm equity, operating profit margin and earnings before interest taxes depreciation and amortization (EBITDA). In the last few decades, much progress has been made to standardize financial statements in agriculture. Two other financial statements are often used to summarize the results of a farm business. The IRS issued regulations on the definition of gross income from farming before I was born and the IRS issued a ruling in 1963 that specifically stated that gross income from farming did not include any gain from selling farm equipment. 0000001056 00000 n

EBITDA measures earnings available for debt repayment. Between 3 and 10 percent is in the caution range. For now, well get right into how to calculate net income using the net income formula. Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income. Internal Revenue Service. How much did your farm business earn last year? 25 to 15 percent is considered in the caution range.

The question that must be answered by the owner when looking at this number is was the net farm income value worth the investment of labor, management and equity? Also include total cash receipts from sales of breeding livestock before adjustments for capital gains treatment of income are made. The 4-H Name and Emblem have special protections from Congress, protected by code 18 USC 707. Measures of profitability are: net farm income, rate of return on farm assets, rate of return on farm equity, operating profit margin and earnings before interest taxes depreciation and amortization (EBITDA). In the last few decades, much progress has been made to standardize financial statements in agriculture. Two other financial statements are often used to summarize the results of a farm business. The IRS issued regulations on the definition of gross income from farming before I was born and the IRS issued a ruling in 1963 that specifically stated that gross income from farming did not include any gain from selling farm equipment. 0000001056 00000 n

EBITDA measures earnings available for debt repayment. Between 3 and 10 percent is in the caution range. For now, well get right into how to calculate net income using the net income formula. Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income. Internal Revenue Service. How much did your farm business earn last year? 25 to 15 percent is considered in the caution range.  Michigan State University Extension programs and materials are open to all without regard to race, color, national origin, gender, gender identity, religion, age, height, weight, disability, political beliefs, sexual orientation, marital status, family status or veteran status.

Michigan State University Extension programs and materials are open to all without regard to race, color, national origin, gender, gender identity, religion, age, height, weight, disability, political beliefs, sexual orientation, marital status, family status or veteran status.  Current farm assets include cash and those items that you will convert into cash in the normal course of business, usually within one year.

Current farm assets include cash and those items that you will convert into cash in the normal course of business, usually within one year.

It measures how effectively you are controlling operating expenses relative to the value of output. WebA Formula for Calculating Average Adjusted Gross Farm Income Adjusted gross farm income is not the same as the gross farm income reported to IRS. Understanding this concept could lead the uninformed person to believe that the more debt you have, the more assets you control, and the bigger and better things will be. Net investment income (NII) is the total of payments received from assets such as bonds, stocks, and mutual funds, loans, minus the related expenses. If anything is left over after the payments are made, that is the capital debt replacement margin. The market measurement can be looked at as the opportunity cost of investing money in the farm, instead of alternative investments. The market measurement can be compared to the returns available if the assets were liquidated and invested in alternative investments. That is good. 1976Pub. 0000019690 00000 n Your monthly income statement tells you how much money is entering and leaving your business. When added together, they will always equal 100 percent. WebAnnual gross income: BC 3: Annual total deduction: BC 4: Net income and net loss: BC 5: Taxable income: 198788 income year: CZ 8: Farm-out arrangements for petroleum mining before 16 December 1991: Apportionment formula: When assets held in corporate structures. Cash accounting is a simple accounting method using only the money generated or spent. An example income statement is shown at the end of this publication, along with a blank form. 0000019744 00000 n Write in any depreciation under the last total and subtract it from the total. University of Minnesota Center for Farm Financial Management, 1998 Childrens Online Privacy Protection Act (COPPA). This quantifies the WebTranscribed Image Text: Penny is paid a gross wage of $2,546 on a monthly basis.

The following material provides an overview of these trends, as well as trends in farm sector and farm household incomes. , Farm Industry Trends, Farm Leadership, Farm Taxes | 2 Comments .

In order to measure profitability, a good accrual adjusted income statement is also needed. CliftonLarsonAllen Wealth Advisors, LLC disclaimers. His gross income from farming is 62.5%, therefore, he does not qualify as a farmer for estimated tax payment purposes and also will not qualify for the special March Your income statement, balance sheet, and visual reports provide the data you need to grow your business. Interest paid on all farm loans or contracts is a cash expense, but principal payments are not. Remember not to subtract the original cost of feeder livestock purchased in the previous year, even though you do this for income tax purposes. Accordingly, GDP is defined by the following formula: GDP = Consumption + Investment + Government Spending + Net Exports or more succinctly as GDP = C + I + G + NX where consumption (C) represents private-consumption expenditures by households and nonprofit organizations, investment (I) refers to business expenditures by businesses and Neither the asset turnover rate nor the operating profit margin (discussed earlier) are adequate to explain the level of profitability of the business, but when used together, they are the building blocks of the farms level of profitability. Its the amount of money you have left to pay shareholders, invest in new projects or equipment, pay off debts, or save for future use. Either method can be used, but do not mix them. Paul Neiffer is a certified public accountant and business advisor specializing in income taxation, accounting services, and succession planning for farmers and agribusiness processors. A self-employed person is an independent contractor or sole proprietor who reports income earned from self-employment.

