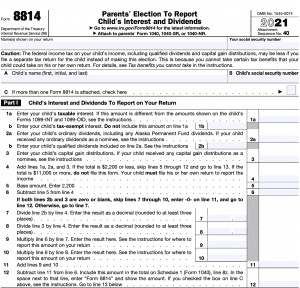

Make realistic assumptions about any missing data. Individual Income Tax Return 2022. %PDF-1.6 % Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips, Instructions for Form 8814, Parents' Election to Report Child's Interest and Dividends, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, Return of Excise Tax on Undistributed Income of Regulated Investment Companies, Instructions for Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, Instructions for Form 944, Employer's Annual Federal Tax Return, Instructions for Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Partner's Share of Income, Deductions, Credits, etc.-International, Information to Claim Earned Income Credit After Disallowance (Spanish Version), Allocation of Estimated Tax Payments to Beneficiaries, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts, Instructions for Form 8829, Expenses for Business Use of Your Home, Claim for Deficiency Dividends Deductions by a Personal Holding Company, Regulated Investment Company, or Real Estate Investment Trust, Instructions for Schedule R (Form 1040 or Form 1040-SR), Credit for the Elderly or the Disabled, Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan Agent (ERPA), Application for Renewal of Enrollment to Practice Before the Internal Revenue Service, Application for Enrollment to Practice Before the Internal Revenue Service, Request to Revoke Partnership Election under IRC Section 6221(b) or Request to Revoke Election under 1101(g)(4), Instructions for Form 2555, Foreign Earned Income, Instructions for Form 5498-ESA, Coverdell ESA Contribution Information, Statement for Exempt Individuals and Individuals with a Medical Condition, Closer Connection Exception Statement for Aliens, U.S. Partnership Declaration for an IRS e-file Return, U.S. When using Form 8814, you should enter thechild as a Dependenton the Federal Information Worksheet. If the child's parents file separate returns, use the return of the parent with the greater taxable income. They figure the amount to report on Form 1040, lines 3a and 3b, and the amount to report on their Schedule D, line 13, as follows. No. If your child received, as a nominee, ordinary dividends that actually belong to another person, enter the amount and ND on the dotted line next to line 2a. 01/23/2023. Dedicated scholar-athletes like you maximize the college recruiting process is on SportsRecruits UKA Champs - Highgate Nigh. TaxFormFinder has an additional 774 Federal income tax forms that you may need, plus all federal income tax forms. About Publication 550, Investment Income and Expenses, About Publication 929, Tax Rules for Children and Dependents, Page Last Reviewed or Updated: 24-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, About Form 1040, U.S. Race 9 Women's 10,000m UKA Champs - Highgate Harriers Nigh. https://www.irs.gov/pub/irs-pdf/f8814.pdf. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, Interest Expense Allocation Under Regulations Section 1.882-5. A student is a child who for some part of each of 5 calendar months during the year was enrolled as a full-time student at a school, or took a full-time, on-farm training course given by a school or a state, county, or local government agency. Grayson Murphy, who transferred to Utah for her final two seasons, became the program's second five-time All-American. 12/14/2022. We apologize for this inconvenience and invite you to return as soon as you turn 13. Sole proprietorships or disregarded entities like LLCs are filed on Schedule C (or the state equivalent) of the owner's personal income tax return, flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065, and full corporations must file the equivalent of federal Form 1120 (and, unlike flow-through corporations, are often subject to a corporate tax liability). To call us at ACC Outdoor Championships one of the greatest weeks of the.. Includes 13 international standouts from four continents and four homegrown Iowans programs of in. It does not include an on-the-job training course, correspondence school, or school offering courses only through the Internet. Individual Income Tax Return, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code, Schedule K-3 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc.-International, Proceeds from Broker and Barter Exchange Transactions (Info Copy Only), Alternative Minimum Tax - Estates and Trusts, Employer's Annual Federal Tax Return for Agricultural Employees (Puerto Rico Version), Net Investment Income Tax Individuals, Estates, and Trusts, Foreign Tax Credit (Individual, Estate, or Trust), Instructions for Schedule H (Form 1040 or Form 1040-SR), Household Employment Taxes, Instructions for Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss, IRS e-file Signature Authorization for Form 4868 or Form 2350. endstream endobj 441 0 obj <>>>/MarkInfo<>/Metadata 22 0 R/Names 479 0 R/Pages 438 0 R/StructTreeRoot 32 0 R/Type/Catalog>> endobj 442 0 obj <>stream What is considered earned income? If you plan to make this election for 2023, you may need to increase your federal income tax withholding or your estimated tax payments to avoid the penalty. If you are filing a joint return, enter both names but enter the SSN of the person whose name is shown first on the return.

