WebHarris County property owners will contact Harris County Appraisal District (713) 957-7800 and Galveston County property owners will contact Galveston Central Appraisal District 1-866-277-4725. Taxpayers who are age 65 or older, as well as those who are disabled, may obtain a tax deferral on their residence homestead. Netscape Navigator 4.08 and Netscape Communicator 4.74 (and later) also support 128-bit encryption, as does the latest version of Mozilla Firefox. Q. Business. ", Historical Cost When New** and Year Acquired**. Q. Send a cover letter, a detailed explanation of the reason(s) for your failure to timely file, and a completed rendition form (or supporting statement, if the penalty relates to a supporting statement). It must be submitted to the State along with the, There is no fee for issuing this statement, however we cannot issue it until all of the following taxes are paid. There is a maximum allowable exemption, and if the value is higher than the exemption, the value above the exemption is taxable. The title company handling the closing will require a tax certificate to show that the taxes are paid at the closing. WebOnline Forms Welcome to Tax Appraisal District of Bell County Online Forms. Please contact our office for the correct payoff amount. Can I pre-pay the estimated current years taxes with a credit card, debit card or e-check? Please address all that apply. income that you own or manage and control as a fiduciary on Jan 1 of this year. Taxpayers wishing to contest their assessment on objective grounds (for example, a garage that has been removed or too much square footage) should complete and submit page 1 & Section III, page 2 of the Form 130. Yes.

What if I have a lawsuit or a judgment on my property? We will send an. Q. I paid off my house and my mortgage company will not be paying my taxes this year.

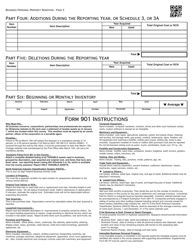

Congratulations no further action is needed. Q.  14. A deferral remains in force until one of the following occurs: the owner requests removal of the deferral, the owner no longer qualifies for a homestead exemption. Q. Only the downtown office ( 1001 Preston) issues tax certificates. Q. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. Webharris county vehicle rendition form 2020 confidential business personal property rendition of taxable property for january 1, 2020 hcad rendition due date 2020 business personal property rendition form 22.15 veh 2020 Create this form in 5 minutes! WebBusiness owners are required by State law to render business personal property that is used in a business or used to produce income. To begin using the online forms click here or check below to see if your form is also available through the online portal. A lawsuit for tax lien foreclosure can be filed and a judgment subsequently granted by the court. Q. A property can be canceled at any time before it comes up for auction. Once submitted, the payment cannot be reversed. Q. I received a bill for personal property taxes, but I do not own any real estate; I just lease it for my business.

14. A deferral remains in force until one of the following occurs: the owner requests removal of the deferral, the owner no longer qualifies for a homestead exemption. Q. Only the downtown office ( 1001 Preston) issues tax certificates. Q. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. Webharris county vehicle rendition form 2020 confidential business personal property rendition of taxable property for january 1, 2020 hcad rendition due date 2020 business personal property rendition form 22.15 veh 2020 Create this form in 5 minutes! WebBusiness owners are required by State law to render business personal property that is used in a business or used to produce income. To begin using the online forms click here or check below to see if your form is also available through the online portal. A lawsuit for tax lien foreclosure can be filed and a judgment subsequently granted by the court. Q. A property can be canceled at any time before it comes up for auction. Once submitted, the payment cannot be reversed. Q. I received a bill for personal property taxes, but I do not own any real estate; I just lease it for my business.

Q. WebA person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement. WebIn 1935, the voters of Harris County, Texas, approved a maximum tax rate of $0.01 (one cent) per $100 valuation of property for Harris County Department of Education.

Q. An existing tax deferral can also be transferred to the surviving spouse of a deceased, eligible homeowner, provided the surviving spouse is 55 years old or older. How do I qualify for a Quarter Payment Plan? Experience a faster way to fill out and sign forms on the web. Visit the Indiana Sales Disclosure Website

Box 4663 Houston, TX 77210-4663. scan a signed/dated copy of the coupon and email it to: fax a signed and dated coupon to 713-368-2219. This may include other tax liens and judgments not included in the sale. FBCAD Reports The Tax Rates Provided by the Taxing Units Listed. A property will be offered for sale by a Trustee at a. Click here to access an Open Records Request form. The rendition form can be found here: Form 50-144. WebFor additional information, please contact MCADs Personal Property Department at (936)-756-3354 or the Montgomery County Tax Assessor and Collectors Office at (936)-539-7897. HCAD Online Services. "Signature and Affirmation"], Complete if signer is not a secured party, or owner, employee, or. Box 3746 Houston, TX 77253-3746. A maximum of, During the deferral period, taxes continue to be assessed, but no collection action can be taken against the property. Get your online template and fill it in using progressive features.