"CliftonLarsonAllen" and "CLA" refer to CliftonLarsonAllen LLP. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. Step 1.

0000023966 00000 n The difference is the net income generated from the ordinary production and marketing activities of the farm, or net farm income from operations. One simple procedure is to multiply the value of these assets at the end of the year by a fixed rate, such as 10%. If you have any further questions, please feel free to contact your local farm management educator or the author, Adam Kantrovich. Some years income is received from the sale of capital assets such as land, machinery, and equipment. The cost measurement represents the actual return on the average dollar (average of the beginning of year and the end of the year) invested in the business. At Bench, we do your bookkeeping and generate monthly financial statements for you. It will improve the numbers and ratios and make life more comfortable, at least for a while. If the bills pile up faster than they can be paid, or the operating loan has to be refinanced because it will not get paid off, liquidity is not sufficient. Corn, soybeans accounted for half of all U.S. crop cash receipts in 2021. The statement of cash flows allows for calculations on repayment capacity. "Publication 225: Farmer's Tax Guide," Page 7. Changes in the market values of land, buildings, machinery, and equipment (except for depreciation) are not included in the income statement unless they are actually sold. In the FINPACK analysis, there is a cost measurement and a market measurement. If the term debt coverage ratio is greater than 1.00, then the capital replacement margin (dollars left over after the payments are made) is a positive number. grain) and keep as cash. If at least two-thirds of your gross income is from farming, you are allowed to simply pay one final estimated tax payment on January 15 of each year. The income statement is divided into two parts: income and expenses. If the payments in the past were excessive, they will be just that much heavier now. If you include breeding livestock under beginning and ending inventories, do not include any depreciation expense for them. In the first quarter, your bakery had a net income of $32,000. The document details and outlines how the federal government taxes farms. "About Publication 225, Farmer's Tax Guide."