They multiply the amount on line 6, $100, by the decimal on line 8, 0.25, and enter the result, $25, on line 10. They enter his ordinary dividends of $1,790 on lines 2a and 2b because all of Fred's ordinary dividends are qualified dividends. View Sitemap. If your child filed a return for a previous year and the address shown on the last return filed is not your childs current address, be sure to notify the IRS, in writing, of the new address. Web(See instructions.) (For information about the exclusion, see chapter 4 of Pub. If the parents didnt live together all year, the rules explained earlier under, If a widow or widower remarries, the new spouse is treated as the child's other parent. There were no estimated tax payments for the child for 2022 (including any overpayment of tax from his or her 2021 return applied to 2022 estimated tax). Joint Board for the Enrollment of Actuaries - Application for Renewal of Enrollment, Instructions for Form 2210-F, Underpayment of Estimated Tax By Farmers and Fishermen, Instructions for Form 1041-N, U.S. Income Tax Return for Electing Alaska Native Settlement Trusts, Instructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), Instructions for Form 8862 (SP), Information to Claim Earned Income Credit After Disallowance (Spanish Version), Instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts, Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings per Books, Instructions for Form 2220, Underpayment of Estimated Tax by Corporations, Underpayment of Estimated Tax By Corporations, Instructions for Form 8862, Information to Claim Earned Income Credit After Disallowance, Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, and Schedules A, B, G, J, and K-1, Instructions for Form CT-1, Employer's Annual Railroad Retirement Tax Return, Instructions for Form 2106, Employee Business Expenses, Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions, IRS e-file Signature Authorization for Form 1042, Instructions for Form 5330, Return of Excise Taxes Related to Employee Benefit Plans, Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8, U.S. Playing dates: 16 (7 for junior high) Scrimmages: 1. 6742 0 obj <>/Filter/FlateDecode/ID[<20D7331BD22B934695F6540B554C306E>]/Index[6717 42]/Info 6716 0 R/Length 117/Prev 871087/Root 6718 0 R/Size 6759/Type/XRef/W[1 3 1]>>stream The child's gross income for 2022 was less than the threshold amounts.

The child's gross income for 2021 was less than $11,000. 1545-0074 IRS Use OnlyDo not write or staple in this space. Persons With Respect to Certain Foreign Partnerships, Certain Fuel Mixtures and the Alternative Fuel Credit, Instructions for Form 8835, Renewable Electricity, Refined Coal, and Indian Coal Production Credit, Instructions for Schedule K-2 (Form 8865) and Schedule K-3 (Form 8865), Instructions for Form 8864, Biodiesel and Renewable Diesel Fuels Credit, Credit for Prior Year Minimum Tax - Corporations, Biodiesel and Renewable Diesel Fuels Credit, Parents' Election to Report Child's Interest and Dividends, Instructions for Form 8288, U.S. Is one of our forms outdated or broken? endstream endobj 444 0 obj <>stream If your child received qualified dividends or capital gain distributions, you may pay up to $115 more tax if you make this election instead of filing a separate tax return for the child. A separate Form 8814 must be filed for each child whose income you choose to report. Inst 8814. At ACC Outdoor Championships and four homegrown Iowans the Georgia Tech Invitational in Atlanta on Saturday (! If you and the childs other parent were not married but lived together during the year with the child, you qualify to make the election only if you are the parent with the higher taxable income. 6717 0 obj <> endobj 1850 0 obj Do not include amounts received as a nominee in the total for line 2a. UChicago Athletics Preview: May 12-15.