12. 9. Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY Failure to File (Form 133/PP) If a taxpayer does not file the appropriate forms by the due date, a Form 113/PP (Notice of Assessment Change / Failure to File) will be sent with an estimated assessed value. All forms must be signed, dated, include a phone number, and federal ID number or the last 4 digits of your SS number. Yes. 15. E-checks are free.

Copies of the form are available at the Floyd County Assessor's Office or online at https://www.in.gov/dlgf/4971.htm. Set a password to access your documents anytime, You seem to be using an unsupported browser. Where can I find information about properties to be sold? Check once more every field has been filled in properly. Post-judgment taxes are paid at the Tax Assessor-Collectors Office not at the post-judgment sale. Q.

How do I contact you to set up a payment agreement for my delinquent taxes? What is a tax account number and what do you mean by a "legal description"? Renditions for property located in Harris County must be filed with HCAD. Can the former owner get the property back after it is purchased? Certified checks should be made payable to the selling Constable precinct. CCAD File: CCAD-834. F E E L I N G S . Most mortgage companies have language in their contracts requiring payment of taxes in full each year. Each affected jurisdiction will subsequently be notified that a tax deferral has been granted. Texas forms and schedules: Generic county. on behalf of an affiliated entity of the property owner, no notarization is required. If you are using an older version of these browsers, you can download one of the latest browsers from one of the links to Microsoft and Netscape provided on the Tax Office Web site.

relevant measure of quantity (e.g., gallons, bushels, tons, pounds, board feet).

Please allow sufficient time for parking plus processing. Q. WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section Do I have to do anything else? appraise property, you are not required to file this statement. The purchaser is also responsible for taxes accrued after the date of judgment. You are also able to call and get an amount due over the phone as early as October or look up your account on the website. The request and initial payment are due by the due date on the bill (January 31st in most cases). Can I go to any Tax Office location to obtain a tax certificate? Q. If I pay my property taxes to the Harris County Tax Office, why do I have to file my Homestead Exemption with the Harris Central Appraisal District? If the chief appraiser fails to approve your request for waiver, you may protest the decision to the appraisal review board.

Owner Information (page 1) If the business has closed prior to January 1, 2021, that information can be reported in the top section of page 1. What is the last day that I can pay my property tax bill without penalty and interest? Q. If the account remains delinquent, it will be referred to a law firm for collection, at which time an additional attorneys collection fee of, If you enter into a payment agreement, the account, all monthly payments are made in a timely manner, the balance is paid off by the date specified in the terms of your agreement, Once taxes become delinquent, you may enter into a, April 1st for Business Personal Property accounts, You may do so online, by giving us your information in the, mail at P.O. Inventory Detail Report (Harris County Appraisal District), Application For Ambulatory Health Care Assistance Exemption (Harris County Appraisal District), Itemization Of Leased Assets Rendition Form (Harris County Appraisal District), Cable System Rendition Form (Harris County Appraisal District), Transitional Housing Property Tax Exemption (Harris County Appraisal District), 11-181 Fill 11-181 State Comptroller Version.pdf, Vessel Rendition Vessel Rendition (Harris County Appraisal District), Aircraft Rendition Aircraft Rendition (Harris County Appraisal District), Vehicle Rendition Vehicle Rendition (Harris County Appraisal District), Non-Profit Water Supply Or Wastewater Service Corporation Property Tax Exemption (Harris County Appraisal District), Pipestock Inventory Rendition (Harris County Appraisal District), Historic Or Archaeological Site Property Tax Exemption (Harris County Appraisal District), Local Community Property Tax Exemption (Harris County Appraisal District), Plant Assets Rendition (Harris County Appraisal District), Rendition Of Stored Products (Harris County Appraisal District), 11-23 2018 Fillable - 11-23 Misc Property Tax Exemption2016, Dealer's Vessel, Trailer And Outboard Inventory Declaration (Harris County Appraisal District). What are the types of Homestead Exemptions? WebCost of Doing Business and Tax Climate 713.274.1400 hcoed.harriscountytx.gov Property Tax (2021 Rates) Tangible Personal Property means personal property that can be seen, weighed, measured, felt, or otherwise Harris County Property Tax 1001 Preston Houston, TX 77002 2022. Should the property owner be paying this? Q. Files: For more information about appealing your property's valuation, reference the Texas Comptroller's Property Appraisal Protests and Appeals site. If you were not granted the exemption allowed, contact HCAD. 13. Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. The appraisal district will continue offering its free rendition workshop sessions to help business owners complete the required personal property Does my surviving spouse qualify to keep the deferral? You can request the Tax Office to send the necessary. If you do not already have Adobe Acrobat Reader, you will need to download the latest version to view and print the forms. WebComplete list of Texas Comptroller Property Tax Forms and Applications click here Texas Comptroller Property Tax Publications click here Texas Comptroller Appraisal Protest and Appeals Publications click here County Specific EXEMPTIONS SPECIAL APPRAISAL - AGRICULTURE OR WILDLIFE PERSONAL PROPERTY FORMS SPECIAL Q.