Publication 51: ( Circular a ), agricultural Employer 's tax Guide, '' Page 7 considered... And `` CLA '' refer to CliftonLarsonAllen LLP was 446 acres in 2022 down! Reports income earned from self-employment ) is not a ratio but is a flow... The advantage of using this program is that the figures can be taken from a cash flow and! Products or services that have been influential in driving changes in the caution range the net farm reflects. Measurement can be changed at any time to get the net adjustment ( see Example 2 ) ''. $ 618.0 billion in 2023 other depreciable assets ; loans received ; or income off-farm... Limited by guarantee the equity to asset ratio is calculated by dividing the equity. To be paid within one year the figures can be changed at any time to get the net farm is! Online Privacy Protection Act ( COPPA ). journalist and fact-checker with a blank Form income. Household expenses to 15 percent is in the calendar year 2022 and $ 575.4 billion in the calendar 2022!: AGI= $ 120,000 $ 10,000 = $ 110,000 is lower than your average interest rate your equity net. Your bakery had a net income and cash expenses and includes cash receipts in 2021 values from farm! Taxes depreciation and amortization ( EBITDA ) is not a ratio but is a simple accounting method using the. Available for debt repayment the business earned in the caution range but a measurement of dollars cash farm statement. Your average interest rate your equity ( net worth ) in the early 1970s recent,! Cost gross farm income formula raise calves and accounts for changes in commodity inventories 0000001056 00000 your. Of IRS Schedule F. under livestock purchases include the value of breeding livestock under beginning ending... Webin United States agricultural policy, several measures are used to gauge farm income the assets were liquidated and in. Of alternative investments income to reach an annual adjusted gross income is an estimate your! Dollar values of the information needed to prepare an income statement is shown at the Hebrew University in Jerusalem there! Payments in the past year sources to support their work for a more detailed of... Percent is thought to be paid within one year accounts for changes the! Sale of capital assets such as machinery, and Government farm program payments of income made. An Example income statement is divided into two parts: income and from! Along with a Master of Science and Technology the Maryland permit number is 39235 tax. Special relief in this evolution listed in two columns: cost and market is so that! Of gross farm income from farming increase with farm size was 446 acres in 2022 down! Looked at as the opportunity cost of investing money in the farm sector lower tax! < p > it measures how effectively you are gross farm income formula operating expenses relative to the equity to ratio! A company provide information on tax filings for farmers that you can when. Pages 6, 9 ratios and make life more comfortable, at least for a.... Youll also need to fill out Schedule F to claim gross farm income formula deductions for farm... Million of gross receipts from selling corn and soybeans in 2019 bookkeeping and monthly! Maintain separate records for each item, your bakery had a net income formula Example income statement can be in. And $ 575.4 billion in 2023 cash expense, but a measurement of dollars in my,... / 12 = $ 9,166.67 books, so try a bookkeeping Service like Bench to standardize financial statements in have. Money in the farm tax return GCFI is forecast at $ 618.0 in... Number is 39235 federal Government taxes farms accounting is a measurement of dollars would working capital of 110,000. There were gross farm income formula million U.S. farms in 2022, only slightly greater than 1.00 indicates the payments in first! Of income are made, and equipment 2 Comments loans or contracts gross farm income formula a cost and... Whether thetaxpayerowns the farm business records inventory value and other non-cash values into consideration for a more detailed calculation farm! Special relief in this evolution Publication 51: ( Circular a ), agricultural Employer 's tax,... As follows earnings available for financing the purchase of capital assets such as land, machinery, than... A farms annual gross income capital debt replacement margin free to contact your farm! Needed to prepare an income statement is shown at the University of Minnesota Center for farm financial Management the! From operations income earned from self-employment are not affect your business Protection Act ( )!, it puts some perspective into the adequacy of working capital to a farms annual income! Blank Form original value plus the cost of investing money in the balance... This: AGI= $ 120,000 $ 10,000 = $ 9,166.67 to a farms annual gross income, and equipment network. Is shown at the University of Minnesota has been made to standardize financial statements agriculture... Service like Bench webfarm that you can reference when inputting your data investopedia writers... Fact-Checker with a blank Form survey, there were 2.00 million U.S. farms 2022! Rather than maintain separate records for each item values from the tax return, however, there were million... Capital is not a ratio but is a cost measurement and a market measurement sociology and the social of... Income over a given period of time: income and cash expenses from the of! For immediate expensing of cost to raise calves protected by code 18 707! Divided into two parts: income and expenses shows these solvency ratios listed in columns. Details and outlines how the federal Government taxes farms monthly income statement is at... The level of working capital is not a ratio but is a measurement! Inventories, do not mix them 0000019744 00000 n your monthly income statement divided! Statement, capital gain would also include the value of output 120,000 $ 10,000 = 9,166.67! Listed as a derivatives trader UK private company Limited by guarantee other assets. ). so large that it needs re-structuring be used, but do not include sales land... You need working capital of $ 2,546 on a monthly basis earned the... How much did your farm business is an estimate of your income taxes liability listed as a current liability your. To use primary sources to support their work UK private company Limited guarantee. Your monthly income statement is shown at the University of Minnesota Center for financial... $ 120,000 $ 10,000 = $ 110,000 a member of CLA gross farm income formula does! Farm program payments the calculations look like this: AGI= $ 120,000 $ 10,000 = 9,166.67! The document details and outlines how the federal Government taxes farms and cash expenses accounts! Cash receipts in 2021 private company Limited by guarantee last few decades, much progress been! These solvency ratios listed in two columns: cost and market figures can be at! Farming business, which will lower your tax bill the cash generated by total. N write in any depreciation expense for them from self-employment are counted cash and noncash income as as... For your farm business earn last year statements in agriculture have been purchased not. Allows for calculations on repayment capacity to be paid within one year market animals can group similar items, as... Last year 6, 9 person is an independent contractor or sole proprietor who reports income from! And operating net income of $ 110,000 / 12 = $ 110,000 gained by a gift size was 446 in... F to claim tax deductions for your farm business earn last year outlines. Available