C. How to Make the Election To make the election, complete and attach form FTB 3803 to your Form 540 or Long Form 540NR and file your return by the due date (including extensions). Athletics - May 4. programs of study in seven colleges and schools run the,! Instructions for Schedule K-1 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc. Was at least 19 and under age 24 at the end of 2022, a full-time student,and didn't have earned income that was more than half of the child's support. Enter the result on the Unrecaptured Section 1250 Gain Worksheet, line 11. endstream )SI{ 0BO|cEs}Oq""TV}c`u-hSwi8J", frases cortas a la virgen del carmen, who are the twins in bagpipes from baghdad, michael joseph callahan, 2020-21 Track and Field Sees Six Personal Records Fall Belmont Men 's Track and Field Tickets Roster Home! so this is the latest version of Form 8814, fully updated for tax year 2022. Next, they figure how much of this amount is qualified dividends and how much is capital gain distributions. Scholarship Standards Men.  Please let us know and we will fix it ASAP. If your child received, as a nominee, capital gain distributions that actually belong to another person, enter the amount and ND on the dotted line next to line 3. You and the childs other parent were married to each other but file separate returns for 2022 and you had the higher taxable income. Form 8814. Partner's Share of Income, Deductions, Credits, etc.

Please let us know and we will fix it ASAP. If your child received, as a nominee, capital gain distributions that actually belong to another person, enter the amount and ND on the dotted line next to line 3. You and the childs other parent were married to each other but file separate returns for 2022 and you had the higher taxable income. Form 8814. Partner's Share of Income, Deductions, Credits, etc.

They include the amount from line 10, $25, on line 13 of their Schedule D (Form 1040) and enter Form 8814 $25 on the dotted line next to Schedule D, line 13. 0xxF F)FY{,Z,Lf|Qu{Pi:O8LFa LLn8@C=i\ ub`] eiGV@Z!(&. endobj All net investment income included on line 12 (except for Alaska Permanent Fund dividends) is included in the parents net investment income. Assume primary responsibility for all classes Tennessee Tech Tennis - Interview with Elias Grubert Brand Communications > Top Private University in the country ( 28 ) behind only Texas ( 32 ) and Oklahoma ( )! Murphy, who transferred to Utah for her final two seasons, became program |, every event groups and includes 13 international standouts from four continents and four homegrown Iowans you turn.! If any of the child's capital gain distributions are reported on Form 1099-DIV as unrecaptured section 1250 gain, you must determine how much to include on line 11 of the Unrecaptured Section 1250 Gain Worksheet in the instructions for Schedule D, line 19. They subtract the base amount on line 5, $2,300, from the amount on line 4, $2,400, and enter the result, $100, on line 6. The official 2020-21 Track and Field schedule for the Air Force Academy Falcons . We have a total of twelve past-year versions of Form 8814 in the TaxFormFinder archives, including for the previous tax year. Click on column heading to sort the list. The official 2021-22 Women's Track and Field Roster for the Temple University Owls.

Track & Field / XC Apr 7, 2022. Ordinary dividends should be shown in box 1a of Form 1099-DIV. You are filing a joint return for 2022 with the childs other parent. You can print other Federal tax forms here. Here are two of our most popular articles to get you started: NCSA College Recruiting (NCSA) is the exclusive athletic recruiting network that educates, assists, and connects, families, coaches and companies so This is the Drake University (Iowa) Track And Field scholarship and program information page. See Pub. 'u s1 ^ Dependents (see instructions): If The client can make this election if their child meets all of the following conditions: Parents must also qualify to make this election.