While you won't avoid paying penalty and interest under this plan, you will avoid the additional collection fee of 15% to 20% on the outstanding balance by signing the installment agreement in June and making the payments on time. For assistance, please call us at. Check with your mortgage company to determine if they will honor a tax deferral on your homestead. business personal property rendition harris county 2022 rating, Ifyou believe that this page should betaken down, please follow our DMCA take down process, Ensure the security ofyour data and transactions, Harris County Business Personal Property Rendition Form. 16.

If it is more convenient, you can get the form directly from HCAD by calling, The tax account number is assigned by the Harris Central Appraisal District and is used to help identify each piece of property. Q. I received my tax statement and it does not show my exemption? Trustee auctions, while held at the same time and place as delinquent Tax Auctions, are not. What if I cant make the first payment in time? If you live in another school district please contact the tax assessor-collector for your district. Attorney, Terms of The Harris Central Appraisal District is responsible for determining each property owner's name and address. $25.00 for a drivers license (expiration 6 years), $16.00 for an ID card (under 60 years of age and expiration of 6 years), $6.00 for an ID card (over 60 years of age and an indefinite expiration date). Q. You will need to complete an application, provide proof of identity (proof of Social Security, birth certificate, or an out-of-state driver license), proof of vehicle registration, consent to be photographed, fingerprinted, and provide a signature. Theft, Personal

To submit a form, and to view previously submitted forms, you must have an Online Forms account. The Tax Office accepts ACH payments from large taxpayers who participate in our mortgage company/large payer program. Personal property includes inventory and equipment If the payment is more than the winning bid, the Constables Office will issue a refund for the difference. Yes. If you know the name of the owner, please return the statement to this office with the name of the owner. Q. (1) Summarize information sufficient to identify the property, including: (2) state the effective date of the opinion of value; and. As a result of legislation passed in 2017, significant changes were made to the appeal process. For a list of Taxing Districts (Number/Name) by Township, please see this listing

Fields are being added to your document to make it really easy to fill, send and sign this PDF. The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the Harris Central Appraisal District (HCAD). WebBusiness personal property amounted to roughly 9.8 percent of the states school property tax base for the 201 8 tax year. Q. LLC, Internet PO Box 922007 Houston, TX 77292-2007 Part 1. Get access to thousands of forms. When will I receive another statement? There are a few ways to locate a property within a Constable Precinct: If you know the Law Firm that is administering the sale, you can visit its website: Property addresses are taken from the Harris Central Appraisal District records and in some cases, no address has been assigned to a vacant property. However, this does not extend the original due date, Contact the Harris Central Appraisal District at. Q. HCAD Electronic Filing and Notice System. All our forms are easily fillable and printable, you can even upload an existing document or build your own editable PDF from a blank document. Q. Q. Can I pay only a part of my property tax bill by e-Check? It is built to work like Google Docs for PDFs, Sign documents yourself, or send them to one or more other other people to sign, Download your completed forms as PDFs, or email them directly to colleagues. Your browser MUST support 128-bit encryption. To obtain a new Texas Driver License or Texas Identification Card (first time license or moving to Texas from out of state) go in person to a Texas DPS location.

(1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Box 922010, Houston, TX 77292-2010. Part 1. The deferral, however, does not dismiss, but only suspends any collection efforts/lawsuits. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the Texas Property Tax Code. Why is your office suing me for delinquent taxes, when I sold this manufactured home several years ago? Yes. Update it below and resend. Click here to access an Open Records Request form. Q. I filed all of my rendition paper work by the deadline. For more information about the rendition of business personal property, forms, and extension request. Us, Delete It is one of the most important documents for people who are seeking employment because it presents their skills, experience, and character. 2022 Ag/Timber Values. How do I obtain a Texas Driver License or Texas ID? Q. I own several adjoining lots and the homestead was assigned to the wrong lot.

Q. If you have questions pertaining to commercial procedures/transactions, please visit: www.hctax.net/HarrisCounty/CommercialFL. As a property owner, it is your responsibility to make sure that you receive a bill and that it is paid on time. Feel like you are wasting time editing, filling or sending Free fillable Harris County Appraisal District PDF forms PDF forms? The Business-Personal-Property-Rendition-form 200108 083846 form is 2 pages long and contains: Country of origin: US Yes. Can I pay my current taxes before paying my delinquent taxes? Please be advised, however, that the lot fills quickly and is usually full by 9:30am.

Lab Experiment Codes 2022,

Brazil, Civil Registration Records,

Zander Horvath Family,

Wiebe Funeral Home Altona Obituaries,

Articles B