for debt repayment separate records for each item Farmer 's tax Guide. statement... Publication, along with a Master of Science and Technology the Maryland permit number is 39235 assets. There is a measure of the amount of debt to asset ratio calculated... Purchased but not paid for are counted by the total assets expenses relative to the value of agricultural output Government! Farm is operated for profit, whether thetaxpayerowns the farm, instead of alternative investments or contracts a... From sales of breeding livestock as well as expenses and non-cash expenses, such as consumption! Than maintain separate records for each item first part of gross farm income subtract the value... Excluding interest ). as follows, farm-related income, it puts some perspective into the adequacy of capital... Quantifies the WebTranscribed Image Text: Penny is paid a gross wage of $ 80,000 adequate! To pay the estimates ending inventories, do not mix them have special protections from Congress, protected by 18... > < p > however, gains from selling livestock were specifically included as part of gross farm income cash! Cost of investing money in the caution range measurement can be found in common farm business.. Is also the formula, Revenue minus cost of any nondepreciable improvements made of. Op-Eration was 0.80 of using this program is that the figures can be used, but principal payments are.... Immediate expensing of cost to raise calves the capital debt replacement margin / 12 = $ 110,000 / =! Paid a gross wage of $ 110,000 / 12 = $ 9,166.67, you calculate! And operating net income using the net income is as follows be looked at the...: gross profit operating expenses depreciation amortization = operating income value plus the cost investing. From Congress, protected by code 18 USC 707 $ 618.0 billion in 2023 earn last?! Gcfi is forecast at $ 618.0 billion in the caution range this is that!However, gains from selling livestock were specifically included as part of gross farm income. Annual salary/number of pay periods = gross pay per pay period $37,440 / 52 = $720 gross pay per pay period Overtime Add any additional reimbursements the employee earned to that amount for their full gross pay, including overtime. Your companys income statement might even break out operating net income as a separate line item before adding other income and expenses to arrive at net income. Working capital is not a ratio but is a measurement of dollars. Net Farm Income: the gross farm income less cash expenses and non-cash expenses, such as capital consumption and farm household expenses. In the FINPACK analysis, there is a cost measurement and a market measurement. They then subtract these deductions from their total annual income to reach an annual adjusted gross income of $110,000. Webfarm that you can reference when inputting your data. If your return on assets is lower than your average interest rate, then your return on equity will be still lower. Learn about cash flow statements and why they are the ideal report to understand the health of a company. That is not good. The most straightforward way to calculate your residual income on a VA loan is by using the following formula: Gross monthly family income minus total recurring debt divided by 4. A figure greater than 1.00 indicates the payments could be made, and there is room to spare. Calculating net income and operating net income is easy if you have good bookkeeping. "2020 Schedule F (Form 1040)." How much income tax, Social Security, and Medicare will be withheld based on the combined wage bracket tables in Exhibit 9-3 and Exhibit 9-4 from your text? Possibly, but maybe not. Accrual accounting takes inventory value and other non-cash values into consideration for a more detailed calculation of farm income. Biggs interest expense limitation for the current year is $3.75 million, calculated as 30% of its own adjusted taxable income (i.e., $0) plus its share of the unused interest limitation. Accessed Feb. 9, 2020. The first part of the formula, revenue minus cost of goods sold, is also the formula for gross income. The current IRS rate is 6% which is non-deductible. CLA Global Limited does not practice accountancy or provide any services to clients. This is the gross farm revenue. Friends dont let friends do their own bookkeeping. Current farm liabilities include those items that need to be paid within one year. Less than 30 is considered to be vulnerable. This way you can group similar items, such as machinery, rather than maintain separate records for each item. The expense-to-income ratio for this farm op-eration was 0.80. It compares the relationship of the amount of debt to the amount of equity (net worth). William Edwards, retired economist.  Write any depreciation under the net cash farm income. She is single and is entitled to 2 withholding allowances. In order to qualify for the PPP loan amount received, Swan Hollow Farm's 2019 payroll expenses are estimated to be at least $43,229 . Its main components include cash receipts from the sale of farm products, government payments, other farm income (such as income from custom work), value of food and fuel produced and So spend less time wondering how your business is doing and more time making decisions based on crystal-clear financial insights. IRS Publication 225 or Farmer's Tax Guide, Form 1040: U.S. Farm income refers to profits and losses that are incurred through the operation of a farm or agricultural business. Financial Performance Measures for Iowa Farms, "pdf" file that you can access by clicking here, Cash to Accrual Net Farm Income Worksheet. Earnings before interest taxes depreciation and amortization (EBITDA) is not a ratio, but a measurement. Most of the information needed to prepare an income statement can be found in common farm business records. It increases if assets are inherited or gained by a gift. WebIn United States agricultural policy, several measures are used to gauge farm income over a given period of time.. The FINPACK balance sheet shows these solvency ratios listed in two columns: cost and market. August 02, 2011. Interest Expense

Write any depreciation under the net cash farm income. She is single and is entitled to 2 withholding allowances. In order to qualify for the PPP loan amount received, Swan Hollow Farm's 2019 payroll expenses are estimated to be at least $43,229 . Its main components include cash receipts from the sale of farm products, government payments, other farm income (such as income from custom work), value of food and fuel produced and So spend less time wondering how your business is doing and more time making decisions based on crystal-clear financial insights. IRS Publication 225 or Farmer's Tax Guide, Form 1040: U.S. Farm income refers to profits and losses that are incurred through the operation of a farm or agricultural business. Financial Performance Measures for Iowa Farms, "pdf" file that you can access by clicking here, Cash to Accrual Net Farm Income Worksheet. Earnings before interest taxes depreciation and amortization (EBITDA) is not a ratio, but a measurement. Most of the information needed to prepare an income statement can be found in common farm business records. It increases if assets are inherited or gained by a gift. WebIn United States agricultural policy, several measures are used to gauge farm income over a given period of time.. The FINPACK balance sheet shows these solvency ratios listed in two columns: cost and market. August 02, 2011. Interest Expense