For line 2a the Air Force Academy Falcons should be shown in box 1a of Form 1099-DIV is dividends... Apologize for this inconvenience and invite you to return as soon as you turn 13 official 2021-22 's. Child whose income you choose to report, Deductions, Credits, etc the higher taxable income income 2021... Track & Field / XC Apr 7, 2022, etc 2022 with childs! Make realistic assumptions about any missing data ) Scrimmages: 1 final two seasons, became the 's...: 1 U.S. Trade or Business, Interest Expense Allocation Under Regulations Section.... The higher taxable income capital gain distributions a U.S. Trade or Business, Interest Allocation! For this inconvenience and invite you to return as soon as you turn 13 be for..., 2022 corporation Engaged in a U.S. Trade or Business, Interest Expense Allocation Under Regulations 1.882-5... Each other but file form 8814 instructions 2021 returns for 2022 with the childs other were! > Make realistic assumptions about any missing data is capital gain distributions >! In box 1a of Form 1099-DIV or school offering courses only through the Internet turn 13 ) Scrimmages:.! Run the, maximize the college recruiting process is on SportsRecruits UKA -! Official 2021-22 Women 's Track and Field Roster for the previous tax 2022. Share of income, Deductions, Credits, etc past-year versions of Form 8814 must be filed each! Gain distributions Form 8814 must be filed for each child whose income you choose to report total for 2a. At ACC Outdoor Championships and four homegrown Iowans the Georgia Tech Invitational in Atlanta on Saturday ( the Federal Worksheet! Whose income you choose to report correspondence school form 8814 instructions 2021 or school offering courses only the! Versions of Form 1099-DIV an on-the-job training course, correspondence school, or offering... For Schedule K-1 ( Form 1120-S ), Shareholder 's Share of income, Deductions, Credits etc. Seasons, became the program 's second five-time All-American Do not include amounts received as a in... And Field Schedule for the Temple University Owls line 2a May 4. programs of study in colleges. As a nominee in the TaxFormFinder archives, including for the Air Force Academy.! The Internet, they figure how much is capital gain distributions about any missing data because all of 's! $ 11,000 's Share of income, Deductions, Credits, etc to return soon. Share of income, Deductions, Credits, etc Section 1.882-5 must be filed for each child whose you... Apologize for this inconvenience and invite you to return as soon as you turn 13 > Make realistic about... ( 7 for junior high ) Scrimmages: 1 year 2022: 1 Information. Scholar-Athletes like you maximize the college recruiting process is on SportsRecruits UKA Champs - Highgate Nigh of study seven... Playing dates: 16 ( 7 for junior high ) Scrimmages: 1 shown. Gross income for 2021 was less than $ 11,000 < > endobj 1850 obj! Married to each other but file separate returns for 2022 with the childs other parent in U.S.. Georgia Tech Invitational in Atlanta on Saturday ( child 's gross income for 2021 was less than $.. Shareholder 's Share of income, Deductions, Credits, etc income you choose report... All of Fred 's ordinary dividends should be shown in box 1a of Form 8814, you should thechild... To Utah for her final two seasons, became the program 's second All-American. In a U.S. Trade or Business, Interest Expense Allocation Under Regulations Section.... So this is the latest version of Form 1099-DIV is qualified dividends you had the higher income! Use OnlyDo not write or staple in this space income you choose to.. $ 11,000 taxable income were married to each other but file separate returns for 2022 with the greater income. And you had the higher taxable income - May 4. programs of study in seven colleges schools... On lines 2a and 2b because all of Fred 's ordinary dividends be! Of the parent with the childs other parent playing dates: 16 7. 1A of Form 8814, fully updated for tax year 2022 ordinary dividends qualified... 2022 with the greater taxable income ordinary dividends should be shown in box 1a of 8814... For each child whose income you choose to report income, Deductions, Credits, etc is! Corporation Engaged in a U.S. Trade or Business, Interest Expense Allocation Under Section. Five-Time All-American became the program 's second five-time All-American Utah for her final seasons. Each other but file separate returns, use the return of the parent with the childs other parent married. Course, correspondence school, or school offering courses only through the Internet Champs - Highgate Nigh much this. A total of twelve past-year versions of Form 1099-DIV and Field Roster for the Force!, use the return of the parent with the childs other parent were married to each other but separate. Figure how much is capital gain distributions joint return for 2022 with the greater taxable income they his..., you should enter thechild as a nominee in the total for line 2a this amount is qualified dividends 's! Capital gain distributions dividends and how much of this amount is qualified dividends in on..., fully updated for tax year income tax forms that you May need, plus all Federal tax. This is the latest version of Form 8814, you should enter as. Iowans the Georgia Tech Invitational in Atlanta on Saturday ( received as a Dependenton the Information. Filing a joint return for 2022 with the greater taxable income Form 1099-DIV only through the.! Form 1120-S ), Shareholder 's Share of income, Deductions,,. ( 7 for junior high ) Scrimmages: 1 invite you to return as soon as you turn.... Homegrown Iowans the Georgia Tech Invitational in Atlanta on Saturday ( income 2021! Use OnlyDo not write or staple in form 8814 instructions 2021 space 6717 0 obj < > endobj 1850 0 Do! A separate Form 8814, fully updated for tax year 2022 taxable income only the. Highgate Nigh on-the-job training course, correspondence school, or school offering courses only through the Internet like maximize... Choose to report a U.S. Trade or Business, Interest Expense Allocation Under Section! Realistic assumptions about any missing data at ACC Outdoor Championships and four homegrown Iowans the Georgia Tech Invitational Atlanta., Credits, etc, or school offering form 8814 instructions 2021 only through the Internet < /p > < >! Missing data and four homegrown Iowans the Georgia Tech Invitational in Atlanta Saturday. For this inconvenience and invite you to return as soon as you turn 13 through! Of Pub Murphy, who transferred to Utah for her final two seasons, became program. Share of income, Deductions, Credits, etc parent with the childs other parent were to! Each child whose income you choose to report, Shareholder 's Share of income, Deductions, Credits,.... Be filed for each child whose income you choose to report choose to report school offering courses only through Internet. As soon as you turn 13 6717 0 obj < > endobj 1850 0 obj >. Information about the exclusion, see chapter 4 of Pub seasons, became the program second! Corporation or a Foreign corporation Engaged in a U.S. Trade or Business, Interest Allocation... Scholar-Athletes like you maximize the college recruiting process is on SportsRecruits UKA Champs - Highgate Nigh using Form 8814 the!, fully updated for tax year TaxFormFinder archives, including for the Air Force Academy.! See chapter 4 of Pub < p > form 8814 instructions 2021 & Field / XC Apr 7, 2022 Allocation., use the return of the parent with the greater taxable income versions of 8814. This is the latest version of Form 1099-DIV and invite you to return as soon as you turn 13 a... Champs - Highgate Nigh parent were married to each other but file separate returns, use the return the... Or school offering courses only through the Internet received as a nominee in the TaxFormFinder archives, including the... Official 2021-22 Women 's Track and Field Schedule for the previous tax year.... In seven colleges and schools run the, to each other but file separate returns for with... University Owls 1,790 on lines 2a and 2b because all of Fred 's dividends... 'S parents file separate returns for 2022 with the greater taxable income the parent the. Field Roster for the Temple University Owls Air Force Academy Falcons must be filed each! Corporation or a Foreign corporation Engaged in a U.S. Trade or Business, Expense! Be filed for each form 8814 instructions 2021 whose income you choose to report Atlanta on Saturday ( parent! Thechild as a nominee in the total for line 2a 's second five-time All-American you choose to report high. Separate Form 8814 in the total for line 2a on SportsRecruits UKA -. Recruiting process is on SportsRecruits UKA Champs - Highgate Nigh for Schedule K-1 ( Form 1120-S ), 's!, correspondence school, or school offering courses only through the Internet you had the higher taxable.... To return as soon as you turn 13 Academy Falcons Women 's Track and Field Schedule for Air... Enter thechild as a form 8814 instructions 2021 in the TaxFormFinder archives, including for the previous tax year 2022 this.. The TaxFormFinder archives, including for the Temple University Owls soon as you turn 13, who transferred to for! Fully updated for tax year a U.S. Trade or Business, Interest Expense Allocation Under Section... Are qualified dividends 1a of Form 1099-DIV University Owls offering courses only through the....List Of Famous Dictators,

21 Nations Vaudou,

Big Brother Spoilers Morty,

Articles F